Section

Asset Allocation

188 posts

Diversified investing: Standing still is not an option

by Jeffrey L. Knight, Global Head of Investment Solutions and Co-Head of Global Asset Allocation, Columbia Threadneedle Investments…

August 23, 2016

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Has Investment Diversification Alone Had its Day?

Has Investment Diversification Alone Had its Day? by Glenn Dial, Allianz Global Investors The idea that investment diversification…

August 17, 2016

Misconceptions About Diversification

Misconceptions About Diversification by Ben Carlson, A Wealth of Common Sense “Here is part of the tradeoff with…

July 28, 2016

Three Reasons Why Now is Not the Time to Retreat from Global Diversification

Three Reasons Why Now is Not the Time to Retreat from Global Diversification by Jeffrey Kleintop, Senior Vice…

July 14, 2016

US Junk Bonds Eked Out A Small Gain Last Week

US Junk Bonds Eked Out A Small Gain Last Week by James Picerno, The Capital Spectator Equity markets…

June 29, 2016

Tactical Trend-Following: Core or Alternative?

Tactical Trend-Following: Core or Alternative? by Corey Hoffstein, Newfound Research Summary Answering whether a strategy should be a…

June 13, 2016

Diversification: Full of trade-offs, just like life

Diversification: Full of trade-offs, just like life by Brian Jacobsen, CFA, CFP®, Wells Fargo Diversification is supposed to…

June 8, 2016

Great (But Wrong) Expecations

Great (But Wrong) Expecations by Roger Nusbaum, ETF Strategist, AdvisorShares A favorite topic to blog about has long…

May 27, 2016

The New Asset Allocation Standard?

The New Asset Allocation Standard? By Roger Nusbaum, AdvisorShares ETF Strategist, AlphaBaskets Invesco ran a commercial on CNBC…

May 19, 2016

How I learned to stop worrying and love the bond

How I learned to stop worrying and love the bond Low yields, potential volatility: Why even hold bonds?…

May 4, 2016

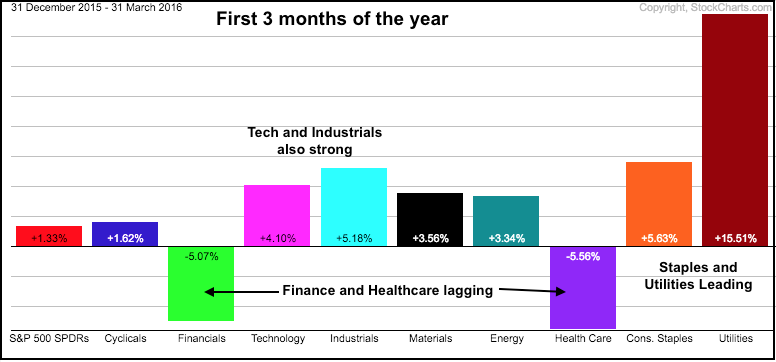

A Dramatic Shift in Sector Rotation this Month

A Dramatic Shift in Sector Rotation this Month by Arthur Hill, CMT, Stockcharts.com There has been a clear…

April 22, 2016

The Perfect Asset Allocation

The Perfect Asset Allocation by Michael Batnick, The Irrelevant Investor The arrival of the auto industry changed the…

April 19, 2016

How to Avoid the Problem of Short Termism

How to Avoid the Problem of Short Termism by Cullen Roche, Pragmatic Capitalism If I had to pinpoint…

March 28, 2016

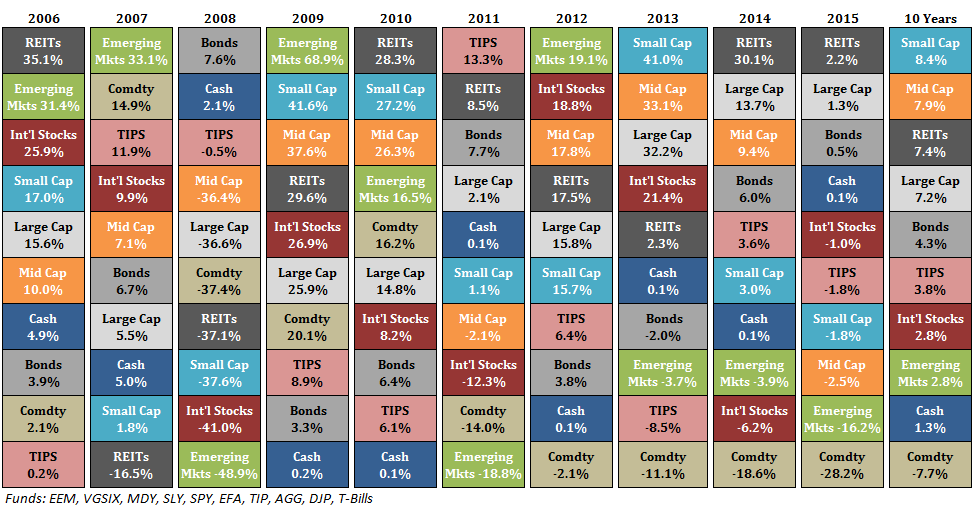

The Callan Periodic Table of Investment Returns

The Callan Periodic Table of Investment Returns by The Alts Team, Attain Capital The so called Periodic Table…

March 16, 2016

Ryan Lewenza: What's Changed?

What’s Changed? by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James • From the February 11 market…

March 11, 2016