Section

Policy

202 posts

Lumber Dispute Is One U.S. May Not Win

The U.S. relies on Canadian softwood lumber for home-building supplies, so is raising tariffs against their northerly neighbor…

May 4, 2017

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Trump Tax Plan: What You Need to Know

The Trump Tax Plan: What You Need to Know by Brad McMillan, CIO, Commonwealth Financial Network The big…

April 28, 2017

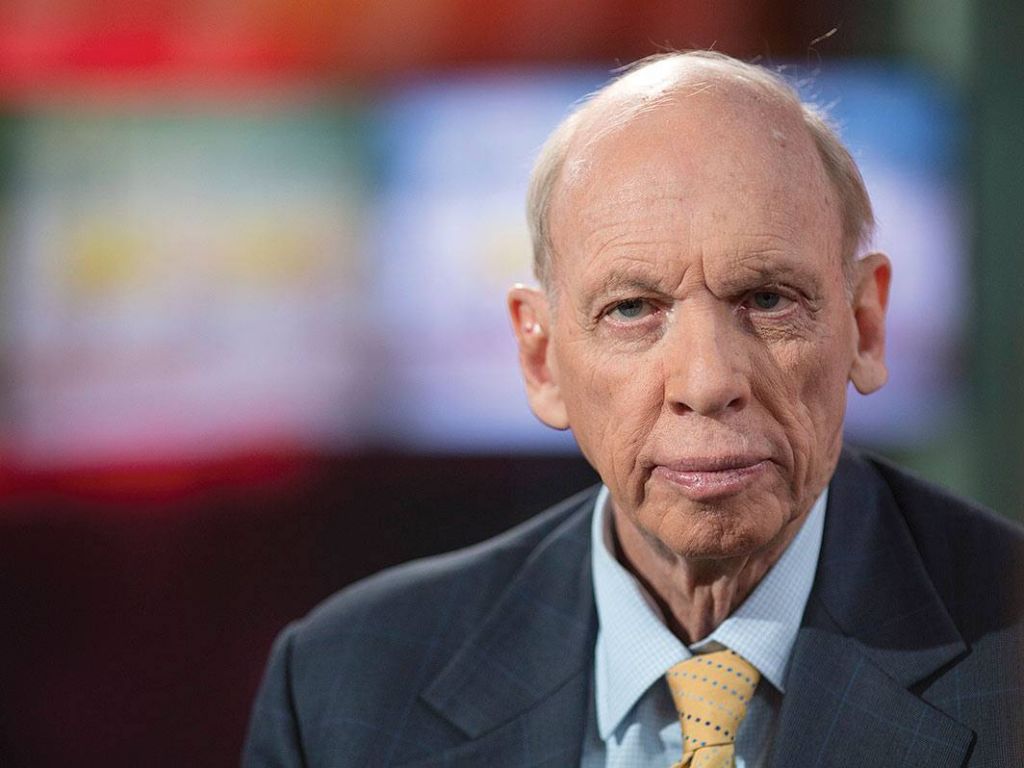

Byron Wien: Winning is Easy, Governing is Hard

by Byron Wien, Blackstone Donald Trump swept into office on a populist wave. His promise of greater growth…

March 30, 2017

Echo Chamber

by Michael Lebowitz, 720 Global Research Since the U.S. economic recovery from the 2008 financial crisis, institutional economists…

March 22, 2017

When the Chair Speaks, the Market Listens

by Ryan Detrick, LPL Research Ask fixed income investors what keeps them up at night, and they might…

February 17, 2017

Fed Up – A Look Behind the Curtain

by Michael Lebowitz, 720 Global Research Danielle DiMartino Booth, a former Dallas Federal Reserve official, released a new…

February 15, 2017

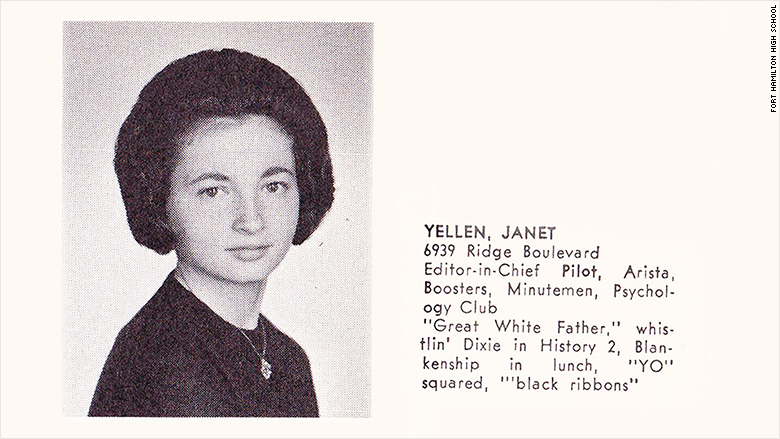

(Rebel) Yellen

by Scott Brown Ph.D., Chief Economist, Raymond James Fed Chair Janet Yellen will present her monetary policy testimony…

February 15, 2017

Elections in Europe could mean investment opportunity

Elections in Europe could mean investment opportunity by Matt Dennis, Senior Portfolio Manager, Invesco Ltd. Invesco Canada A brimming…

February 9, 2017

Political Turmoil Could Restrain Market in 2017

by Brad McMillan, CIO, Commonwealth Financial Network As we approach the end of the beginning of the year,…

February 1, 2017

Keep one eye on the market, the other on policy change

by Douglas Drabik, Fixed Income, Raymond James Interest rates inched up last week 8bp to 10bp 5 years…

January 31, 2017

The Source of Uncertainty

by David Blitzer, Chairman of the Index Committee, S&P Dow Jones Indices In 2017 politics, not economics will…

January 17, 2017