Rick Rieder explains why today's buyback boom is an economic distortion created by the Federal Reserve's excessively accommodative monetary policy.

by Rick Reider, Managing Director, Blackrock

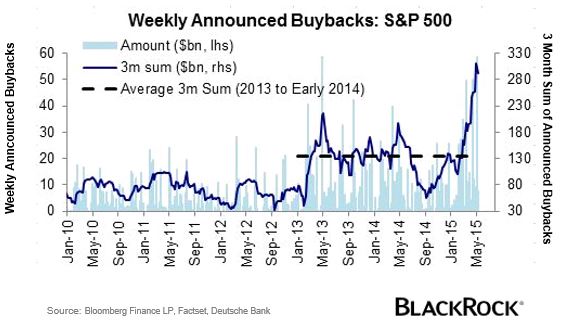

There has been a lot of debate recently about whether today’s buyback boom — a record $133 billion in buybacks for S&P companies were announced in April — is good or bad for the economy and for markets.

While some defend the buyback practice as a method of returning cash to shareholders, others, including my colleague Larry Fink, have argued that some companies today are focusing on maximizing short-term shareholder value at the expense of investing in the future.

In my opinion, today’s boom is just one economic distortion created by the Federal Reserve (Fed)’s excessively accommodative monetary policy.

The boom is, in essence, a response to today’s extraordinarily low interest rates, which have translated into abundant liquidity for corporations seeking to borrow cheaply in the capital markets.

While investment-grade corporate debt-to-equity levels are admittedly lower today than they were in the early 1990s, this metric has increased from 72% in 2010 to 85% today, and it’s likely headed higher. If we were to exclude the less leveraged information technology sector, it would already appear considerably higher, and by ratings bucket, nearly all investment-grade segments have been participating in this borrowing binge.

Indeed, the supply of dollar bond issuance in this year’s first quarter hit record levels, and those levels don’t account for the increased use of “reverse Yankee issuance,” whereby U.S. corporations issue into European markets denominated in euros.

In the early stages of this recovery, many corporations sensibly used access to inexpensive debt to term-out existing debt and to raise cash cushions on their balance sheets, an understandable response to the financial crisis and subsequent recession. In recent years, however, we have increasingly seen debt used for stock buybacks and dividends, as the chart below shows, in essence rewarding equity-holders at the (possible) expense of bondholders.

Sources: Bloomberg Finance LP, Factset, Deutsche Bank

Now, there is nothing wrong with stock buybacks and dividends per se, and indeed they can contribute to a very sensible corporate capital allocation strategy, but should this use of capital crowd out long-term capital expenditure (investment) in a firm’s core business, or begin to threaten its credit quality, then it can become concerning.

And this is what we are seeing today. At an aggregate level, the percentage of U.S. corporate cash sources now used for some form of immediate shareholder benefit, such as stock buybacks or dividend payments, has recently exceeded the amount firms are spending on capex. At current interest rate levels, corporate leaders are incentivized to merely leverage firm capital stacks and avoid riskier capex that may not pay off, particularly as shareholders agitate for a return of cash.

Indeed, the global economy is witnessing a massive redistribution of wealth and income with borrowers, equity shareholders and short-term investors benefiting; and savers, bondholders and longer-term investors being placed at risk.

Looking forward, I do expect that corporate borrowing should moderate as rates gradually rise. In the end, leveraging cycles eventually turn, policy evolves, and the threat of technological and competitive disruption should combine to force companies back to investing in their productive capacity. In the meantime, as we wait for the start of rate normalization, firms continue to play capital structure arbitrage, and the cost of waiting to lift off from “emergency” interest rate levels grows.

Sources: BlackRock, Bloomberg, Factset, Deutsche Bank

Rick Rieder, Managing Director, is BlackRock’s Chief Investment Officer of Fundamental Fixed Income, is Co-head of Americas Fixed Income, and is a regular contributor to The Blog. You can find more of his posts here.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of May 2015 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2015 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owners.

iS-15685