Section

Economy

4448 posts

Lots of Support for Higher 30-Year Yields Right Now ... and Also U.S. Equities

by SIACharts.com For this weeks edition of the SIA Equity Leaders Weekly, we will be updating the U.S. Dollar vs.…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

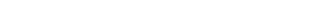

Keeping Your Balance During Shaky Markets

by Paul DeNoon and Gershon Distenfeld, AllianceBernstein While capital markets have had their ups and downs, it’s been…

A Roadmap for Rates

A Roadmap for Rates July 02 2013 Uncertainty over the Federal Reserve’s timeline for tapering quantitative easing has…

The Economy and Bond Market Radar (July 1, 2013)

The Economy and Bond Market Radar (July 1, 2013) After a dramatic sell-off in the bond markets last…

Scott Minerd: Policy Induced Volatility Continues

June 26 2013 The recent bond market collapse is reminiscent of the Great Crash of 1994. Further pressure…

Eric Sprott: Investment Outlook (June 2013)

Have we lost control yet? Eric Sprott and Etienne Bordeleau, Sprott Asset Management Recent comments by the Federal…

Guest Post: Why the Status Quo is Doomed

Submitted by Charles Hugh-Smith of OfTwoMinds blog, The wheels have come off the endless growth via expanding debt…

Albert Edwards: "Marc Faber Is Right. QE99 Here We Come"

The bloodbath in the bond markets has led some 'greatly rotating' commentators to see this as the end…

James Howard Kunstler's Mid Year Digest

Mid Year Digest (via Market Shadows) James Howard Kunstler's Mid Year Digest Wondering why the money world got…

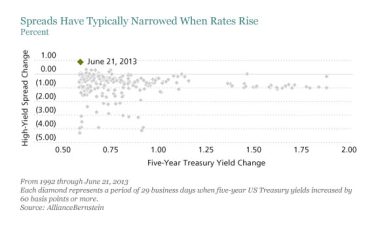

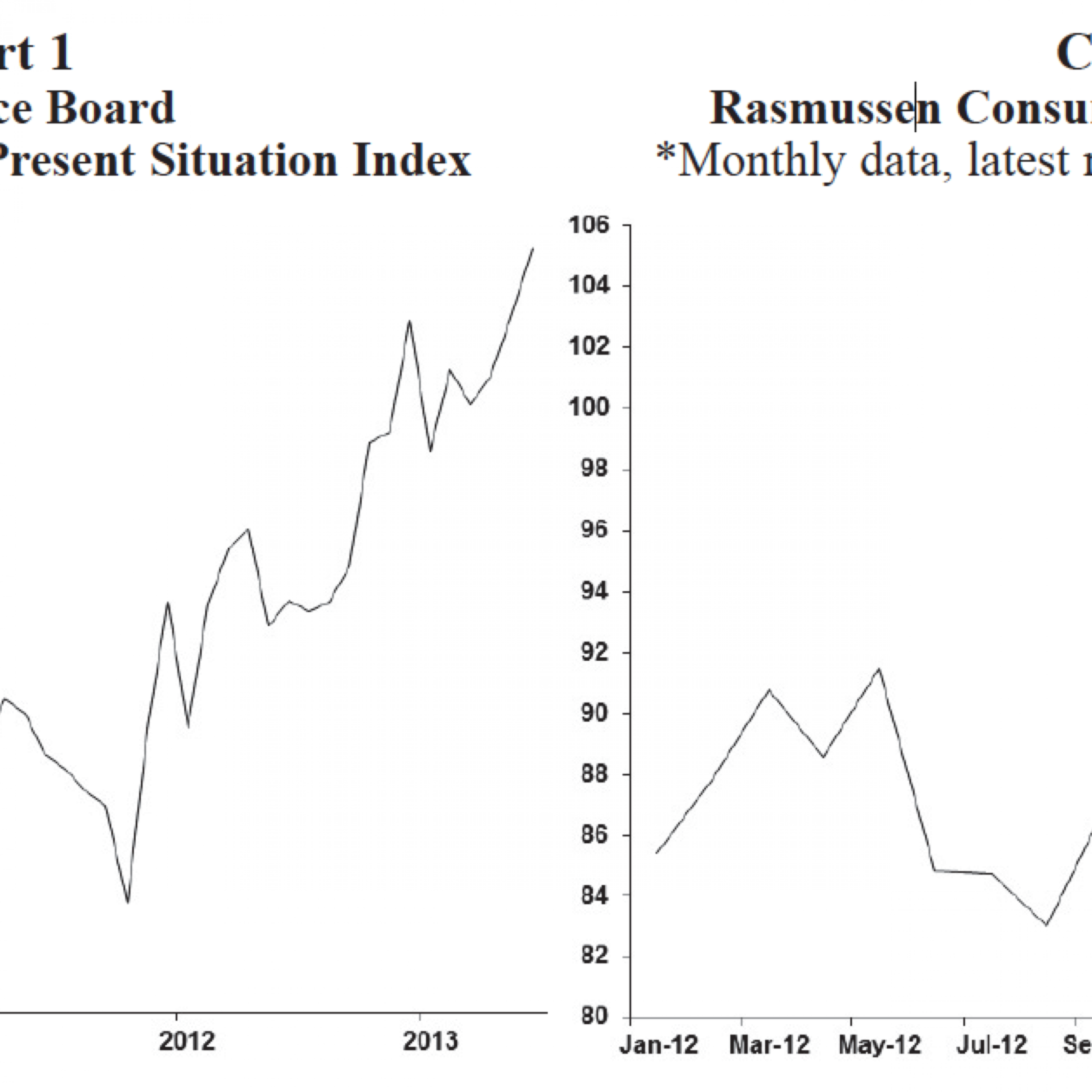

James Paulsen: Investment Outlook (June 25, 2013)

by James Paulsen, Wells Capital Management (Wells Fargo) Is this a Good or Bad Yield Rise? In recent…

The Banker Who Was God

The Banker Who Was God (via Market Shadows) The Banker Who Was God From this week’s Market Shadows…

Markets Don’t Like China's ‘Reasonable’

China’s central bank issued a statement that the Chinese banking system had liquidity levels that were “reasonable” today.

There by hangs a tale. ‘Reasonable’ is that which may fairy and properly be required of an individual (a case of prudent action observed under a set of given circumstances).

Overnight bond-purchase rates ended up double what they should have been at 8. 4920% on June 21st.

Italy's €8-billion Loss! Draghi!

by ToTheTick.com The Financial Times has revealed that Italy is facing losses of €8 billion due to derivative…