Section

Alternative Investing

710 posts

Dramatic Changes May be Ahead with Election Outcomes in Japan, Brazil, and the U.S.

by Kristina Hooper, Global Market Strategist, Invesco Ltd., Invesco Canada The next few months will be critical for several…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Style drift & the rise of the generalist

by Craig Basinger, Chris Kerlow, Shane Obata, Derek Benedet, Connected Wealth, Richardson GMP When starting in the investment…

A New 49 Year Low in Unemployment Claims and The 'Inverted' Yield Curve

by Urban Carmel, The Fat Pitch Summary: The macro data from the past month continues to mostly point to positive growth. On…

The Efficiency Factor in Stock vs. Index Picking

by Charles Roth, Thornburg Investment Management If the efficient markets hypothesis is questionable at the stock level, it’s…

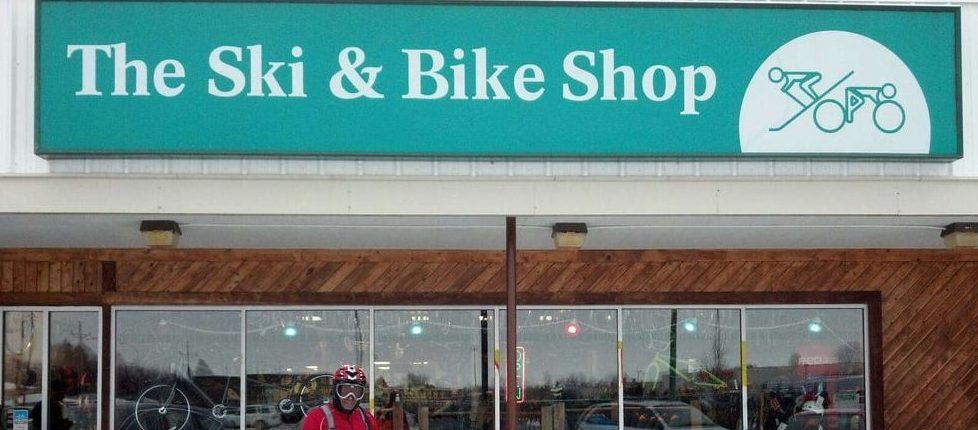

Skis and Bikes: The Untold Story of Diversification

by Adam Butler, Rodrigo Gordillo, and Michael Philbrick, Resolve Asset Management In most parts of Canada we have…

Neils Jensen: Private Credit Demystified

by Niels Clemen Jensen, Absolute Return Partners I am the king of debt. I understand debt probably better…

Alternative assets: A primer

by Research Team, Purpose Investments “Alternatives” is a name given to a very wide range of assets. However,…

Alternative assets: A primer

by Research Team, Purpose Investments “Alternatives” is a name given to a very wide range of assets. However,…

Early-Stage Investing with Adam Sharp (EXCLUSIVE INTERVIEW)

by Frank Holmes, CIO, CEO, U.S. Global Investors Share this page with your friends: Print Please note: The…

Managing a dividend portfolio when rates rise

by Invesco Canada Recent monetary tightening in Canada and the U.S. has put dividend investing in focus, and…

Sandy Liang: Maximizing Return in a Rising Rate Environment

Sandy Liang, portfolio manager, Purpose Investments, talks about the nature of his investment strategy given the rising…

Rodrigo Gordillo: Why most advisors have portfolio construction backwards and how to fix it

Rodrigo Gordillo, Managing Partner and Portfolio Manager at Resolve Asset Management shines a light on one of the…

Brexit: Are Markets Underestimating the Chances of the UK Not Leaving?

by Sandy Nairn, Chairman of Templeton Global Equity Group, CEO of Edinburgh Partners, Franklin Templeton Investments With nine…

5 investing ideas for the second half

by Richard Turnill, Global Chief Investment Strategist, Blackrock Richard shares five ideas for beefing up portfolio resilience amid…

Kass: The Underpricing of Risk

by Doug Kass, Seabreeze Partners Management 'The boldness of asking deep questions may require unforeseen flexibility if we…