Section

active investing

334 posts

Why Do Investors Keep Buying “Actively” Managed Funds?

by Cullen Roche, The Pragmatic Capitalist Important question here by Larry Swedroe from last week. If we…

June 16, 2014

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Three Classes of Investors Who Should Sell Stocks Now

by Ben Carlson, A Wealth of Common Sense “We tend to judge the probability of an event by…

June 3, 2014

Investment Management: Beyond "He's a Terrific Stock Picker!"

by Cam Hui, Humble Student of the Markets If investors don't have time or inclination to manage their…

May 30, 2014

Data is Cheap. Meaning is Expensive

by R.P. Seawright, Above the Market I occasionally write for outside publications. When those publications are digital iterations…

May 30, 2014

David Winters: A Different Drummer

Orignally aired March 28, 2014 CONSUELO MACK: This week on WealthTrack…How do you hit the investment jack pot?…

May 29, 2014

What's Your Tolerance for Complexity?

by Ben Carlson, A Wealth of Common Sense “Being passive doesn’t mean doing nothing.” – Larry Swedroe One…

May 20, 2014

Timing the Market vs. Aligning with the Market

by SIACharts.com For this week's Equity Leaders Weekly, we are going to examine one of the most popular…

May 8, 2014

How to Create an Outperforming Canadian Mutual Fund Strategy?

By Paul Kornfeld, National Manger of SIACharts.com, Business Development Creating an ideal mutual fund strategy for your clients…

April 23, 2014

A Look at 'Cluster Shrinkage' as a Portfolio Management Concept (GestaltU)

by Adam Butler, GestaltU At GestaltU we see ourselves as incrementalists. We aren’t so much prone to true…

April 8, 2014

Markets are Undergoing Some Serious Rotation

by Macro Man It's been said that the three most important factors in property are location, location, location.…

April 8, 2014

Discovering The Genius Du Jour

by James Picerno, Capital Spectator Selection bias is everywhere in financial journalism, and for obvious reasons (obvious if…

March 27, 2014

David Nadel: Royce Rediscovers India

When you think small cap investing India is probably not the first country that comes to mind. But…

March 25, 2014

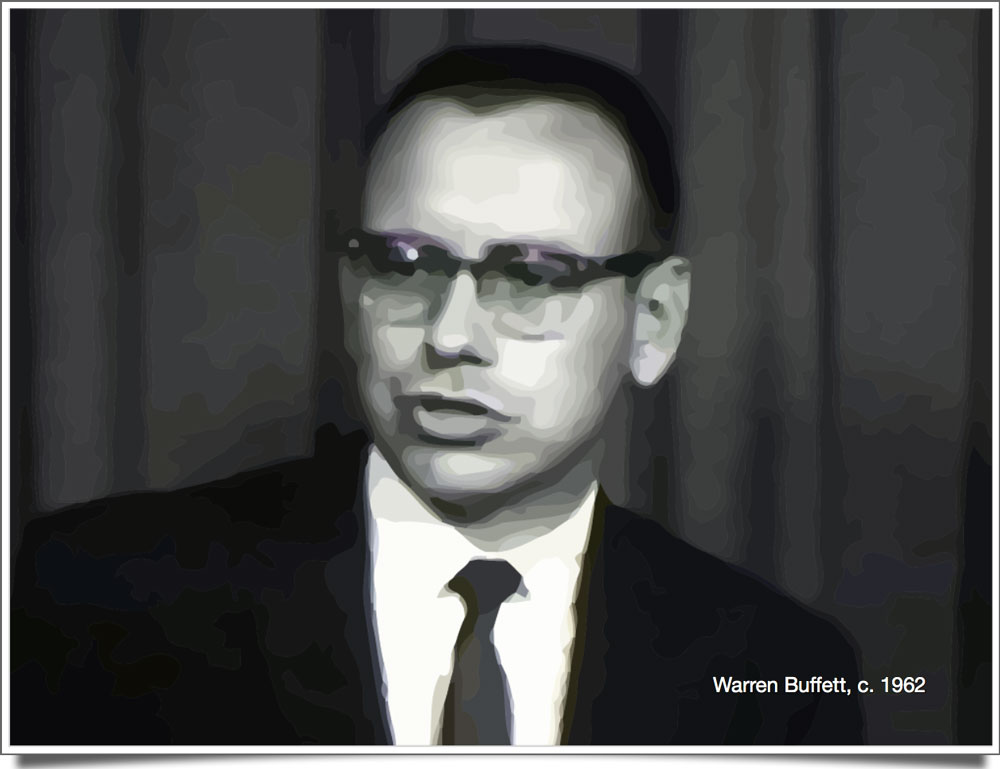

Buffett the Market Timer? Part 1: The Partnership Years

by The Brooklyn Investor OK, so I know this thing about not timing the market leads to a…

March 24, 2014

Sources of Performance Decay (GestaltU)

by Adam Butler, GestaltU Above all, the greatest fear in empirical finance is that the out of sample…

March 12, 2014

Toward a Simpler Palate (GestaltU)

by Adam Butler, GestaltU My palate is simpler than it used to be. A young chef adds and…

March 12, 2014