by Cullen Roche, Pragmatic Capitalism

Some random thoughts here on a slow news day:

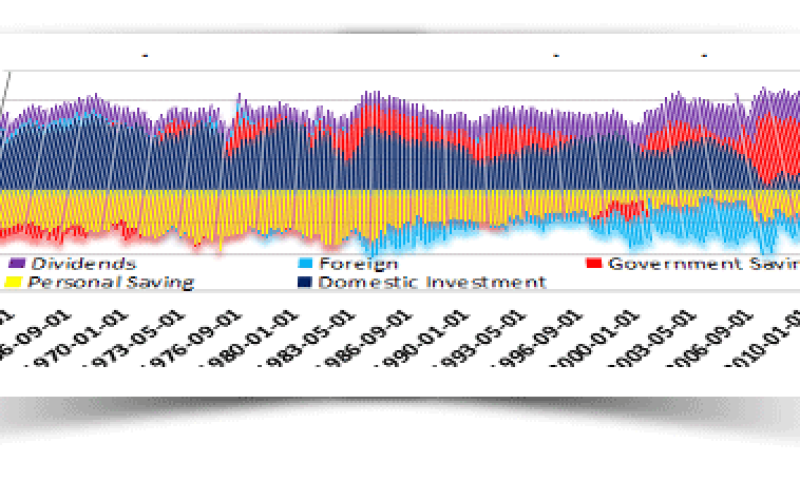

- The Merrill Lynch Monthly Fund Survey says the big money is most worried about a hard landing in China. But what’s more interesting to me is how little they’re worried about the potential for fiscal tightening in the USA. It seems as though markets have had this one backwards for years now. Fiscal policy has been enormous to the tune of trillions in budget deficits per year for 4 years and running. That’s been a huge support mechanism for the state of corporate profits. I often point out the simple and intuitive chart below which proves just how important the deficit has been in driving corporate profits. In a normal period, corporate profits are driven primarily by dividends and private investment. But that red bar is showing how the tables turned in recent years and corporate profits were increasingly driven by the deficit. This means investors are getting QE precisely wrong. They think the Fed is steering the markets and profits when in reality it has been Congress. In other words, it’s not Fed “tapering” that we should be concerned about, but Congressional “tapering”….

- Today’s industrial production report showed more of the same stagnant economic trends. At 77.8 we’re still seeing capacity utilization that is operating well below capacity (the 20 year average is 80.8), but is also not rolling over. We’re sort of just running in place.

- Have you seen this interview from CNBC with Joe Petrowski, the CEO of Gulf Oil? He says we could see $50 oil this year. And it’s not because he thinks the US economy is weakening, but because he says the supply of oil and natural gas is surging. He says it’s “simple economics”. Too much supply, weak demand = lower prices. That could be an interesting tailwind for the economy if it materializes. Of course, oil and gas prices have been going in the exact opposite direction, but if Petrowski is right we could see the equivalent of a huge wealth transfer from oil companies to households.

Copyright © Pragmatic Capitalism