Section

Alternative Investing

713 posts

Confusing Brains with a Bull Market

by William Smead, Smead Capital Management It is hard to think about 1981, my first full year in…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Cliff Asness: Fixed Income Fantasies

by Clifford Asness, Ph. D. AQR Capital Management, Inc. My last few entries highlighted some recent AQR papers…

Jeremy Grantham: Investing in a World of Overpriced Assets

Career Risk and Stalin’s Pension Fund: Investing in a World of Overpriced Assets (With a Single Reasonably-Priced Asset)…

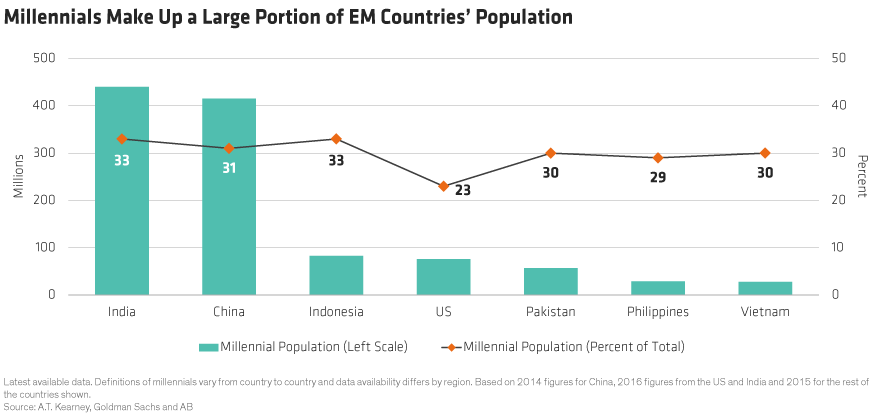

Investing in the Emerging Millennial Boom

by Laurent Saltiel, Naveen Jayasundaram, Sergey Davalchenko, Kate Huang, AllianceBernstein Millennials are becoming a powerful force in emerging…

Skis and Bikes: The Untold Story of Diversification

by Adam Butler, Rodrigo Gordillo, and Michael Philbrick, Resolve Asset Management Skis and Bikes In most parts of…

This Week in Bitcoin: The IRS Targets Coinbase, Venezuela to Mint Its Own Cryptocurrency

by Frank Holmes, CIO, CEO, U.S. Global Investors December 11, 2017 Writing about blockchain and bitcoin right now…

Investing in the Emerging Millennial Boom - Context

by Equities, AllianceBernstein Millennials are becoming a powerful force in emerging markets (EM). Understanding the social and consumer…

2018 Investment Outlook: Balancing cyclical and structural influences in multi-asset investing

2018 Investment Outlook: Balancing cyclical and structural influences in multi-asset investing by Invesco Canada Despite what has been…

Jurrien Timmer: Minus Inflation and Leverage, A Bear Market Doesn't Add Up

DECEMBER 2017 Minus Inflation and Leverage, a Bear Market Doesn’t Add Up Inflation and leverage are key drivers…

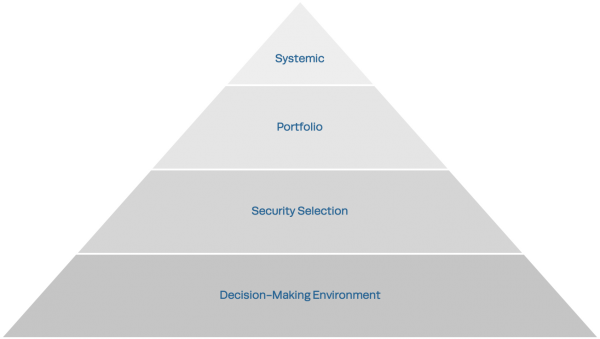

The skier's guide to portfolio risk management

by Cameron Webster, CFA, Mawer Investment Management, via The Art of Boring Blog The ski season is officially…

The skier’s guide to portfolio risk management

by Mawer Investment Management, via The Art of Boring Blog The ski season is officially open and the…

The skier’s guide to portfolio risk management

by Mawer Investment Management, via The Art of Boring Blog The ski season is officially open and the…

The skier’s guide to portfolio risk management

by Mawer Investment Management, via The Art of Boring Blog The ski season is officially open and the…

The Fed’s Long Unwinding Road

by Michael Hasenstab, Chief Investment Officer, Templeton Global Macro, Franklin Templeton Investments In the latest edition of “Global…

What is ESG, and why should investors care?

What is ESG, and why should investors care? by Invesco Canada Shoppers looking for “healthy food” must contend…