by Richard Turnill, Global Chief Investment Strategist, Blackrock

Richard shares five ideas for beefing up portfolio resilience amid a more uncertain economic outlook.

Markets are in a tug-of-war as we enter the second half of 2018: Strong global growth and corporate earnings on the one side. Rising economic risks such as trade disputes on the other.

We still see the former winning out, with robust U.S. growth helping to sustain the global economic expansion and boost earnings. Yet the range of possibilities for the economic outlook has widened, as we write in our Global Investment Outlook Midyear 2018. On the upside: U.S. stimulus (think corporate tax rates and fiscal spending) could boost corporate investment and lift potential growth. On the downside: rising trade tensions could dent economic growth.

Against this backdrop of greater uncertainty, we think it is prudent to dial down risk exposure and build greater resilience into portfolios. How do we advocate adding resilience? Here are five ideas.

1. Prefer U.S. equities.

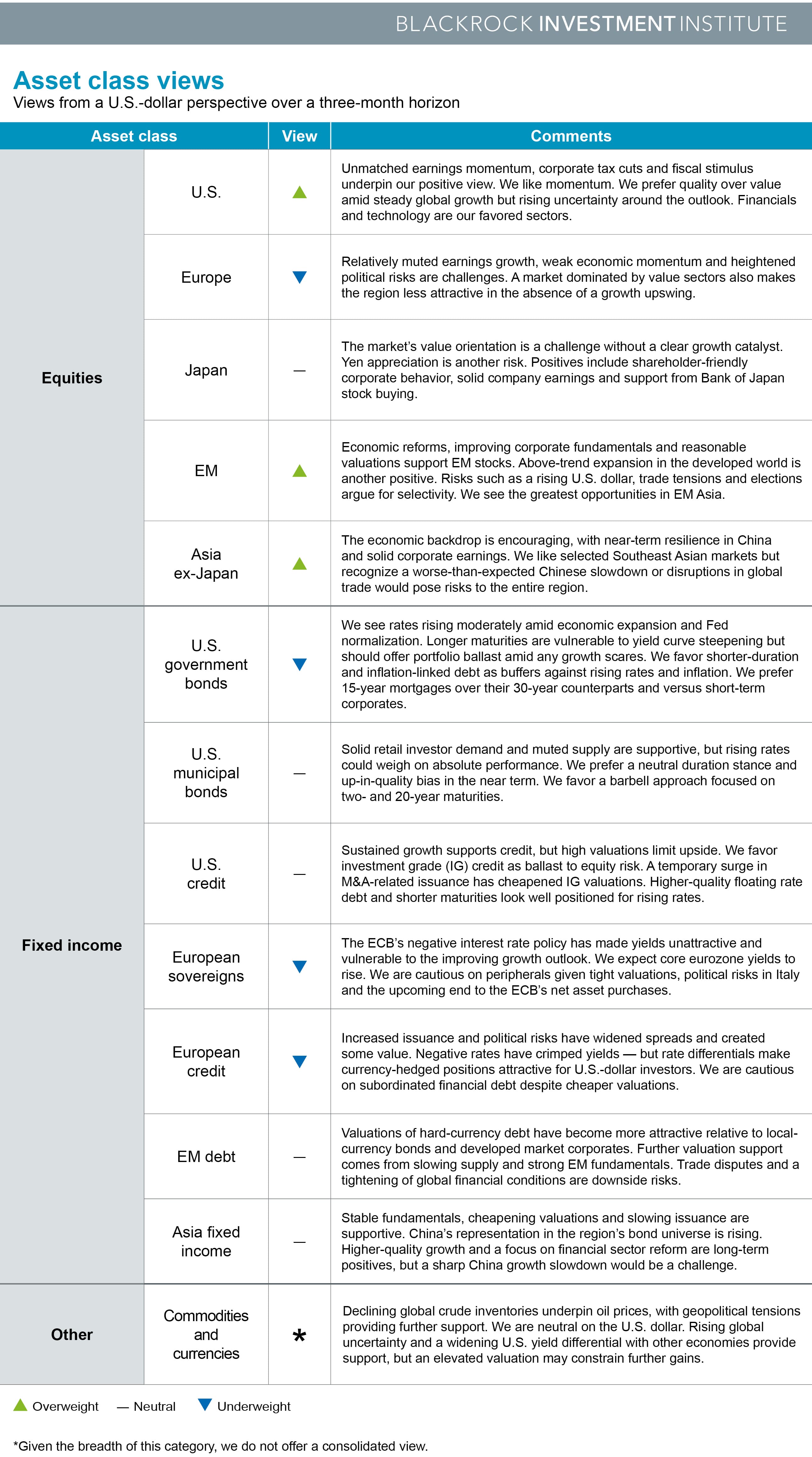

Our call for portfolio resilience leads us to prefer U.S. equities over other developed markets. U.S. firms have unmatched earnings growth supported by corporate spending discipline, corporate tax cuts and fiscal stimulus. Financials and technology are our favored sectors, and we prefer quality over value. Elsewhere, we still like emerging market (EM) equities, especially stocks in EM Asia–but we are becoming more selective for reasons including rising trade risks and a stronger U.S. dollar.

2. Consider quality exposures in equities.

We still like momentum stocks, but see the need to add a dose of quality to portfolios as uncertainty rises. A good defense today requires exposure to stocks with the potential to weather volatility and outrun inflation. To us, this means a focus on quality companies able to generate and grow free cash flow while maintaining healthy balance sheets. We find many such companies in the U.S., where earnings growth fueled by the tax overhaul offers an edge. Companies able—and willing—to increase dividends appear better poised to withstand volatility. We see a tougher go for highly bid “stable” dividend stocks as higher U.S. rates make “risk-free” shorter-term bonds attractive alternatives.

3. Favor U.S. short duration.

For U.S. dollar-based investors, monetary policy normalization brings a restoration: Cash is making a comeback in portfolios, evident in an increase in flows to cash-like instruments as short rates have risen. Yields for two-year Treasuries and short-maturity investment grade (IG) corporates are now well above the level of inflation. That means these assets can once again play their traditional portfolio role—preservation of principal.

4. Go up-in-quality in credit.

We advocate building ballast into portfolios via U.S. investment grade (IG) bonds. They typically outperform their high yield counterparts when uncertainty rises, given their higher quality and lower default risks. Yields for two-year Treasuries and short-maturity IG corporates are now well above the level of inflation. That means these assets can once again play their traditional portfolio role – preservation of principal. We also see floating-rate bank loans having an edge over high yield bonds. The former have lower duration and benefit from rising income as short rates reset higher. Though we favor short duration in fixed income, exposure to longer-term government debt such as U.S. Treasuries or German bunds may help cushion portfolios against any growth shocks. Separately, we do still like emerging market debt (EMD) despite its higher risk than developed market bonds, but we now prefer hard-currency EMD over local-currency counterparts.

5. Don’t forget about sustainable investing.

Our research suggests firms with high environmental, social and governance (ESG) scores may be more resilient to perils ranging from ethical lapses to climate risks. This implies a focus on ESG may offer some cushion during market downturns (read more in our June post on what sustainable investing could bring to a portfolio).

To be clear, our call for making portfolios more resilient does not mean we advocate abandoning risk assets. We remain pro-risk and still prefer equities over the fixed income. We have just tempered our risk-on stance amid the more uncertain outlook. For more on our portfolio ideas for the second half, see our detailed investment views below, and check out our full midyear outlook.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.

Copyright © Blackrock