Section

active investing

334 posts

"Passive Investing" is Not Passive

by Cullen Roche, Pragmatic Capitalism This is my OCD speaking again and I’m not gonna beat around the…

September 5, 2014

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Active Vs. Passive Debate Has Become Rather Tiresome

by James Picerno, The Capital Spectator Morningstar got a lot of pushback from readers in the wake of…

August 28, 2014

The End of Stock Picking

by Cullen Roche, Pragmatic Capitalism Jason Zweig has a nice piece in yesterday’s Wall Street Journal on the end…

August 25, 2014

Why Active Managers Underperform

by Cam Hui, Humble Students of the Markets It is a tru-ism these days that active managers tend…

August 15, 2014

We Are All Active Investors – Part 2

by Cullen Roche, Pragmatic Capitalism Early last year I wrote a post describing the illusion of “passive investing”.…

August 13, 2014

Putting the “Underperformance” of Active Managers in Perspective

by Cullen Roche, Pragmatic Capitalism This mantra has been beaten into the brains of investors over the last…

August 11, 2014

Getting Closer: Fed Continues its Tapering & Moving Toward Rate Hikes

Getting Closer: Fed Continues its Tapering & Moving Toward Rate Hikes by Liz Ann Sonders July 30, 2014…

July 31, 2014

Why 'Buy and Hold' is a Misnomer

“Wealth isn’t primarily determined by investment performance, but by investment behavior.” – Nick Murray Dr. Andrew Lo,…

July 31, 2014

What to do when Valuations are High?

by David Merkel, Aleph Blog A letter from a reader: Hi David, What would you recommend for…

July 11, 2014

Charles Ellis: The Rise (and Fall) of Performance Investing

by Ben Carlson, A Wealth of Common Sense “The “winner’s game” of rigorous, individualized values discovery and counseling…

July 9, 2014

Under What Circumstances Will 'Smart Beta' Work?

by David Merkel, Aleph Blog I’m not an advocate for smart beta. There are several reasons for that:…

June 25, 2014

Nearly Every Breadth Measure Shows Market is Overbought

by The Short Side of Long This months market breadth report focuses on the reoccurring theme, no matter which…

June 24, 2014

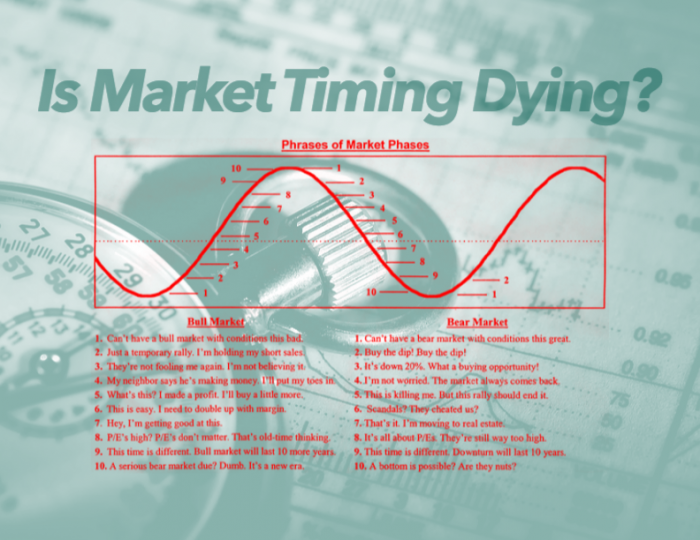

Another Nail in the Market-Timing Coffin

by Servo Wealth There is no siren song so seductive as one from an investment manager who promises…

June 23, 2014

An Updated Definition of Active Investing

by R.P. Seawright, Above the Market We have all heard the arguments about the flaws of active management…

June 20, 2014

Philosophy Differs From Strategy

by Rick Ferri Want to be a successful investor? Have a sound investment philosophy before trying…

June 17, 2014