Section

Economy

4502 posts

Jeffrey Saut: "Throw Deep?!"

“Throw Deep?!” by Jeffrey Saut, Chief Investment Strategist, Raymond James April 28, 2014 Back in the late 1980s…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

The Economy and Bond Market Radar (April 29, 2014)

The Economy and Bond Market Radar (April 29, 2014) Treasury bond yields declined this week, pushing the benchmark…

Emerging Markets Radar (April 29, 2014)

Emerging Markets Radar (April 29, 2014) Strengths A report by Erste Group shows European Union (EU) membership has…

David Merkel: Why it is Hard to Win in Investing

by David Merkel, Aleph Blog Before I start this evening, I want to say something about many investment…

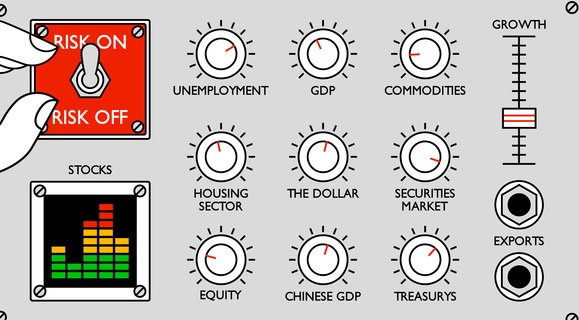

Why the Bull Market (and Economy) Still Have a Couple of Years to Run

The Transition From a Risk Premium Reduction Market to a Growth Market by Conor Sen Matt Busigin (@mbusigin)…

Deborah Frame: Why Do We Accept Volatility as a Measure of Risk?

Not Your Grandfather’s Risk Measurement by Deborah Frame, Vice President, Investments, Cougar Global Investments Why Do We Accept…

Why Americans are Biased Toward Real Estate – They Can't Calculate Returns

by Cullen Roche, Pragmatic Capitalism The other day I posted this story citing a Gallup poll about how…

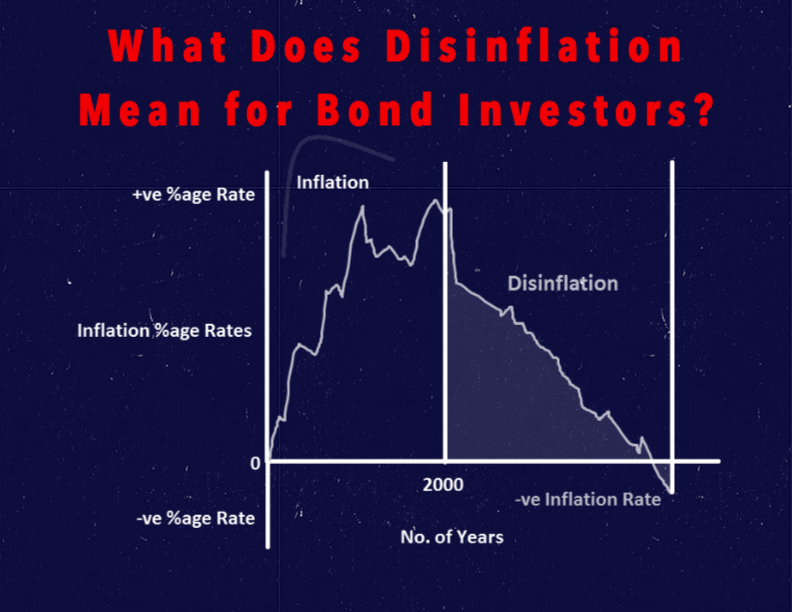

What Does Disinflation Mean for Bond Investors?

by Kathy Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key Points With slow global…

Gold and Long Term Bonds: What's Most Likely?

by SIACharts.com This week for the Equity Leaders Weekly, we going to highlight a long-term interest rate and…

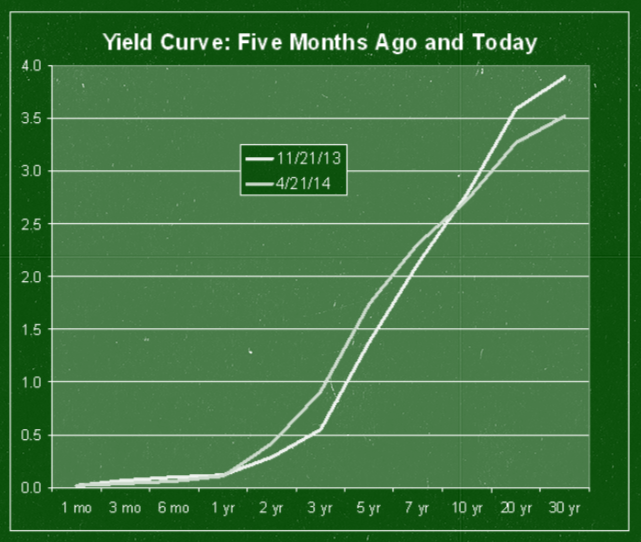

The Long-End of the Yield Curve Flattens

by Eddy Elfenbein, Crossing Wall Street Here’s a look at the yield spread between the 5- and 30-year…

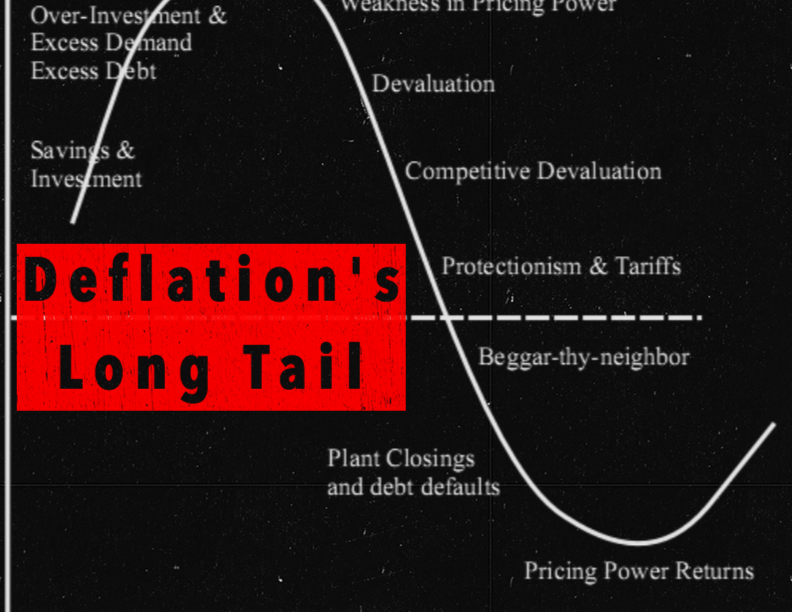

The Long Tail of Deflation

by Market Anthropology It took the Dow Jones Industrial Average and the S&P 500 basically twenty five years…

Jeffrey Saut: "Poker Mentality?!"

“Poker Mentality?!” by Jeffrey Saut, Chief Investment Strategist, Raymond James April 21, 2014 I learned how to play…

"Knowing your time horizon before you make any investment is extremely important.”

by Ben Carlson, A Wealth of Common Sense “Avoid the twin impostors of short term out- and under-performance.…

A Bend in the Road is Not the End of the Road

April 16 2014 Turmoil in Ukraine, growth concerns in Japan, and weakness in U.S. equity markets are giving…