Sponsored Article

New Milestones for NEO Exchange

May 2, 2016

On March 27, 2015 that the NEO Exchange launched its trading platform with the goal of bringing a new level of fairness, transparency, and liquidity to Canadian capital markets.

With a year of trading now under our belts, our data now suggests we have come a long way in realizing that goal, and highlights the positive impact the NEO Exchange is having on the market.

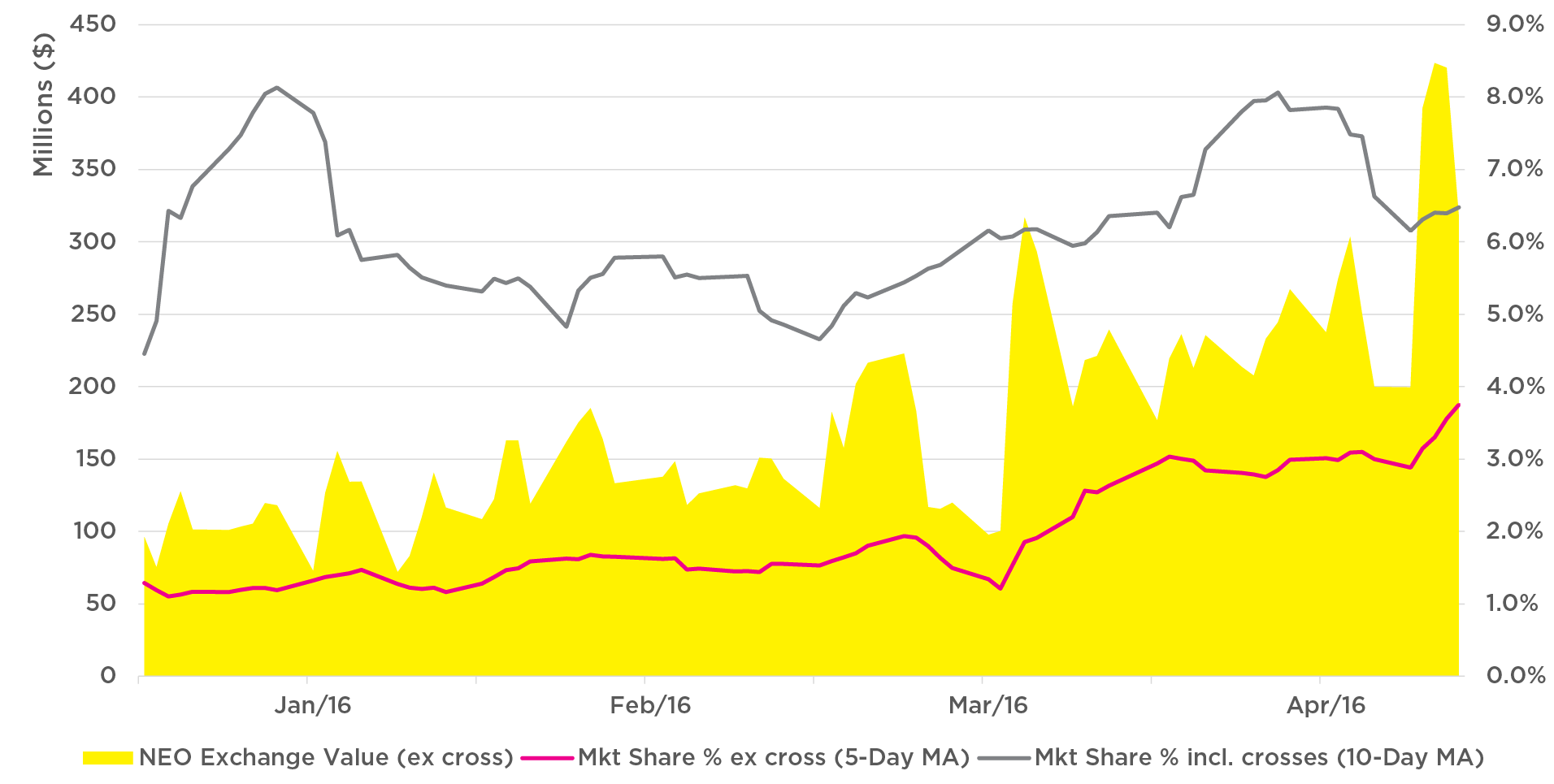

MARKETSHARE PASSES 6% MILESTONE

[Tweet "NEO Exchange marketshare averaged over 6% (incl. crosses) since start of 2016. @Aequitas_NEO"]In 2016, the NEO Exchange has averaged over 6% of the total market by value (including crosses) since the beginning of 2016. For the month of April 2016, this figure reached 7.1% and, excluding crosses, 3.4%.

We offer distinctly unique benefits and mechanisms for all participants, and we’re thrilled that our stance on fairer markets is working as more trading flow than ever before is passing through our Exchange.

Of particular note, ETF trading has really gained momentum, as we have averaged over 24% of the market in ETFs (by value) since the start of April, and over 14% excluding crosses over the same time period. Year to date, our numbers consistently make us a top two or three venue in ETF trading, highlighted by our peak (on April 1st) of 38% by volume and 50% by value, comfortably making us the #1 venue for ETFs on that day.

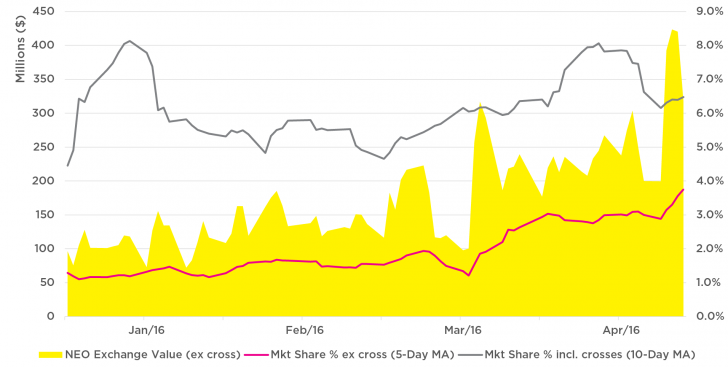

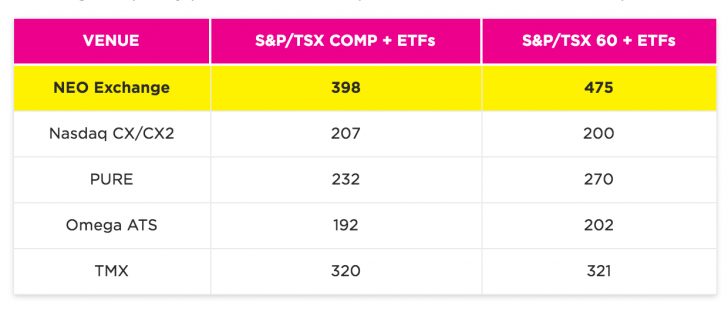

AVERAGE TRADE SIZES

As far as trading sizes go, bigger is certainly better. Trades in today’s markets are increasingly fragmented, meaning the average number of shares per trade is smaller than ever before- largely due to the proliferation of multiple venues catering to high frequency trading flow. At the NEO Exchange, we are committed to fostering sizable orders, and our data suggests that our mechanisms are working. Month to date, NEO Exchange trade sizes lead the way amongst Canadian venues.

In April, when compared against other venues such as Nasdaq CX/CX2, PURE, Omega ATS, and the TMX, the NEO Exchange boasts the largest average trade sizes across the most actively traded set of Canadian securities, those in the S&P/TSX Composite and ETFs. The full breakdown of our trade sizes against other venues is shown in the table below.

With our growing momentum, innovative features that favor size, and meaningful liquidity provision, we anticipate our trade sizes to trend upwards.

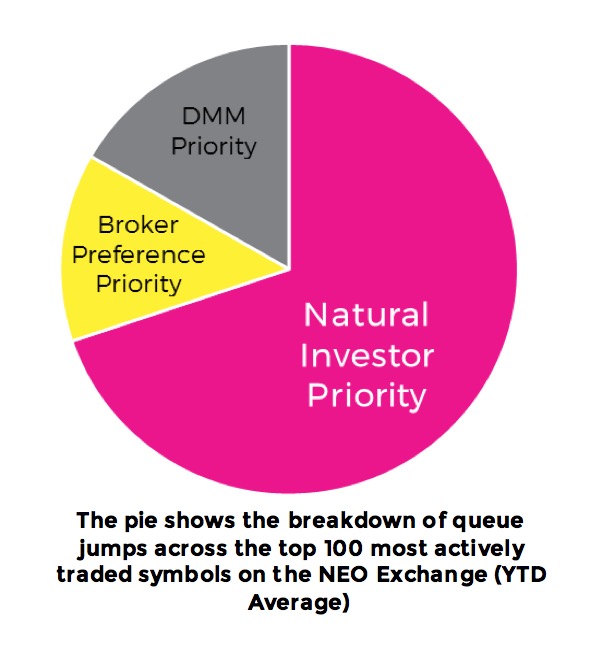

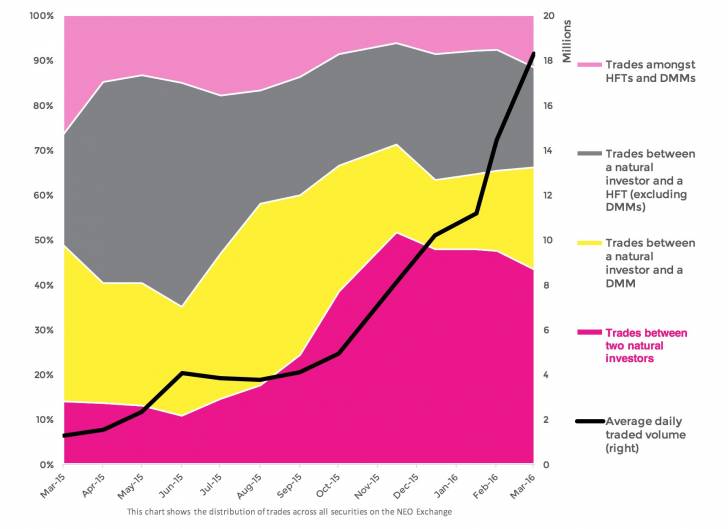

THE EXCHANGE FOR NATURAL INVESTORS

Close to 50% of trading on the NEO exchange is now being done by two natural investors. The NEO Exchange firmly believes that natural investors should serve as the primary sources of liquidity, with professional intermediaries acting as a liquidity safety net instead. This highlights the NEO Exchange commitment to reducing unnecessary intermediation on its marketplace.

By facilitating natural investors trading with other natural investors, the NEO Exchange has improved their execution quality: Natural investors are now less at risk of information leakage or being adversely selected as they’re participating less with predatory HFTs and more with their natural counterparts.

[Tweet "Natural investors now comprise almost 70% of NEO Exchange's total trading volume. @Aequitas_NEO"] To further showcase our mantra of protecting the natural investor, we conducted a study of queue priority on our Exchange. Of all the queue priority mechanisms we offer, which include broker preferencing and market maker priority, we find that the queue jumps from natural investors significantly outweigh all other forms combined. By gaining this priority, natural investors see an improvement in their speed of execution, and in turn, their execution quality.

To further showcase our mantra of protecting the natural investor, we conducted a study of queue priority on our Exchange. Of all the queue priority mechanisms we offer, which include broker preferencing and market maker priority, we find that the queue jumps from natural investors significantly outweigh all other forms combined. By gaining this priority, natural investors see an improvement in their speed of execution, and in turn, their execution quality.

Natural investors are certainly taking notice. Their trading activity continues to rise, and they now comprise almost 70% of the total trading volume on the NEO Exchange (year-to-date).

After a successful first quarter of 2016, we are excited about what the future holds for the NEO Exchange. As our momentum drives us forward, we look forward to seeing improvements across all the aforementioned metrics, ensuring we play our part in making the Canadian capital markets better for all its participants.

Copyright © NEO Exchange