Section

Interest Rates

1030 posts

Deborah Frame: Why Do We Accept Volatility as a Measure of Risk?

Not Your Grandfather’s Risk Measurement by Deborah Frame, Vice President, Investments, Cougar Global Investments Why Do We Accept…

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Why Americans are Biased Toward Real Estate – They Can't Calculate Returns

by Cullen Roche, Pragmatic Capitalism The other day I posted this story citing a Gallup poll about how…

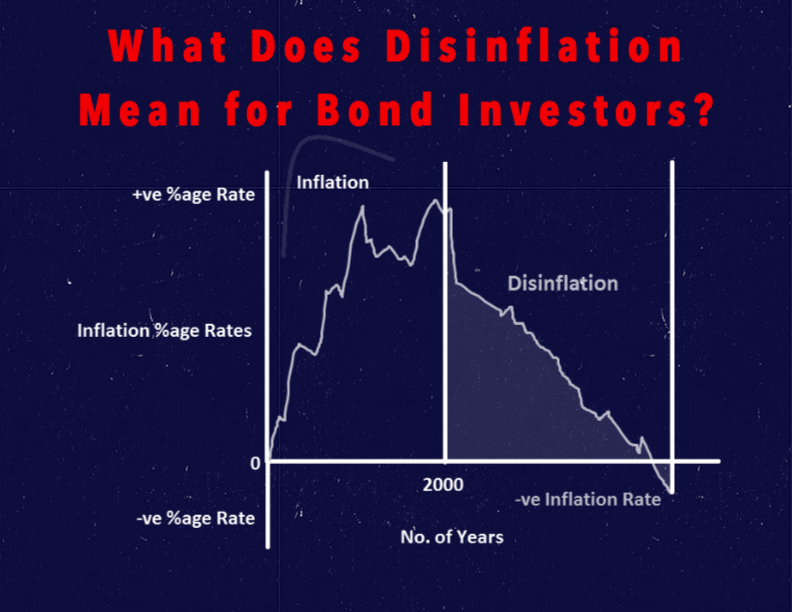

What Does Disinflation Mean for Bond Investors?

by Kathy Jones, Vice President, Fixed Income Strategist, Schwab Center for Financial Research Key Points With slow global…

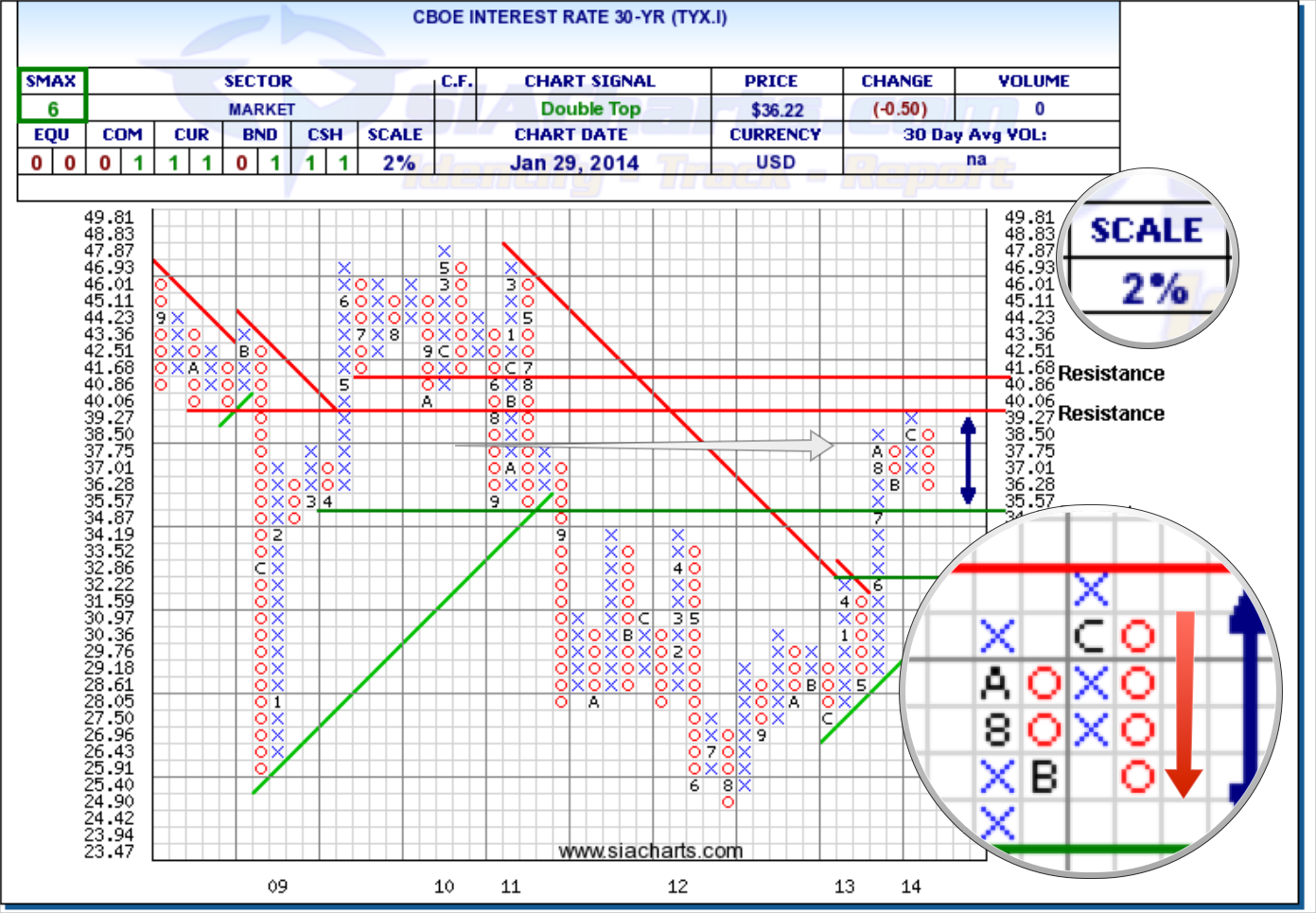

Gold and Long Term Bonds: What's Most Likely?

by SIACharts.com This week for the Equity Leaders Weekly, we going to highlight a long-term interest rate and…

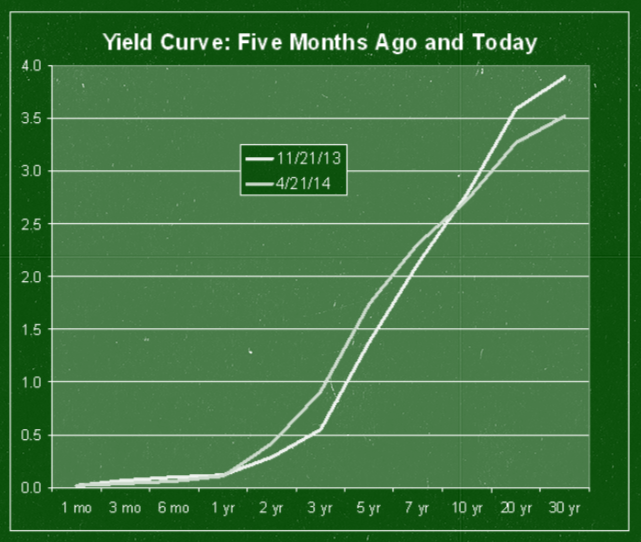

The Long-End of the Yield Curve Flattens

by Eddy Elfenbein, Crossing Wall Street Here’s a look at the yield spread between the 5- and 30-year…

Don't Bet on the Treasury Rally to Continue

by SoberLook.com Treasuries rallied sharply last week, mostly on the back of the sell-off in equities as well…

What Investors Need to Know about Rising Rates

Janet Yellen’s first FOMC press conference as the new Federal Reserve Chair confirmed some market assumptions, but also…

Don’t Believe The Hype Of Rising Interest Rates

by Jesse Felder, The Felder Report “Best investments for a rising rate environment” “The coming crash in the…

A Commodity Story

by Market Anthropology On a relative performance basis we continue to find a discretely transitioning market environment, led…

Higher Rates on the Horizon? Three Implications

Investors were temporarily taken aback last week by the prospect of an earlier-than-expected rate hike. While it’s not…

Inflation Does Not Produce Economic Growth

by Frank Shostak via the Ludwig von Mises Institute, After settling at 3.9 percent in July 2011 the…

Scott Minerd: "Bad News is Good News Again"

Bad News is Good News Again by Scott Minerd, Chief Investment Strategist, Guggenheim Partners LLC February 12, 2014…

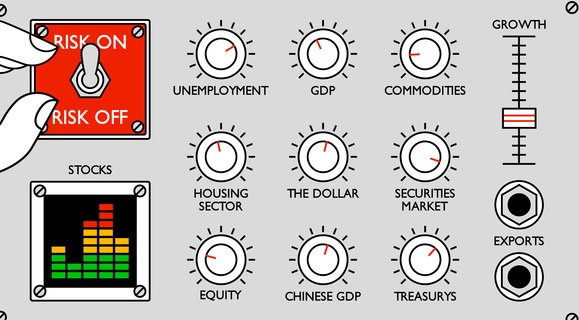

Technical Weekly: 30-Yr Yields and a Risk-Off Pairing Example

by SIACharts.com In this week's edition of the SIA Equity Leaders Weekly, we are going to take a…

Russ Koesterich: A Better Economy May Not Necessarily Be Better For Stocks

Russ K explains why an improving economy doesn’t necessarily mean another stellar year for U.S. equities. by Russ…

Bernanke’s Santa Claus Cheer

by Scott Minerd, CIO, Guggenheim Partners LLC December 23 2013 What will Santa bring for Christmas … does…