by David Templeton, Horan Capital Advisors

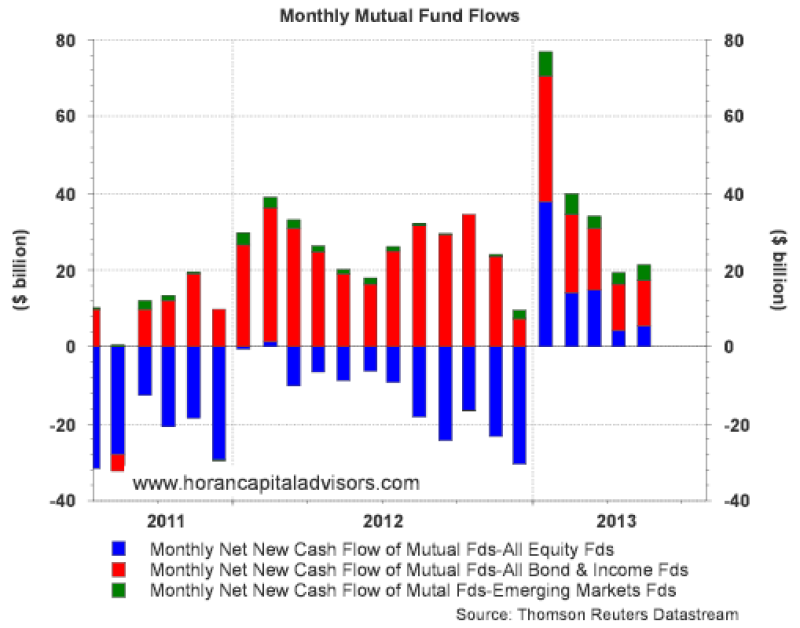

With investors being paid virtually zero percent interest on money market cash for what seems an eternity, data suggests investors are buying almost any investment asset. Broadly speaking, all the talk has been how poorly emerging market investments have performed over the past few years. At HORAN Capital Advisors we even discuss the weak emerging market performance in our just released Investor Letter. Looking at fund flows though, the all equity, all bond and emerging markets mutual funds have been the beneficiaries of fund inflows this year.

The question often arises about mutual fund flow data not being comprehensive enough given the popularity of exchange traded products. Below are a couple of links to recent comments from Lipper about ETF flows.

- Investors Pump $8.4 billion into Equity Exchange-traded Funds (July 12, 2013)

- Exchange Traded Products: Record Volume and Net Outflows (July 24, 2013): This article notes, "In June, equity ETFs/ETPs saw net inflows of US$4.8billion. North American equity ETFs/ETPs gathered the largest net inflows with US$6.9 billion, followed by developed European equity indices with US$3 billion, while emerging market equity had net outflows with US$4.9 billion."

- Reversal of Fortune: ETF Flows Snap Back

The strong buying interest exhibited by investors during this bull market run since the end of the recession in 2009 is confirmed by the declining percentage of cash assets in money market mutual funds dividend by equity mutual fund assets. This declining trend is detailed in the below chart.

Investment Company Institute flow data also confirms flows out of money market mutual funds.

A curious question then is where will the additional investment dollars come from that can find away into equity investments? Avondale Asset Management posted a summary of the conference call notes from TD Ameritrade (AMTD). During the call TD Ameritrade mentions a number of details about the individual investor, one of which is the firm is seeing the start of a "mini" rotation out of bonds. Maybe this will be that source of cash that supports higher equity prices. On the other hand, the equity market does seem in need of rest, if only a brief one so one maybe does not need to be in a rush at the moment.

Disclosure: No position in AMTD