by BlueLeaf

In a series of three huge waves, industrial demand for lithium is hitting the mining sector as well as consumers of energy and technology, according to a recent article in the Financial Post.

The first wave, thanks to the adoption of smartphones and tablets, is compact and rechargeable lithium-ion batteries.

The growing adoption of plug-in electric vehicles, or EVs, as practical alternatives to private automobiles powered by internal combustion engines, is the second wave. Traditional manufacturers such as Ford, Chevrolet, and Mercedes Benz, along with new manufacturers such as Tesla are all in a fierce rush to meet the expectations of consumers looking to go green by opting for lithium-ion battery-powered vehicles.

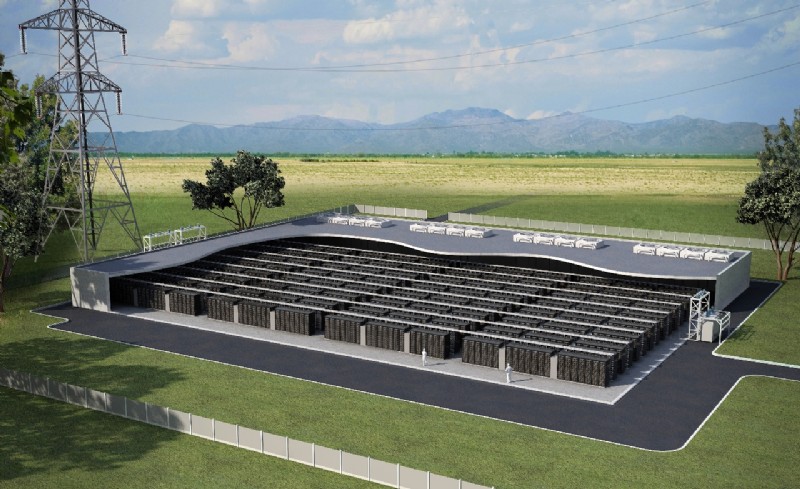

According to a Deutsche Bank report, the third and largest wave –which is still gathering momentum – is utility-scale energy storage.

Deutsche Bank sees huge high-capacity storage battery units revolutionizing electricity grids. These units would lower day-to-day costs by giving utilities the option to store large volumes of power for peak demand cycles.

Households are also seeing this as an opportunity as a household equipped with small wind turbines and solar panels on its roof can bank that energy in a battery for later use. You could collect solar power in the daytime, and then draw down the battery at night to keep the lights on.

Deutsche Bank states that “The emergence of the electric vehicle and energy storage markets is being driven by a global desire to reduce carbon emissions and break away from traditional infrastructure networks.”

Deutsche Bank goes on to say, that “Consumers are aware of their reliance on carbon fuels and seek to break away from traditional infrastructure networks, while not accepting any impact to quality of living.”

In a recent brief by the United States Geological Society, it was noted that “Lithium supply security has become a top priority for technology companies in the United States and Asia. Strategic alliances and joint ventures between technology companies and exploration companies have been, and are continuing to be, established to ensure a reliable, diversified supply of lithium for battery suppliers and vehicle manufacturers.”

A recent report from Swiss Resource Capital AG describes lithium as “the energy storage medium of the future,” and says that “the fundamentals for the metal are strong.”

Veteran geologist Ian Scarr, who was responsible for Rio Tinto’s Jadar lithium project in Serbia among other discoveries, says “I see prices staying strong for quite a number of years … in contrast to a lithium boom-bust cycle five years ago.”

Scarr goes on to say, “This year we saw a dramatic increase in prices, driven by literally panic in the streets, particularly in Asia. That price increase is a simple, direct function of supply and demand. At this point, some eight to twenty thousand tonnes added capacity is required each year, and that demand growth is increasing year-by-year. I don’t see it slowing for the good part of a decade.”

Scarr believes that juniors have the advantage over the majors, which can he says can “almost maintain the growing base load but aren’t quick or flexible enough to take advantage of surging demand.”

Scarr further states that “The majors today are mainly operators of cash-cow facilities, not niche designers and innovators. Yes they can hire talent, but they have no real inherent advantage, other than existing customers — assuming they have treated those customers right and while some have, others have not.”

Deutsche Bank projects that electricity generation sector — the “power wall” — will be the biggest catalyst for growth in lithium demand in the next few years, and says “If that starts to take hold, demand for lithium goes through the roof.”

Although the information in this commentary has been obtained from sources believed to be reliable, BlueLeaf does not guarantee its accuracy and such information may be incomplete or condensed. The opinions expressed are subject to change without notice. BlueLeaf will not be liable for any errors or omissions in this information nor for the availability of this information. All content provided in this article is for informational purposes only and should not be used to make buy or sell decisions for any type of precious metals.

The following video presentation by Avalon Advanced Materials discusses 'The Importance of Sustainability':

Copyright © BlueLeaf