Frequently when advisors are first introduced to the relative strength philosophy behind SIACharts, there is a questioning behind buying strength and selling weakness, as the traditional belief has been to sell strength and buy weakness instead. For this week's SIA Equity Leaders Weekly, we are going to look more in depth into the "buy strength and sell weakness" methodology to help to dispel the belief that some advisors may continue to carry.

Valeant Pharma Intl (VRX.TO)

Currently in the #1 spot, the chart on the right of VRX.TO shows when it became our #1 ranked stock in the SIA S&P/TSX 60 Report back on November 23, 2011. Normally we recommend that you look to make a purchase from the positions in the top 25% of the report, but in this case we are waiting until it has hit the #1 spot, making it the extreme example of buying strength instead of selling it. Since that date, VRX.TO has moved up an additional 116.8% (as the close of Jul.16/13) while the TSX 60 benchmark, the XIU.TO, has moved up 8.8%.

Click on Image to Enlarge

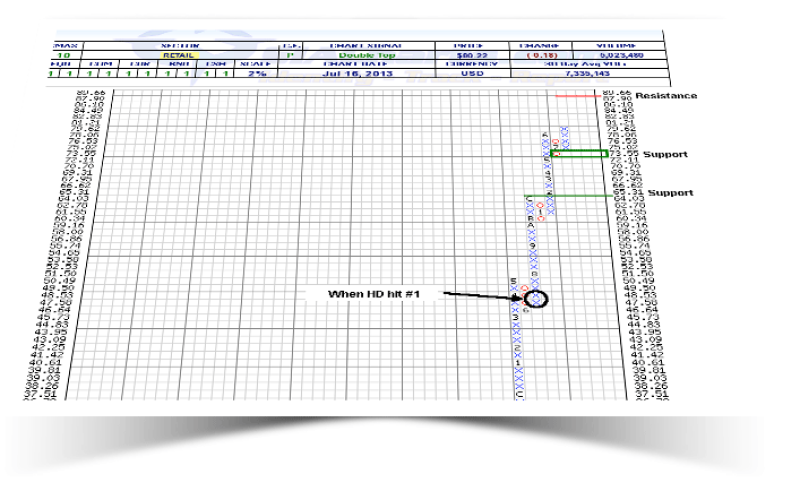

Home Depot (HD)

The second position we are going to look at comes from our current #1 rank from the S&P 100 Report, Home Depot. Home Depot became the top pick back on June 4, 2012 at a price of $47.78 (for this example we are involving dividends) and is now at $80.22 (close of July 16,2013) giving us a 67.9% increase since hitting that top status. In comparison, the OEF (S&P 100 ETF) has moved up 31.9% over that same time frame.

Looking at both of these examples above it should be quite obvious that buying strength, and waiting even longer than necessary until it reaches its strongest relative strength level against its peer group in the report, has continued to add outperformance for our clients. You are not too late to get in, and you have not missed the boat as that ship has not already sailed. Continually staying in the strength and not buying weakness instead is what has helped our advisors to reduce their risk and has helped to increase their performance as these examples have shown.

Click on Image to Enlarge