by James Paulsen, Wells Capital Management (Wells Fargo)

Is this a Good or Bad Yield Rise?

In recent days, the aggressive rise in bond yields has dominated financial market mindsets. The issue is whether the recent surge in the 10-year Treasury bond yield will soon curtail economic growth and lead to a more significant decline in the stock market. Ultimately, this depends on whether the rise in yields drives confidence lower (a bad yield rise) or whether it is rising confidence which is causing yields to be pushed higher (a good yield rise).

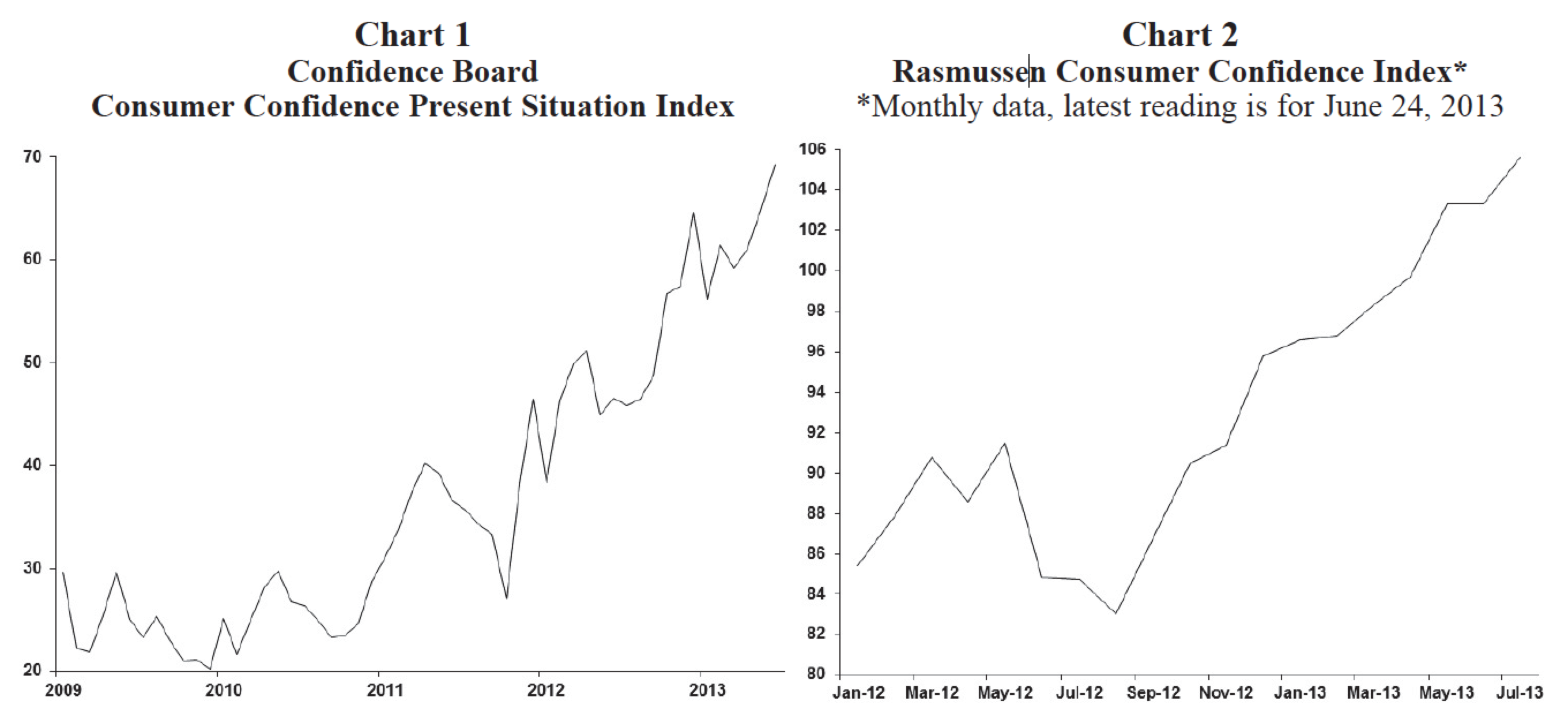

History suggests two significantly different relationships between bond yields and confidence. Since 1967, when the 10-year Treasury bond yield was below 6%, rising yields have typically been associated with rising confidence. When bond yields have been above 6%, however, a rising bond yield has usually been associated with declining confidence. Moreover, the impact of rising yields on the risk/reward character of the stock market is also materially different depending on whether yield hikes occurred while confidence was rising or falling.

Confidence has been RISING!

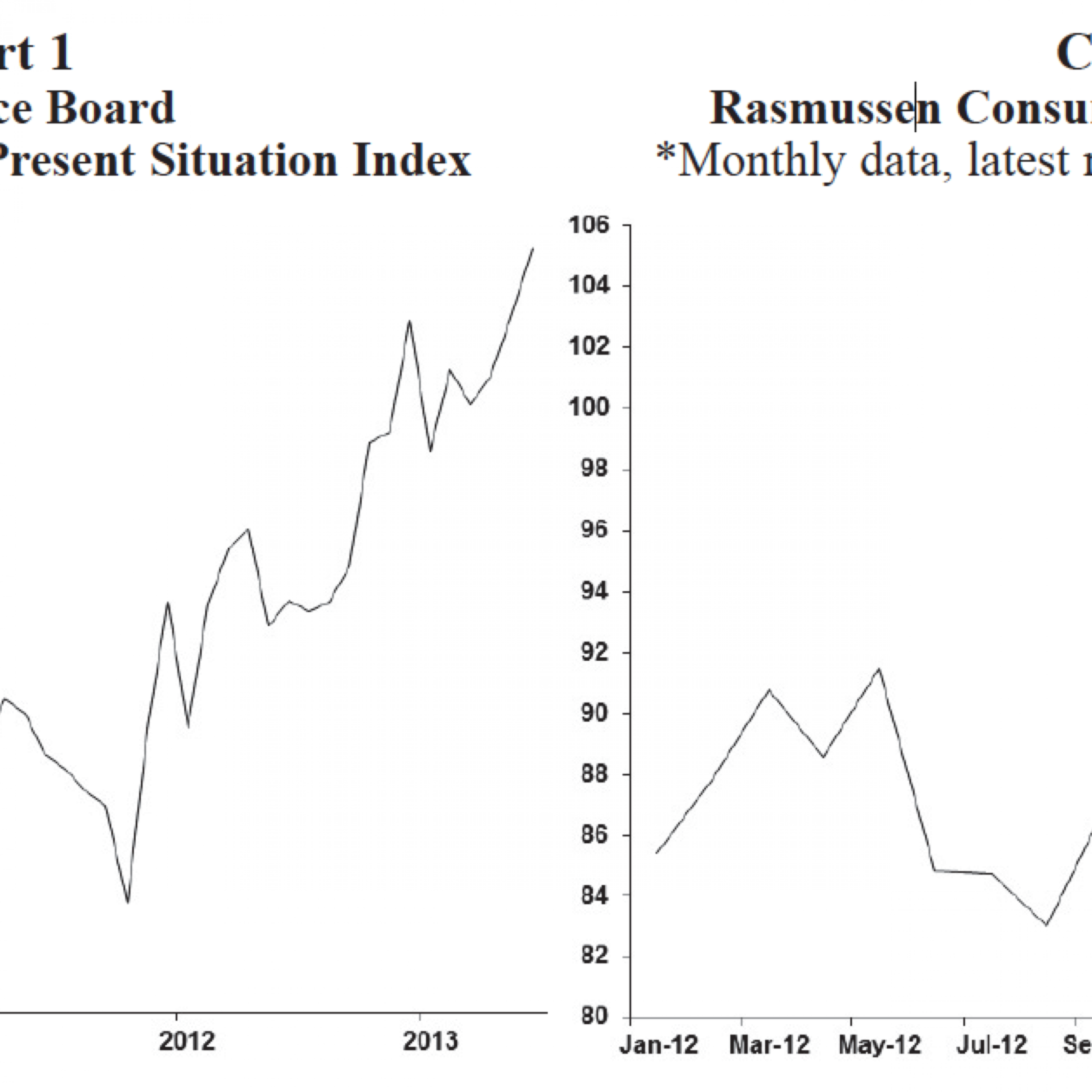

Charts 1 and 2 show the economy enters the recent period of higher yields with rising consumer confidence. After languishing near post-war lows since the 2008 crisis, confidence finally geared in 2012. As registered by the Conference Board (monthly) or Rasmussen (daily), confidence has risen to its highest level of the economic recovery to a five-year high! The latest Rasmussen measure in Chart 2 is for Monday, June 24, showing confidence remains near its high a couple days “after” the Fed announcement last Wednesday that they may start tapering monetary accommodation. Moreover, the Conference Board June release posted a healthy advance in confidence despite an almost 50 basis point rise in the 10-year Treasury bond yield during May.

Confidence in the economic recovery is stronger than at any time since the recession ended and its level is markedly more healthy compared to the last two times the 10-year bond yield surged higher in this recovery. In the first half of 2009, the 10-year yield rose from about 2% to 3.5% and in late 2010 into early 2011 it rose from about 2.5% to 3.5%. In both cases, the stock market faltered and the economy slowed aborting the rise in yields. However, from Chart 1, in both of these previous cases, consumer confidence was extremely weak (mostly below a reading of 30 whereas today the confidence index is about 70) when yields rose. Today, confidence is near a five-year high, more than double what it was during the previous yield hiccups and at a level which makes the economy much more able to better weather higher interest rates.

Yields: Confidence-driven or confidence-destroyer?

Charts 3 and 4 illustrate two distinct relationships between confidence and yields. At least since 1967

(when the Conference Board first began their consumer confidence survey), confidence and yields have tended to rise together when yields have been below 6% whereas confidence has typically declined when yields have risen from above 6%. While correlation does not imply causation, these charts certainly raise the possibility that sometimes (usually from low yields levels) rising confidence tends to push yields higher while at other times (at higher yield levels) rising yields tend to drive (destroy) confidence lower.

Perhaps, when yield levels are very low, rising consumer confidence may force bond yields higher but since both are interpreted as signs of economic improvement, they tend to bolster feelings of recovery sustainability rather than curtail activities. By contrast, from high yield levels, rising yields often connote potential inflation risk which tends to raise economic stability fears and leads to lower confidence levels. In this fashion, rising yields could be good or bad. The key is confidence. Is confidence driving yields higher or are rising yields lowering confidence?

Confidence and yields

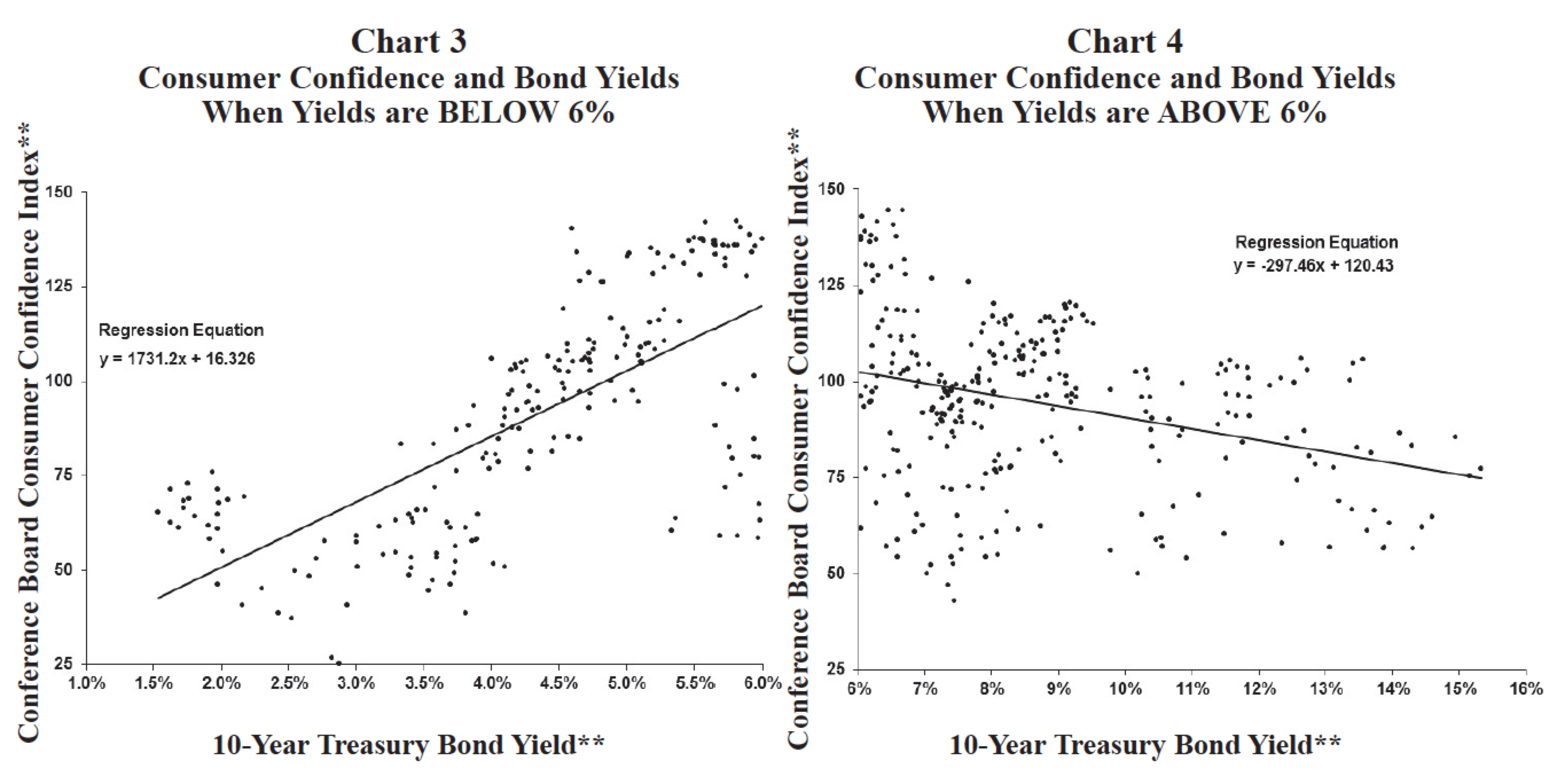

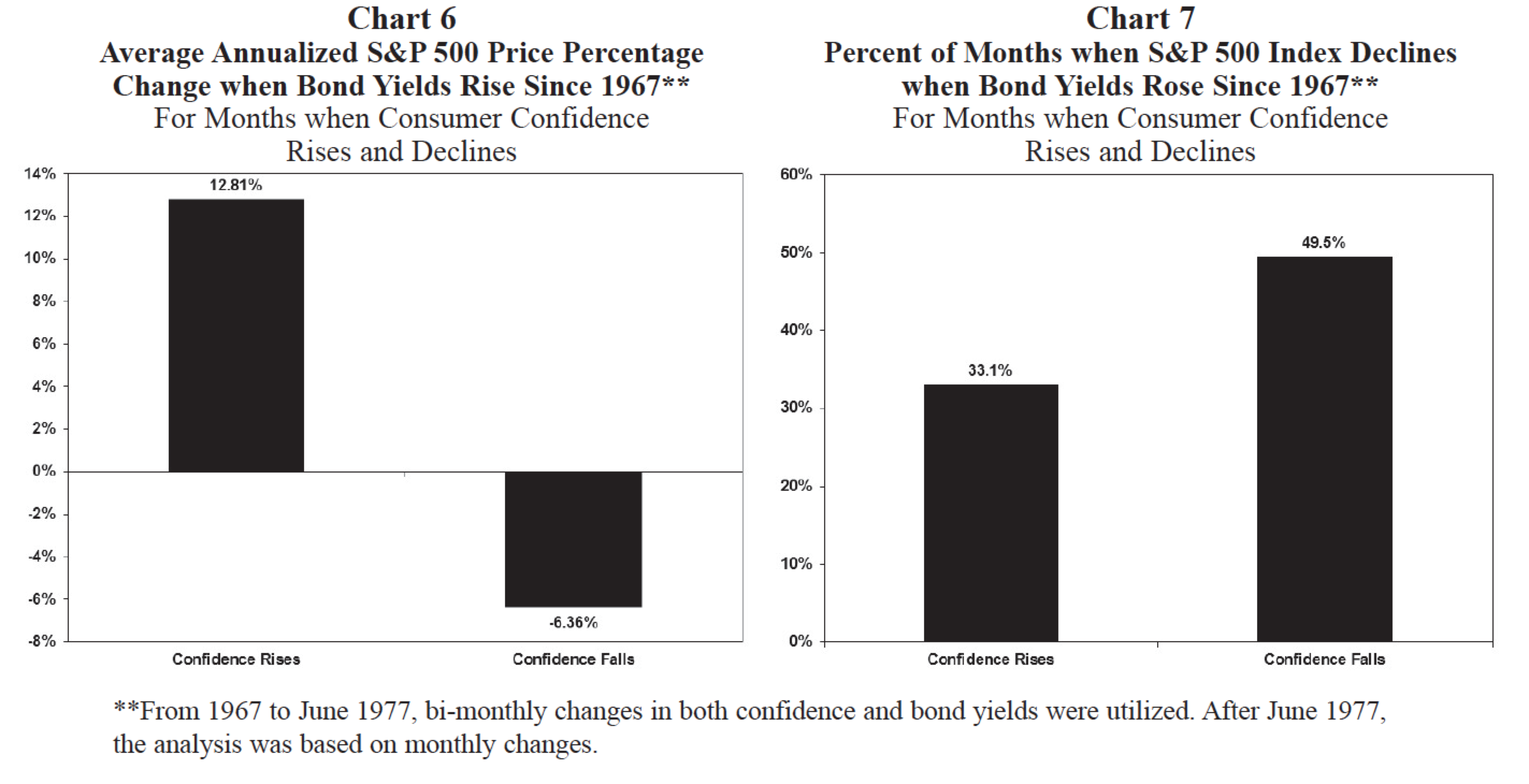

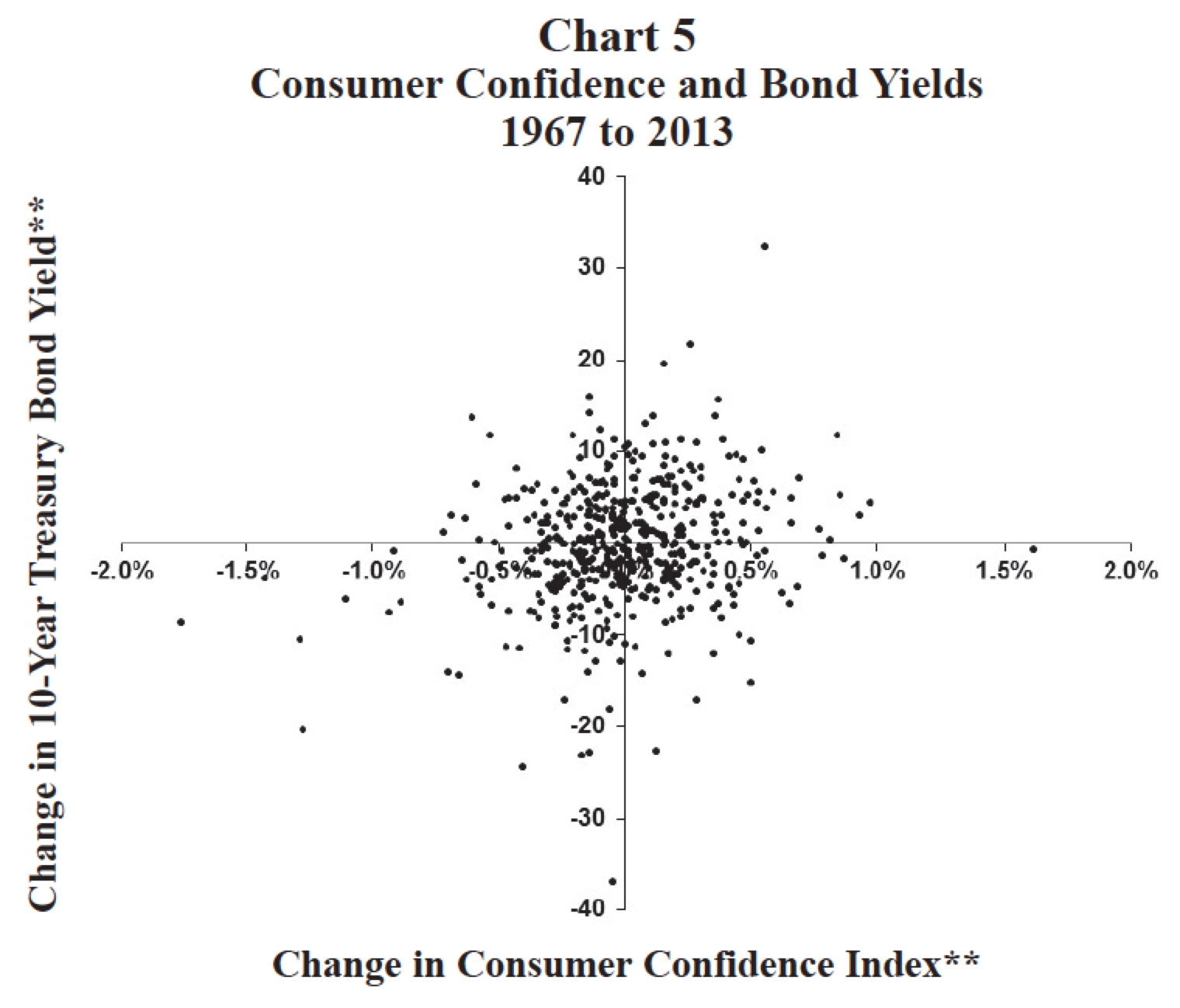

The relationship between yield changes and changes in consumer confidence is complicated and diverse. Chart 5 shows a scatter plot of historic changes in confidence with changes in bond yields. Every quadrant of this relationship is represented historically. That is, confidence and yields have often moved in the same direction (upper right and lower left quadrants) and also frequently in opposite directions (upper left or lower right quadrants).

In this chart, rising bond yields are illustrated by points which are right of the vertical axis. However, those which are also above the horizontal axis represent periods when confidence rose as yields increased whereas those points below the horizontal axis illustrate periods of rising yields and declining confidence. Essentially, the upper right quadrant in Chart 5 represents historic periods of “good” yield increases and the lower right quadrant show periods of “bad” yield hikes.

The response of the stock market (and by extension the performance of the economy) to rising yields has depended on whether the yield rise was “good” or “bad.” That is, the stock market has done quite well when yields rise provided confidence also improves. Alternatively, the stock market typically has struggled if yields rise and confidence weakens. Since 1967, during periods when bond yields have risen while confidence has increased (i.e., a “good” yield rise), average annualized stock price returns have been almost 13% and, despite rising bond yields, the stock market has only declined about one-third of the time. For comparison, when yields have risen and confidence has declined, the stock market has declined nearly one-half the time and with an average annualized price return of -6.4%.

Summary

Not all periods of rising bond yields are equal. We have seemingly begun a new trend higher in bond yields. Although the stock market decline in recent days has been sharp and concerning, ultimately the impact rising yields will have on the performance of the stock market and the economy, will depend on the response of confidence. Even though bond yields bottomed more than a year ago and have risen sharply since May, consumer confidence so far shows signs of strengthening. If confidence remains healthy, could this period prove to be a “good” yield rise? One where economic activity remains surprisingly resilient in the face of higher interest rates and where the stock market, after a period of adjustment, continues to perform better than most anticipate?

In our view, rising confidence has been driving the financial markets since last year. Most investors have finally given up the 2008 Armageddon ghost. Since investors have started to believe the end of the world is not coming soon and the economic recovery is likely sustainable, a revaluation of financial assets is taking place. Rising confidence has run through the S&P 500 as evidenced by an almost 3 point higher price-earnings multiple at its recent peak compared to its valuation level in 2012. Rising confidence has also melted the Armageddon premium in the price of gold; it recently re-priced junk bond yield spreads to their tightest of the recovery and has also been evident in the eurozone financial markets as registered by a massive decline in Greece bond yields. Rising confidence is also increasingly evident in the economy. Consumers are stepping up and purchasing big-ticket homes and autos like never before and mutual fund flows are finally entering the stock market.

Should confidence begin to decline and economic reports soften in the next few months, the recent climb in yields could become a “bad” yield rise. In this case, the increase in yields will likely be reversed as they were in the other two aborted yield hikes earlier in this recovery. However, with evidence of rising confidence breaking out everywhere, it should not be surprising confidence has finally found its way to the Federal Reserve and to the U.S. bond market. Yes, yields are rising. But the key is that improving confidence seems to be at the core of what is driving them higher. If this continues, higher interest rates should not materially impact economic activity and the stock market may continue to provide favorable results.

Which is a better environment? A 3.5% mortgage interest rate with a widespread cultural mindset which believes Armageddon is just around the corner or are the prospects for the economy better with a 4.5% mortgage interest rate in an economy where most players are comfortable and confident in the longer- run sustainability of the economic recovery? A “good” yield rise is a welcome result. While yields may be rising, their impact is likely to be overwhelmed by renewed, enhanced, and confident capitalistic economic behaviors.

Wells Capital Management (WellsCap) is a registered investment adviser and a wholly owned subsidiary of Wells Fargo Bank, N.A. WellsCap provides investment management services for a variety of institutions. The views expressed are those of the author at the time of writing and are subject to change. This material has been distributed for educational/informational purposes only, and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product. The material is based upon information we consider reliable, but its accuracy and completeness cannot be guaranteed. Past performance is not a guarantee of future returns. As with any investment vehicle, there is a potential for profit as well as the possibility of loss. For additional information on Wells Capital Management and its advisory services, please view our web site at www.wellscap.com, or refer to our Form ADV Part II, which is available upon request by calling 415.396.8000.

WELLS CAPITAL MANAGEMENT® is a registered service mark of Wells Capital Management, Inc.

Written by James W. Paulsen, Ph.D. 612.667.5 For distribution changes call 415.222.1 www.wellscap.com< ©2013 Wells Capital Management