Section

Economy

4498 posts

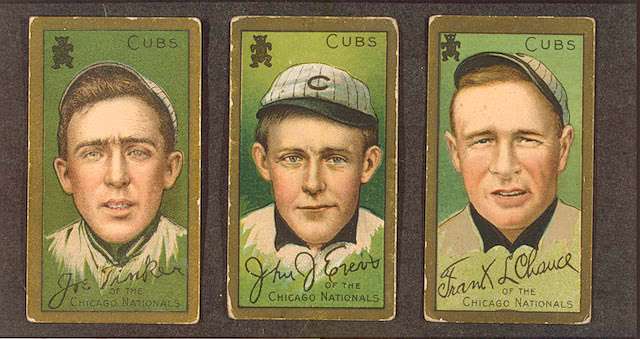

Jeffrey Saut: "Pile on" Effect Exagerrated Downside Dive

“Tinker to Evers to Chance” by Jeffrey Saut, Chief Investment Strategist, Raymond James February 3, 2014 Last week…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Liz Ann Sonders: So Cruel – Pullback Could Become Correction

February 3, 2014 by Liz Ann Sonders, Senior Vice President, Chief Investment Strategist, Charles Schwab & Co., Inc.…

How Major Asset Classes Performed in January 2014

Major Asset Classes | Jan 2014 | Performance Review by Capital Spectator January was a rough month for…

Five Reasons the ECB will Have to Ease Again

by SoberLook.com It may be something symbolic such as a small rate cut or possibly a more substantial…

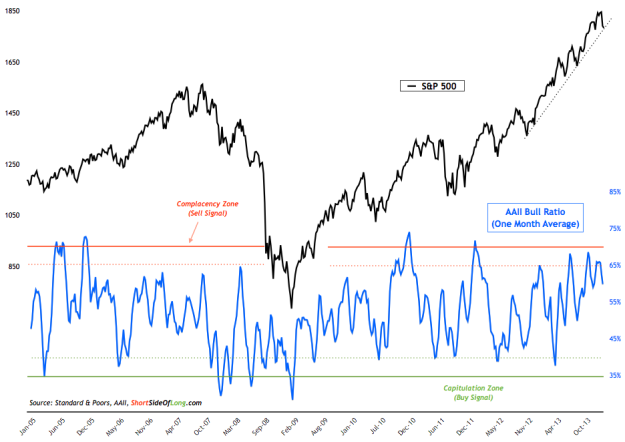

Market Sentiment Going into February is Looking Pretty Stark

February Sentiment Summary by Short Side of Long Equities Chart 1: Individual investor optimism has just started to…

The Economy and Bond Market Radar (February 3, 2014)

The Economy and Bond Market Radar (February 3, 2014) Treasury bond yields continued their recent slide, heading lower…

Byron Wien: Preparing for a Volatile Year

Preparing for a Volatile Year by Byron Wien, Vice Chairman, Blackstone Advisory Partners LP February 2014 Last year’s…

Derek Hernquist: Worry-Free Urgency

by Derek Hernquist “Boundaries are necessary because of people’s tendency to escalate commitment to past choices.” Chip and…

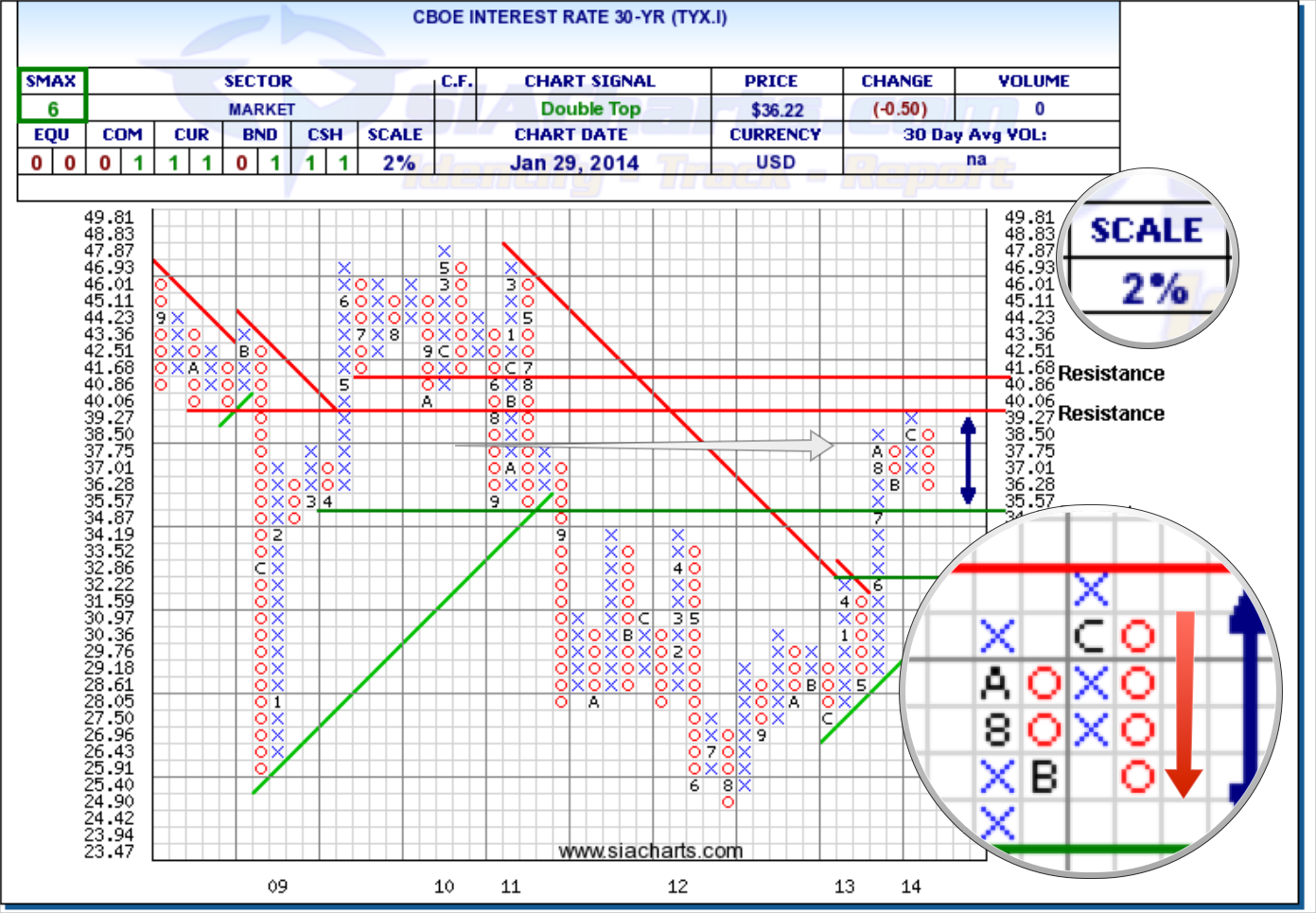

Technical Weekly: 30-Yr Yields and a Risk-Off Pairing Example

by SIACharts.com In this week's edition of the SIA Equity Leaders Weekly, we are going to take a…

Peter Tchir: Is QE a Victimless Crime?

by Peter Tchir of TF Market Advisors, QE a Victimless Crime? If that title can’t make you want…

Gavekal Explains The Emerging Market Panic

by Charles Gave and Louis Gave via Evergreen Gavekal, With emerging markets in panic mode, investors are bound…

Jeffrey Saut: "Bear Raid"

“Bear Raid?” by Jeffrey Saut, Chief Investment Strategist, Raymond James January 27, 2014 I should have guessed that…

Nick Colas: Welcome To The Age Of The Online High School

Via ConvergEx's Nick Colas, Online high schools may not become the norm, and they might not bring graduation…

The Economy and Bond Market Radar (January 27, 2014)

The Economy and Bond Market Radar (January 27, 2014) Treasury bond yields fell again this week and are…