Section

Factors

49 posts

Eugene Fama: Stick with Basic Factors

by Ron Rimkus, CFA, CFA Institute Have the advances in technology, computing power, and data made the markets…

July 5, 2017

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Value US Sectoral Analysis: What's Under the Hood?

by Nicolas Rabener, FactorResearch SUMMARY Using price-to-book (PB) or price-to-earnings (PE) results in similar Value factor performance Some…

May 31, 2017

Beware Calm Surface Waters

MARKET ETHOS Beware Calm Surface Waters by Craig Basinger, CFA , Connected Wealth, RichardsonGMP PDF Version Earlier this…

May 15, 2017

Are Factor Portfolios Better Diversified Than Not?

by Corey Hoffstein, Newfound Research This post is available as a PDF here. The debate rages on over…

March 22, 2017

Smart Beta Returns (Hint: History Is Worse than Useless)

by Rob Arnott Noah Beck Vitali Kalesnik, Research Affiliates Key Points Using past performance to forecast future performance…

February 17, 2017

Outlook 2017: Factor investing in the coming year

Outlook 2017: Factor investing in the coming year by Dan Draper & Bernhard Langer, Managing Director, PowerShares by…

December 8, 2016

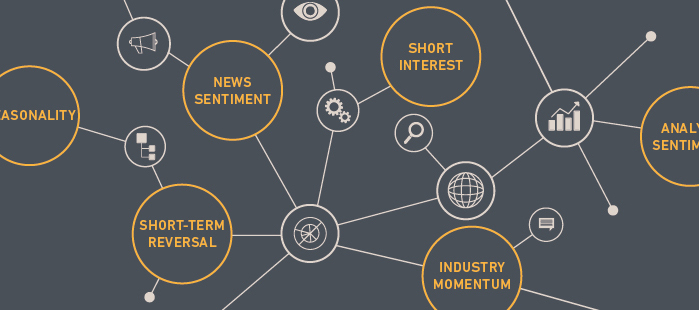

Which Factors Are More Time-Sensitive?

by Dimitris Melas, Global Head of Equity Research, MSCI Hedge funds and other investors who manage portfolios that…

September 29, 2016