Section

Emerging Markets

418 posts

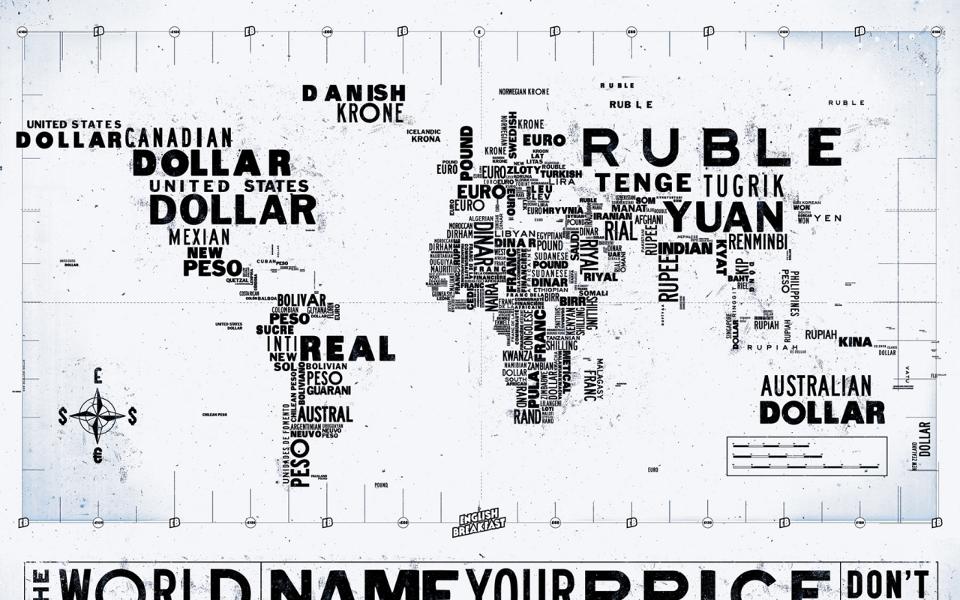

Following the Money in EM Currency Markets

Following the Money in EM Currency Markets by Matthew Peterson, Chief Wealth Strategist, LPL Financial Emerging markets (EM)…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Emerging markets: The “trade of a decade”?

Emerging markets: The “trade of a decade”? by Jeff Feng, Invesco Canada In a recent Bloomberg article, Research…

Six Questions on Emerging-Equity Turmoil

Six Questions on Emerging-Equity Turmoil by Equity Research, AllianceBernstein It’s been a terrible start to the year for…

Brazil's Stock Market has had a Miserable Five Years

Brazil's Stock Market has had a Miserable Five Years by Tiho Brkan, The Short Side of Long Source: Short…

Could Emerging Markets Rebound?

Could Emerging Markets Rebound? Emerging Markets breadth remains very weak and oversold

Emerging-Markets Stocks Took The Lead Last Week

Emerging-Markets Stocks Took The Lead Last Week by James Picerno, The Capital Spectator Emerging-markets equities enjoyed a solid…

A few more signs that the pain in EM is ending

A few more signs that the pain in EM is ending by Eric Bush, CFA, Gavekal Capital …

EAFE crushing EEM since 2012

SIA Equity Leaders: EAFE crushing EEM since 2012 by SIACharts.com For this week’s SIA Equity Leaders Weekly, we…

The Case for a Bottom in Emerging Markets

The Case for a Bottom in Emerging Markets by Tiho Brkan, The Short Side of Long “Black Monday” panic…

As Market Fears Grow, Stay Focused on the Long Term

As Market Fears Grow, Stay Focused on the Long Term by Brad McMillan, CIO, Commonwealth Financial Network One…

The Great Emerging-Market Bubble

The Great Emerging-Market Bubble by Bill Emmot, Project Syndicate LONDON – Something has gone badly wrong in the…

Crude Oil Extremely Oversold, Approaching Bottom

by Tiho Brkan, The Short Side of Long Crude Oil is extremely oversold from short and long term perspective…

Some Thoughts On Emerging Markets

by Michael Batnick, The Irrelevant Investor Emerging Markets have been performing awfully lately. And by lately, I mean…

Emerging Europe Analyst: “Poland Today Reminds Me of America”

Joanna Sawicka still remembers having to wait in line for hours to buy food and school supplies. In communist-controlled Poland, such basic goods were rationed. Families received special government-issued cards that permitted them to buy only the minimal amount of meat per month. This experience made a lasting impression on Joanna as a child and inspired her to work toward a life in which she would not want for anything.

Now the research analyst for our Emerging Europe Fund (EUROX), Joanna recently visited her native Poland and found it to be a drastically different country from the one she grew up in. I sat down with her to chat about her travels and where she thought the Eastern European country might be headed from here.

So tell me about your trip.Basically it was a family trip. I got to spend time with my parents and some old friends, not to mention check out how Poland looks now and see the changes that have happened since I last visited nine years ago.

I combined the trip with a short two-day visit to Warsaw, where I attended the Capital Markets Summit at the Warsaw Stock Exchange. The main topics of discussion during the conference included real estate and the growing role of debt capital markets. We also discussed the continued effort to privatize Polish businesses, a process that began in 1991 after the fall of communism.

What’s changed since your last visit?I saw big changes. There’s now a small business on every street corner. A lot of my old friends own businesses now. Poland is the largest beneficiary of European Union funds, and people are clearly taking advantage of having more money and better opportunities.

Another change I saw were the highways and roads being developed. They’re so much bigger and better from when I was a child. The highway from Warsaw to Bialystok, where I was born, used to be one lane each way. Now it’s being developed into two lanes each way, so it will be faster, better-looking and more convenient. The cars are also better now than what I remember. The Fiats and Polonezes have been replaced with Mercedes and BMWs.

On the other hand, electronics and clothing have become very expensive. While I was over there, I priced the iPad for my daughter and was surprised to find that it was quite a bit more expensive than here in the U.S. I was also able to visit CCC, one of the holdings in the Emerging Europe Fund. It’s a retail shoe and handbag store that looks a little like Payless ShoeSource, but it’s bigger and nicer. It’s being managed very cost-efficiently because they have few people working there.

What advice do you have for someone who’s interested in investing in Poland?As always, if you’re investing in another country, you need to be careful with currencies. As for Poland in particular, be selective. There are many good opportunities, but it’s important to be familiar with the company’s story as well as the people managing it. Right now, political risk is a concern, and the financial sector is under some pressure. The populist Law and Justice Party seeks to increase taxes on banks and opposes the domestic ownership of lenders.

What do you see in store for Poland?I see Poland moving forward quickly and with confidence. When I was little, the neighborhood grocery store carried next to nothing other than milk and bread. For meat, you had to wait in a line for a couple of hours. Today, I can go to the same store and easily find anything that’s available here in the U.S. In fact, Polish stores carry an even wider selection of produce and other goods than what Americans might be used to.

In that respect, the Poland of today reminds me of America. It has so many new opportunities, and people’s lives have vastly improved since the end of communism. Investment dollars are coming in from abroad, and many people have taken the opportunity to open up their own businesses. It’s still more challenging to open a business in Poland than in the U.S., though. There’s so much bureaucracy, and the paperwork takes a lot of time to complete. You have to know the right people. Although there is room for further improvement, I’m very proud of Poland and its people.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio. The Emerging Europe Fund invests more than 25% of its investments in companies principally engaged in the oil & gas or banking industries. The risk of concentrating investments in this group of industries will make the fund more susceptible to risk in these industries than funds which do not concentrate their investments in an industry and may make the fund’s performance more volatile.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Emerging Europe Fund as a percentage of net assets as of 6/30/2015: CCC SA 0.80%, Fiat Chrysler Automobiles N.V. 0.00%, Bayerische Motoren Werke AG 1.03%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Will the China Crash Bring Down the Whole House?

A lot of people are talking about how bad China is. It's worse than the U.S. 2007, it's…