by Patrick O'Shaughnessy, Millenial Invest

Ever heard that joke about how if you are young and you aren't a democrat, you have no heart, but if you are old and you aren't a republican, you have no brain? Well, there seems to be something similar happening with the portfolios of young and old investors. Stocks with the youngest median owners are very expensive (but so exciting!), but stocks with the oldest median owners are much more fairly valued.

I spoke at the CFA's 2015 national Wealth Management conference yesterday on the topic of "Millennials and Money" and sadly, I had to report that millennials are making three big mistakes: they aren't saving enough (-2% savings rate), their asset allocation is back asswards (very heavy on cash, light on stocks), and their stock selection stinks.

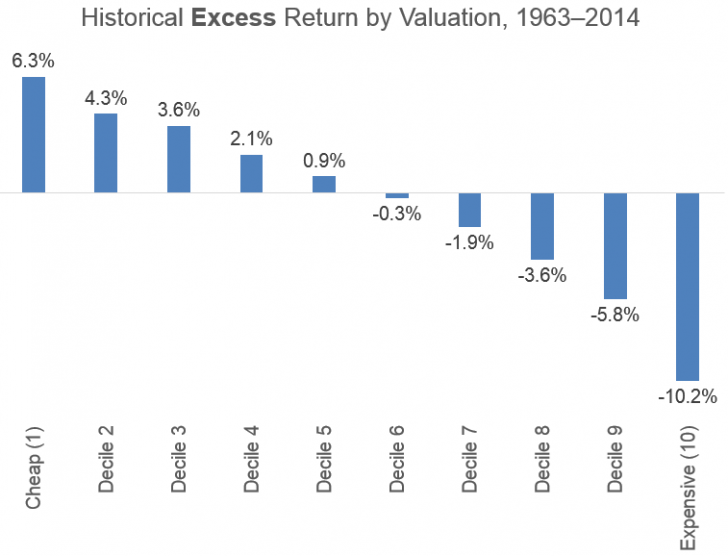

It is this third category--poor stock selection--that I found most interesting. First, a quick reminder of how powerful valuations are for predicting future stock returns, on average. Value here is a combination of P/E, P/S, EBITDA/EV, FCF/EV and Shareholder Yield (deciles rebalanced annually).

By just buying the cheapest stocks, you can significantly outperform over the long term (much easier said than done). Expensive stocks do so poorly that they have delivered a negative real return (after inflation). Simply put, you shouldn't buy expensive stocks (even though some of them crush, the group gets killed).

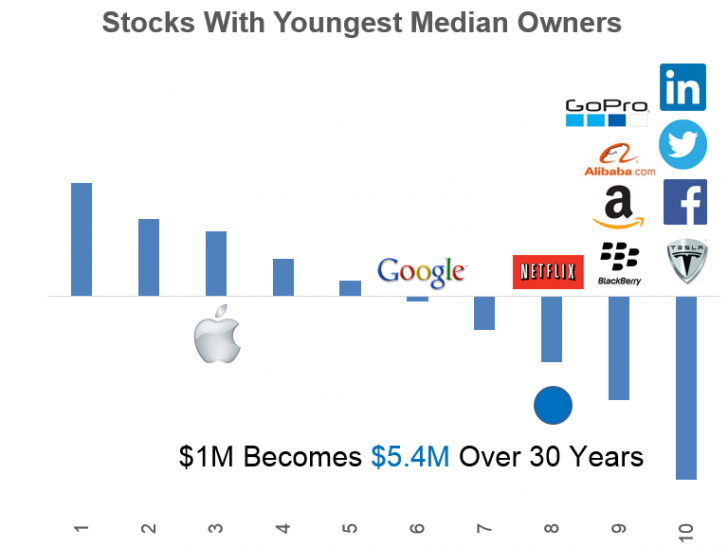

So now let's plot the stocks that have the youngest median owners (this is according to data from SigFig, which tracks 2.5 million portfolios representing about $350 billion in assets...their data is awesome). Look where they fall on the value spectrum.

I wasn't surprised by these (although I'm not sure what Blackberry is doing there...), but the key point is how expensive they are, on average. If you take them as an equal weighted portfolio, they are priced in about the 80th percentile of the market. Not good. Stocks in this valuation decile have done poorly through history. An average 30-year return would turn $1M into $5.4M (nominal).

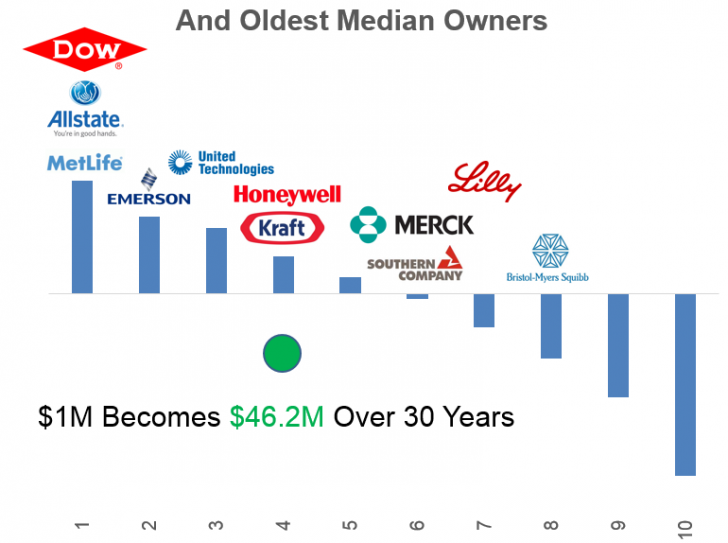

Now, let's contrast the millennial portfolio with the boring (but much better valued) grandpa portfolio:

This group of stocks is about as exciting as watching paint dry. And yet, taken as a group, it is priced to do much better than the millennial portfolio. Using the average historical return for stocks falling in a similar valuation bucket, the grandpa portfolio would grow from $1M to $46.2M over 30-years.

Millennials are notoriously skeptical of the market, but have started dipping their toes in with stocks that they know and love. Unfortunately, these stocks are priced to do poorly. Millennials should embrace value investing, but value stocks are no fun. Returns earned from value stocks, however, are quite fun indeed. Millennials could learn a lot from their grandparents.

Copyright © Millenial Invest