Section

Adapative Asset Allocation

15 posts

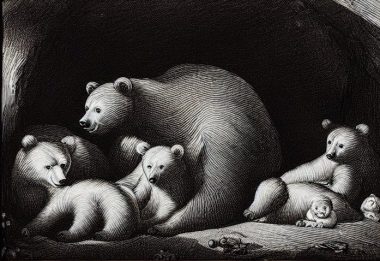

Defying the Bear’s Grasp: The Emotional Journey of Achieving Managed Futures Prosperity

by Rodrigo Gordillo, President, ReSolve Asset Management Introduction I’ve been hearing many macro managers and managed futures industry…

April 19, 2023

Prepare, Don’t Predict: Building Resilient Portfolios with Private Credit

For decades, investors climbed the 60/40 ladder with confidence. Now, every step feels less steady. High inflation that refuses to budge, interest rates that won’t come down anytime soon, and the growing correlation between stocks and bonds...

From All-Weather to All-Terrain Investing for the Stormy Decade Ahead

by Adam Butler, Rodrigo Gordillo, and Mike Philbrick, ReSolve Asset Management The endowment portfolio characterized by 60 percent…

January 15, 2023

Generational investment opportunity, Adapting portfolios for market & inflation volatility, ETFs & strategies

Recently, at the ETFInsight/Credo 9th Annual ETF Conference we had the honour and pleasure of catching up in…

December 27, 2022

5 Risk-Balanced Asset Allocation with Alex Shahidi and Damien Bisserier, Evoke Advisors

Our guests are Alex Shahidi, and Damien Bisserier, both Managing Partners and Co-Chief Investment Officers at Evoke Advisors.…

April 28, 2021

Get Comfortable with Being Uncomfortable, Part 1: Valuations

by Adam Butler, Resolve Asset Management This is the first of a three-part series we’re affectionately calling “How…

August 25, 2020

Time to get comfortable being uncomfortable

Rodrigo Gordillo and Mike Philbrick, quantitative investing authorities and co-founders of Resolve Asset Management contend that it’s time…

September 10, 2019

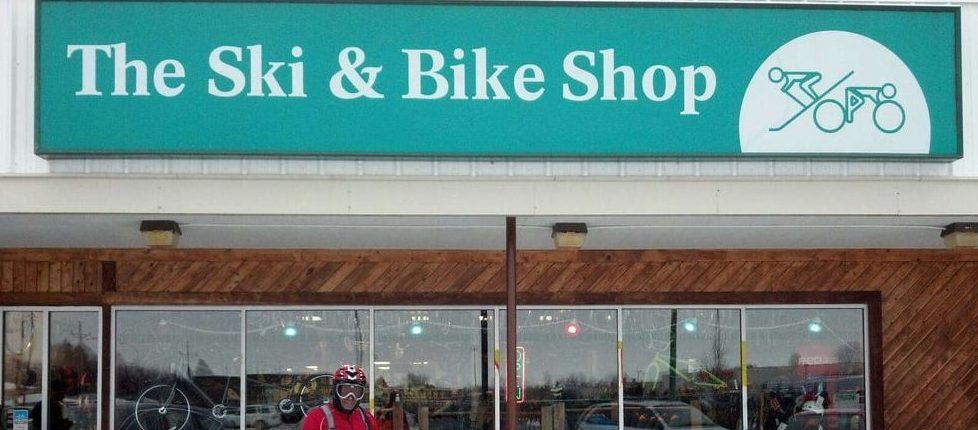

Skis and Bikes: The Untold Story of Diversification

by Adam Butler, Rodrigo Gordillo, and Michael Philbrick, Resolve Asset Management In most parts of Canada we have…

September 7, 2018

Rodrigo Gordillo: Why most advisors have portfolio construction backwards and how to fix it

Rodrigo Gordillo, Managing Partner and Portfolio Manager at Resolve Asset Management shines a light on one of the…

August 14, 2018

Dynamic Asset Allocation for Practitioners, Part 1: Universe Selection

by the Resolve Team, Resolve Asset Management In 2012 we published a whitepaper entitled “Adaptive Asset Allocation: A…

July 27, 2017

Get Comfortable with Being Uncomfortable, Part 2: Maximum Diversification

by Adam Butler, CEO Resolve Asset Management This is the second of a three-part series we’re affectionately calling…

May 19, 2017

Get Comfortable with Being Uncomfortable, Part 1: Valuations

by Adam Butler, Resolve Asset Management This is the first of a three-part series we’re affectionately calling “How…

May 5, 2017

Interview with MIT's Andrew Lo (Masters in Business)

Interview with Andrew Lo (Masters in Business) Bloomberg View columnist Barry Ritholtz interviews Andrew Lo, director of the…

April 29, 2017

Missing Both the Best AND Worst Periods Improves Performance

by Adam Butler, Resolve Asset ManagementThe buy-and-hold crowd, including many mutual fund companies and a large cross-section of…

March 8, 2017

Asset Allocation is Not for the Faint of Heart (Long Live Diversification)

by Adam Butler, Resolve Asset Management I’m starting to feel like a rancourous curmudgeon, but I am frustrated by…

January 23, 2017

Tactical Asset Allocation Alpha and The Greatest Trick the Devil Ever Pulled

by Adam Butler, Resolve Asset Management, via GestaltU.com “The greatest trick the Devil ever pulled was convincing the…

September 27, 2016