Section

Spotlight

173 posts

Shock, Slack, and Strategy: Why Canadian Markets Just Hit a Turning Point

It is the kind of conversation that starts with a whisper and ends in a thunderclap. In the…

April 4, 2025

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

Tariff Turbulence: Why Volatility is a Catalyst, Not a Crisis

Based on a conversation1 between David Richardson, Head, Enterprise Strategy, RBC Global Asset Management, and Stuart Kedwell, CFA,…

April 3, 2025

Merger Arbitrage Advantage: Delivering Durable, Uncorrelated Return Streams

Introduction: Understanding the Opportunity in Merger Arbitrage Merger arbitrage—a subset of event-driven investing—represents a distinctive opportunity for portfolio…

April 3, 2025

A Deep Dive on AI: AGF Leaders Weigh In on Market Disruptions and Opportunities

Navigating AI’s Impact on Markets “We’re still in the early innings.” That’s the assessment from AGF Portfolio Manager…

April 2, 2025

Capitalism’s Chemical Crisis Creeps Closer, Quietly

Why Jeremy Grantham Thinks We’re Poisoning Ourselves Out of Capitalism – and What Investors Must Do Next By…

April 1, 2025

The Ergodic Gambler: Why Your Portfolio is Not What You Think It Is

"[Ray] Dalio tends to say you can have 16 uncorrelated return streams. That’s just categorically untrue." Mutiny Fund's…

April 1, 2025

The Return of the "Macro Unicorn"

Why Investors Should Brace for a Break in the Old Rules “There are decades where nothing happens; and…

March 30, 2025

The Twilight of U.S. Shale and the Coming Energy Windfall

The world is waking up to an inconvenient reality: the shale revolution is ending. The relentless march of…

March 26, 2025

Confidence Shaken, But Not Yet Spent: RBC Economists Decode the Resilience—and Risks—In Canadian Consumer Behaviour

Despite cratering consumer confidence, Canadian shoppers have yet to fully close their wallets. That’s the key takeaway1 from…

March 26, 2025

Global Shocks and Fixed Income Signals: Strategic View from Mackenzie’s Dustin Reid

In a recent sweeping discussion on Market Exchange, Mackenzie Investments’ Chief Fixed Income Strategist, Dustin Reid, unpacked a…

March 24, 2025

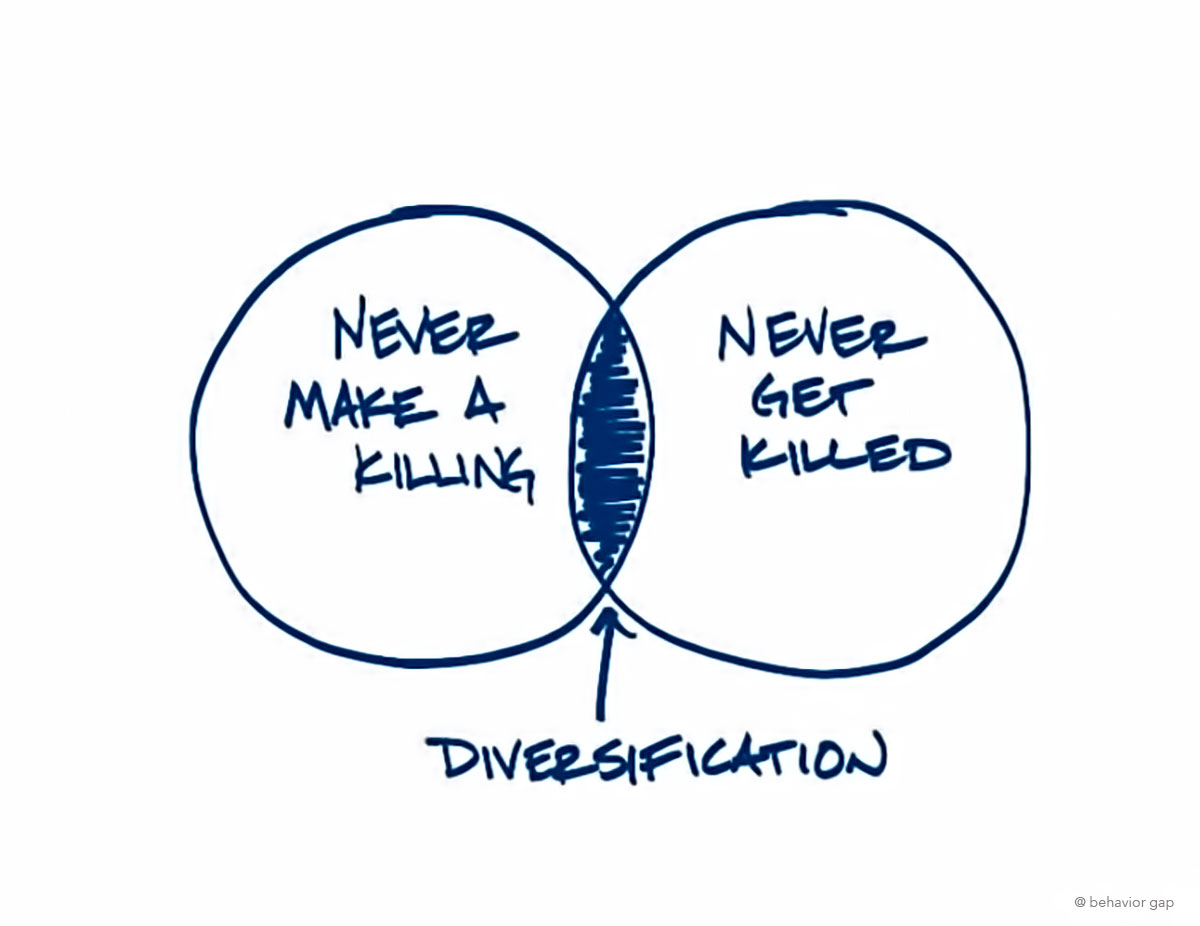

Rethinking Diversification: Navigating Correlation, Concentration, and Crisis in Modern Portfolios

Long revered as the only free lunch in finance, diversification now finds itself on trial, its once-unquestioned wisdom…

March 23, 2025

Harnessing the Power of Private Equity in a Diversified Portfolio

In the world of investing, diversification remains a cornerstone strategy for minimizing risk while maximizing potential returns. While…

March 20, 2025

The Liquidity Myth: Why the Future of Investing is Private

The landscape of wealth management is undergoing a profound shift. As traditional 60/40 portfolios come under scrutiny and…

March 18, 2025

Riding the Edge of Chaos: Why Advisors Must Embrace the New Era of Diversification

There’s an old saying in investing: past performance is no guarantee of future results. It’s a phrase so…

March 18, 2025