by William Smead, Smead Capital Management

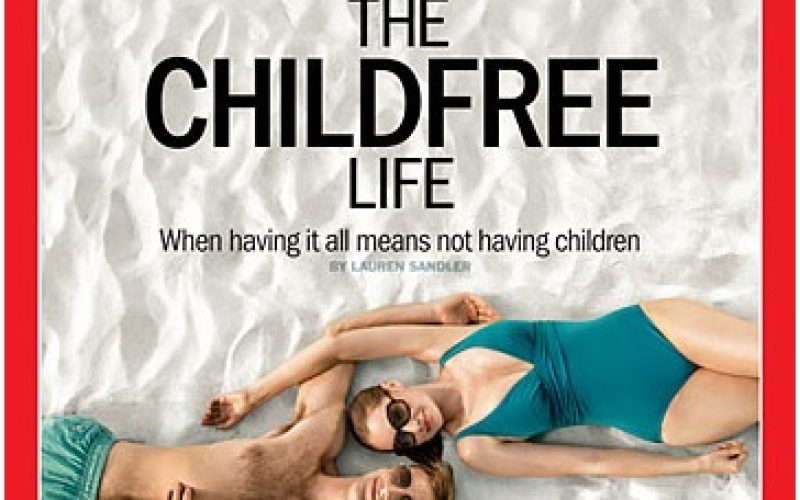

Major magazines have a history of putting a topic on their cover at the end of a long-term trend. For example, “The Death of Equities” was a Business Week cover in late 1979, near the end of a miserable stretch in the US stock market. Time’s recent cover story, “The Childfree Life”, got us wondering about the economics of childbearing in the US? Does Time’s cover mark the end of a trend? Can the US economy succeed without homegrown population increases? Will economic success driven by the current demographics in the US trickle down to unemployed blue collar workers? What does this cover, “The Childfree Life”, mean to investors in the US stock market?

We will argue in this missive that demographic trends, difficult economic times and an emphasis on college education have temporarily interrupted childbearing, as Americans adjusted to the existing culture. The timing of when one marries and has children is markedly different today than it was 30 years ago. Today, women get married at an average of 26.9 years old and men marry at an average of 28.7. In 1980, it was 24.7 for males and 22.0 for females.

Here is what Time’s writer, Lauren Sandler, wrote in her recent cover piece:

The birthrate in the U.S. is the lowest in recorded American history. From 2007 to 2011, the most recent year for which there’s data, the fertility rate declined 9%. A 2010 Pew Research report showed that childlessness has risen across all racial and ethnic groups, adding up to about 1 in 5 American women who end their childbearing years maternity-free, compared with 1 in 10 in the 1970s.

Smead Capital Management is located in Seattle, Washington. Seattle is one of the most environmentally sensitive and savvy places in the US. We regularly wrestle with regulating natural resource industries against the backdrop of economic growth. For instance, the spotted owl was put on the endangered species list and it greatly affected and modified the behavior of major timber companies. Certain salmon species are endangered and we have modified our use of the streams in which they spawn. Should we put babies on the endangered species list? Is the US going to follow Europe and see homegrown population shrink? The answer to us is a resounding no.

First, the demographics of childbearing seem prepared to go through the roof in the next five years. There are 86 million Americans between 18-37 years old, which mean an average age of 28. It is the largest population group in the US. With the once in a lifetime economic cleansing, financial meltdown and staring into the abyss we did in 2007-09, the folks between 25-35 years old hit a wall. They naturally postponed marriage and babies for economic reasons like unemployment, fear of unemployment, housing depression and outright economic fear.

The next five years will most likely bring another group of 25-30 year olds who’ll see the most affordable housing in my lifetime, home price appreciation and rising rents, unemployment dropping, stocks rising and economic fears returning to more normalized levels. Ms. Sandler pointed out a 9% drop in fertility occurred from 2007 to the end of 2011. This coincides perfectly with the financial meltdown and the aftershocks. The fertility of 2007 to 2011 mirrors that of the fertility rate declines during the depression.

Now that this fear is wearing off, we could see twice the normal rate of household formation, twice the marriages, babies, house buying and car buying from the group between 25 and 30 years old. They will be joined by 30-35 year old folks just starting the process as well. The 30-35 year-old age group was heavily affected by the difficult economic times and triggered movies like, “Jeff, Who Lives at Home”. In reflection, the years between 2007 and 2012 seemed to be all about under-employed twenty-somethings drinking too much and waiting for life to begin. It sounds fun until you look at the economic hardships. The theory was it’s better to laugh about it than cry.

In the July 1977 US census, there were 220 million Americans counted. In 1978, at the front of the explosion of baby-boomer marriage and fertility, we had 1.4 million single family housing starts. We can already see this coming. The average household formation from 2009-11 was 650,000 per year in the US and in 2012 it was 1.1 million. We’ll get the 2013 statistics in October and we expect to see a much bigger number than the 1.1 million. Is it any coincidence that the significant improvement in household formation occurred simultaneous to the acceleration of the US housing market?

Second, behaviors are led by people we admire. An interesting divide exists in America between two sets of adult population, There are the 25% of adults who have a four-year degree and have enjoyed and participated in the internet/technology driven economy. Then there are the 75% who have struggled with slow wage growth and been hit very hard by a lack of blue collar jobs in manufacturing and home building. Ironically, it is the 25% which have affected the birth numbers the most and whose picture is represented on the beach living what the writer would consider “the good life”. We argued recently that the birth of the royal baby to Prince Charles and Lady Kate is a watershed event. They are college educated and very appealing to college-educated Americans. Impressive leadership could lead echo-boomers into their marriage and baby-making years in the same way his parents did for us baby boomers.

Third, having kids is creative and fun. This is our own opinion, but we’re pretty sure that bringing life into the world is one of the greatest creative things we ever do. We are driven instinctually through hormones to create offspring and naturally want to return the favor done for us by prior generations. I am the father of five and a grandfather to four kids. When those little ones acknowledge me, I feel like a million bucks and glow all day. The most educated Americans are some of the most creative people in our society and when it becomes trendy again, they will want to create human beings and pour their learning into their children. College-educated Americans averaged 1.78 births per married couple versus the 1.93 birthrate among all households. The theory is that it takes 2.1 births per couple to maintain your population, which Ms. Sandler points out is where we were before financial Armageddon hit between 2007 and 2011.

Finally, as we see it, marriage, child bearing, house buying and family car buying will have a huge affect on economic growth and the multiplier effect in our economy. Just think of the cost of a wedding and what that can do for a local economy. Everyone from the florist to the caterer is thrilled with the wedding and so is everyone who works for them. Then comes a baby, which triggers a ton of healthcare spending, and some serious nesting in the existing abode, most likely followed by a move from a multi-family unit to a single-family home. And those homes create more jobs: the National Association of Homebuilders reports that each square foot of building of a single-family home requires 2.75 times as much labor as multi-family square footage does. We estimate that in 5 to 7 years we could have 325 million Americans and see 2 million single-family housing starts. Blue collar employment should skyrocket as a result.

Significantly older first-time parents mean older first-time grandparents. A huge slug of more affluent Americans getting married means buying houses and buying cars. New grandparents mean home remodeling (nesting) could explode over the next five to ten years if the demographics and trendiness of baby making is triggered by Time magazine’s “watershed” cover. Home Depot reported at its recent investor day that home remodeling/improvement have averaged 4.5% of GDP over the last fifty years and currently stands at 2.6% of GDP. My wife and I are looking for a condo in Seattle and she is demanding one bedroom to be set up for the visits of the grandchildren.

Home building, home remodeling and car buying can do wonders for blue collar employment in the US. You can’t have someone in India plumb your house or hammer the nail or replace the carpet. It is entirely a domestic phenomenon. Almost all the work associated with housing leans on trade’s people. Most of the inputs like shingles, painting and appliances employ massive blue-collar work forces.

We all admire Warren Buffett, but have you noticed that he is buying up residential real estate brokerages and now Berkshire Hathaway owns the second largest residential real estate sales organization in the US? He owns a paint company, a carpet company and his Marmon group is a domestically-oriented hodge-podge of companies with ties to home building. It would be hard for anyone creating a new housing development in the US without their pipes and tubing. He’s a believer in the demographics in the US and he believes that these echo-boomers will lead a revival of the US economy in the process. His underlings are loading up on shares of General Motors (GM), which has a rich history making automobiles tailored towards young families.

This has huge implications for whatever optimism you might have for the US economy and for the profits of domestically-oriented US businesses. It governs your asset allocation and for us it is a huge factor in our stock picking. If we go the way of Europe and Japan and let our home-grown population shrink, the negative nabobs could eventually be correct and the rebound from the abyss is all we get. It is the opinion of Smead Capital Management that demographics and time will win and optimism for long-duration common stock investing in the US will enjoy prosperity “trickling up” from those new babies.

Best Wishes

William Smead

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management