Section

portfolio management

300 posts

Anthony Valeri: Fears Over High-Yield Energy Defaults May be Overblown

Breaking Up is Hard To Do KEY TAKEAWAYS • The high-yield energy sector has kept pace with the…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Counting on Cash

An Active Approach to Sustainable Equity Returns by David Dalgas, CFA, Chief Investment Officer—Global Core Equity, Kenneth Graversen,…

How Historical Market Scenarios Get Used (and Abused)

by Ben Carlson, A Wealth of Common Sense Bridgewater’s Ray Dalio had everyone in the financial industry talking…

The Psychology of Sitting in Cash

by Ben Carlson, A Wealth of Common Sense A reader asks: I took one piece of advice from…

Skin-in-the-Game Investing: Why It Matters

Skin-in-the-Game Investing: Why It Matters by Frank Holmes, CIO, CEO, U.S. Global Investors March 9, 2015 Seven hundred…

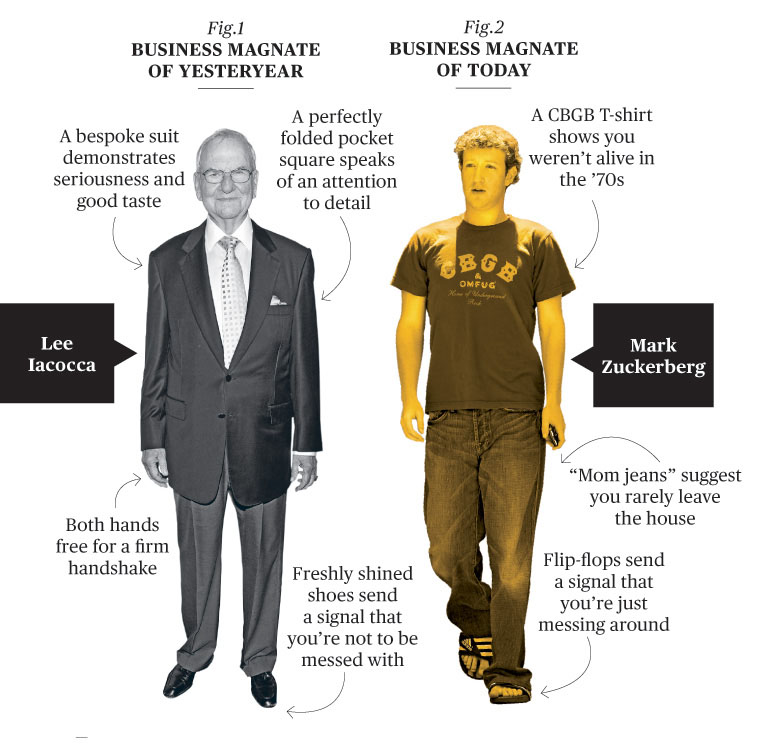

Why The Grandpa Portfolio Will Crush The Millennial Portfolio

by Patrick O'Shaughnessy, Millenial Invest Ever heard that joke about how if you are young and you aren't a…

Jeffrey Saut: The Conference

by Jeffrey Saut, Chief Investment Strategist, Raymond James Greetings from Orlando where the Raymond James 36th Annual Institutional…

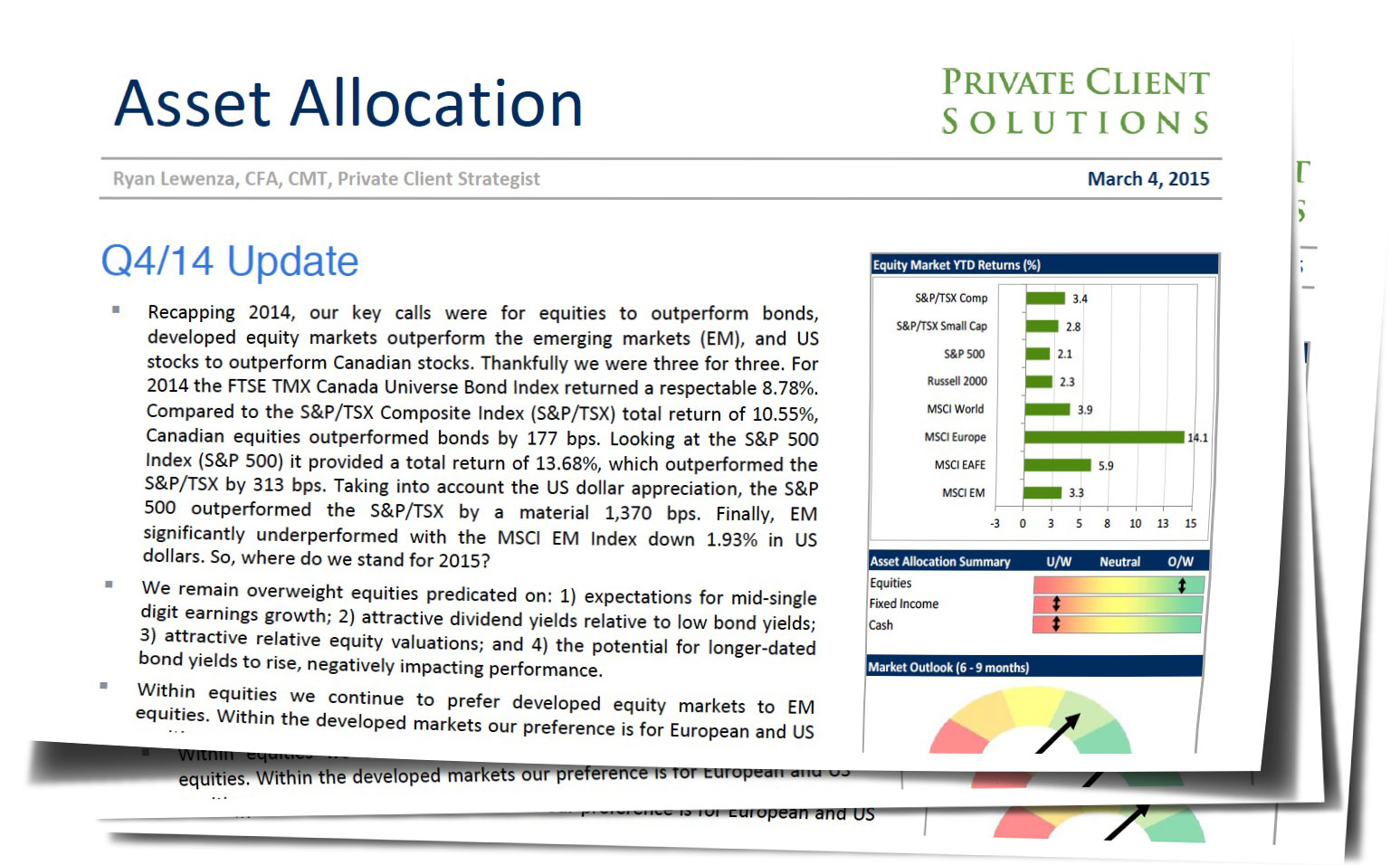

Ryan Lewenza: Asset Allocation Update Q4/14

Asset Allocation – Q4/14 Update by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James • Recapping 2014,…

The Blueprint for a Bond Bear Market?

by Ben Carlson, A Wealth of Common Sense Bond investors are in constant fear of a replay of…

Howard Marks on Skill and Luck in Investing

by Howard Marks, Oaktree Capital Sometimes these memos are inspired by a single event or just one thing…

From Great to Good

by Ben Carlson, A Wealth of Common Sense As I’ve said before, I think Cliff Asness is one…

Long-Term Thinking as a Contrarian Approach

by Ben Carlson, A Wealth of Common Sense One of the most interesting pieces I’ve come across lately…

The 2011 Pattern Continues

by Cam Hui, Humble Student of the Markets Trend Model signal summary Trend Model signal: Risk-on Trading model:…

Adam Butler: Winning By Not Losing

by Adam Butler, GestaltU Fundamental Rule #1: For most investors, financial risk is singularly defined as the probability of…

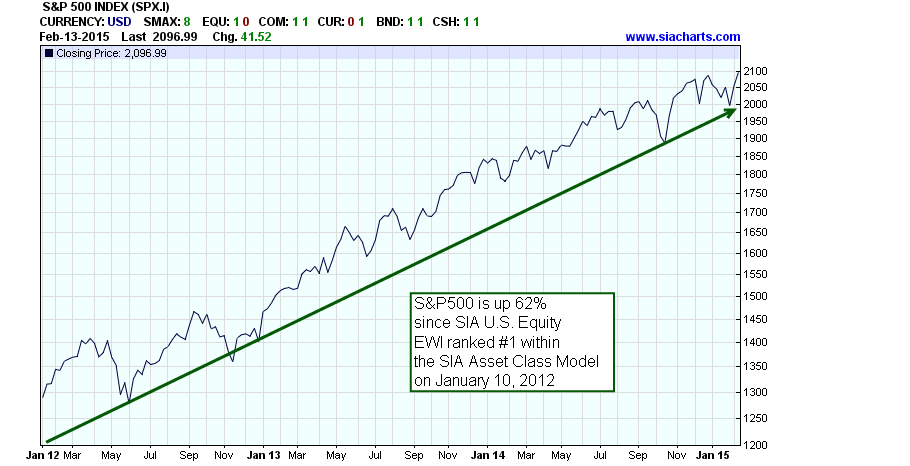

SIA Weekly: The Equity Action Call, U.S. Equities, and Commodities

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to focus on the importance of…