Section

Fixed Income

3290 posts

The Economy and Bond Market Radar (July 29, 2013)

The Economy and Bond Market (July 29, 2013) The treasury market sold off modestly this week as yields…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

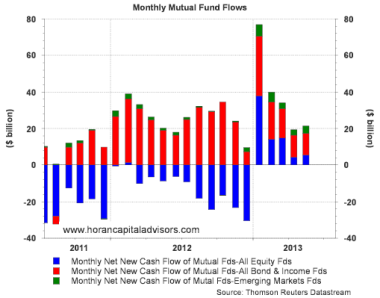

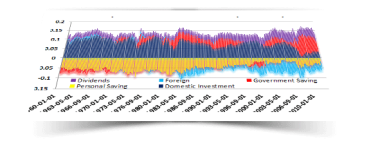

Investors Running Out Of Cash Available For Investments

by David Templeton, Horan Capital Advisors With investors being paid virtually zero percent interest on money market cash…

A One-Pillar Economy

by Scott Minerd, CIO, Guggenheim Partners LLC July 24 2013 Despite blockbuster new home sales, higher interest rates…

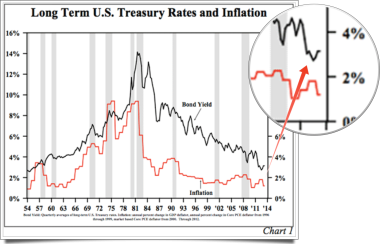

Hoisington: "The Secular Low In Bond Yields Has Yet To Be Recorded"

by Lacy Hunt and Van Hoisington via Hoisington Investment Management, Lower Long Term Rates The secular low in…

The Decline and Fall of Detroit

The Decline and Fall of Detroit (via Market Shadows) The Decline and Fall of Detroit Courtesy of Yves…

Is Inflation Really Gone Forever?

by Jon Ruff, AllianceBernstein Recent movements in asset prices suggest that markets have forsaken any possibility of an…

The Economy and Bond Market Radar (July 22, 2013)

The Economy and Bond Market Radar (July 22, 2013) The treasury market rallied again this week after Fed…

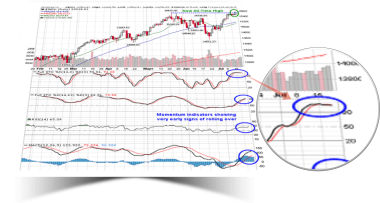

Technical Talk: New All-Time Highs Reached, Momentum Indicators Rolling Over

by Don Vialoux, Tech Talk Upcoming US Events for Today: No Significant Events Scheduled Upcoming International Events for…

7 Things Investors Should Know Now

by Russ Koesterich, Chief Global Strategist, iShares Earlier this month when I provided a quick halftime look at…

Is Gundlach Right, Have Bonds Bottomed?

by Mebane Faber A few weeks ago bond king and fellow Angeleno Jeff Gundlach mentioned that he thought…

Three Things I Think I Think

by Cullen Roche, Pragmatic Capitalism Some random thoughts here on a slow news day: The Merrill Lynch…

Dividend Payers Underperforming Non-Payers For First Six Months Of The Year

by David Templeton, Horan Capital Advisors It seems much of the focus around the stock market this year…

Jim Rogers: "Beware The Man On The White Horse..."

Submitted by Simon Black via Sovereign Man blog, As far back as ancient times, whenever civilizations fell into…

Concerned About Rising Rates? Add Ballast by Going Global

by Alison Martier, AllianceBernstein A US-only bond investor is affected by one business cycle, one yield curve and…