Section

Economy

4519 posts

William Smead: Forrest Gump Stock Market

by William Smead, Smead Capital After watching “Forrest Gump” for about the thirtieth time recently, I realized that…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

How QE Translated Into Hot Money Emerging Market Inflows

by Sober Look As we look across major emerging economies, even some of the strongest have not been…

Are Stocks Too Expensive?

In response to recent questions about whether the stock market is overvalued, Russ gives two reasons why equity…

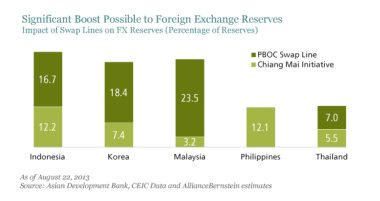

Is Asian Turbulence a Win for China?

by Anthony Chan, AllianceBernstein While this week’s sell-off in Asian currency and bond markets does not, as yet,…

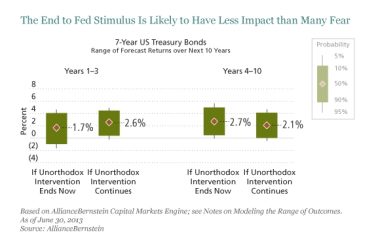

How Much Will Fed Tightening Hurt?

by Seth J. Masters, AllianceBernstein Seth J. Masters (pictured) and Ding Liu A lot of people worry about what…

Jeffrey Saut: Random Thoughts in the Summer Doldrums

Random Thoughts in the Summer Doldrums by Jeffrey Saut, Chief Investment Strategist, Raymond James August 26, 2013 On…

5 China Charts That Look Bullish for Commodities

5 China Charts That Look Bullish for Commodities By Frank Holmes, CEO and Chief Investment Officer, U.S. Global…

The Economy and Bond Market Radar (August 26, 2013)

The Economy and Bond Market Radar (August 26, 2013) Treasury yields were mixed this week as the long…

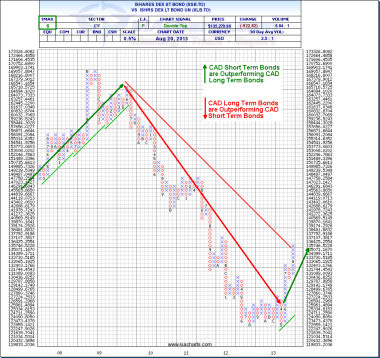

Technical Analysis: Long-Term Interest Rate Direction Has Changed Significantly

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to take a look at a…

The Safe Haven Bubble has Popped – What Comes Next?

by MacroBusiness The safe haven slaughter goes on. You might read elsewhere that what is transpiring in emerging…

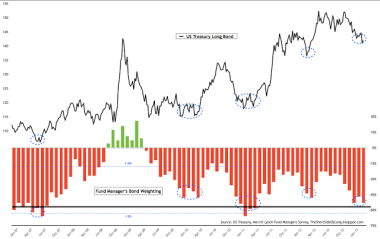

Why the Big Move in Bonds May be Over

by UKarlewitz, The Fat Pitch The main points in this post are: Individual and professional investors have already…

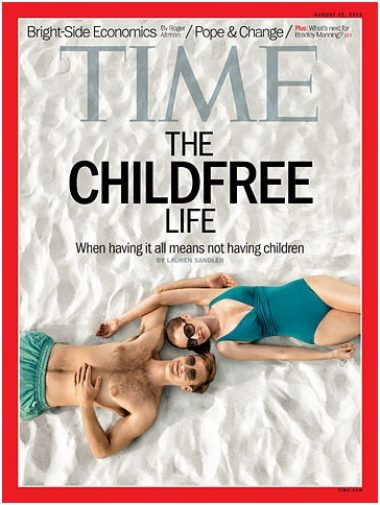

Trickle-Up Economics (Smead)

by William Smead, Smead Capital Management Major magazines have a history of putting a topic on their cover…

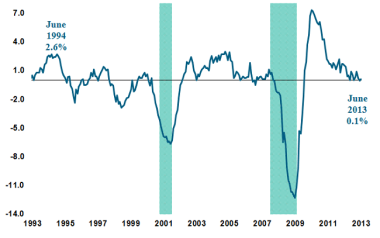

Is the Interest Rate Outlook Closer to 1994 or the Post-World War II Era?

August 21, 2013 by Kathy A. Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key…

Can the Sector That Helped Undo the US Economy be Key to Its Recovery?

In his inaugural blog post, Rick Rieder explores the fortunes of a sector he believes will help make…

Determined to Taper

The release of the July Federal Open Market Committee meeting minutes today and the Jackson Hole Economic Policy…