Section

Agriculture

86 posts

Impact Equals Profit: The Investment Opportunity of a Generation

The investment industry is undergoing a transformation, one that is redefining the relationship between financial returns and global…

February 11, 2025

Navigating Volatility: The Case for Tactical Alpha

In today's volatile markets, alternative investments are key for diversification, resilience, and returns, but they demand expertise to navigate. Ash Lawrence, Head of AGF Capital Partners and Scott Radke, CEO and Co-CIO of New Holland Capital discuss...

Balance Is the Watchword with Commodities Exposure

by Vinod Chathlani, Portfolio Manager—Multi-Asset Solutions, Mark Gleason, CFA, Director—Multi-Asset Business Development, AllianceBernstein The highest inflation in 40…

April 1, 2022

THE MOSAIC CO (MOS) NYSE - Oct 12, 2018

THE MOSAIC CO (MOS) NYSE - Oct 12, 2018 SIA Charts Daily Stock Report (siacharts.com) The SIA Daily…

October 14, 2018

MONSANTO CO (MON) NYSE - Jun 01, 2016

MONSANTO CO (MON) NYSE - Jun 01, 2016 SIA Charts Daily Stock Report (siacharts.com) The SIA Daily Stock…

June 1, 2016

SIA Weekly: Equity Action Call Shifts into Neutral, Asset Class Ranking Sees Dramatic Changes

Equity Action Call Shifts into Neutral, Asset Class Ranking Sees Dramatic Changes by SIACharts.com For this week's SIA…

August 27, 2015

SIA Weekly: Two Large Canadian Sectors Leading the Way Down

Two Large Canadian Sectors Leading the Way Down by SIACharts.com For this week's SIA Equity Leaders Weekly, we…

August 20, 2015

Groundhog Day ... Feels Like

by Cam Hui, Humble Student of the Markets Trend Model signal summary Trend Model signal: Neutral Trading model:…

August 17, 2015

SIA Weekly: Dollars, Devaluation, Direction

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to look at the Currency asset…

August 13, 2015

SIA Weekly: A Look at Two Outperforming Canada Sectors

For this week's SIA Equity Leaders Weekly, we are going to look at two sectors within the Canadian…

July 30, 2015

China’s Market Correction in Three Easy Charts

The sheer size and importance of China’s equity markets cannot be overstated. Second in size only to the New York Stock Exchange, the combined value of the Asian country’s stock markets, according to the Wall Street Journal, is $14 trillion and change. Or at least it was in May, a month before markets fell more than 30 percent. The Shanghai Composite Index alone gave up $2 trillion in value. To put this in perspective, the gross domestic product (GDP) of debt-troubled Greece is around $200 billion.

click to enlarge

So how did this happen? The answer has a lot to do with the quantity and quality of investors.

In most major economies, stock markets trading is dominated by professional money managers. But in China, between 80 and 90 percent of the domestic A-share market is made up of retail investors, many of them novices who sought to participate in the yearlong bull run. An eye-popping 40 million new brokerage accounts were created in the one-year period ended in May. The Communist Party, by comparison, gained only a little over one million new members in the same period. At the peak, accounts were being added at a rate of over three million per week.

click to enlarge

For many of these first-time or relatively inexperienced investors, the price of entry was margin lending. Cosmic amounts of it. Near the end of June, 2.08 trillion yuan ($335 billion) worth of borrowed funds flooded the Shanghai and Shenzhen markets. Margin lending as a percentage of total market cap rose to as high as 20 percent. In the U.S., it’s about 2.5 percent.

click to enlarge

This combination—millions of new accounts mixed with unprecedented leveraging—greatly contributed to the selloff. As you can see above, this leverage is now unraveling as investors are forced to sell in order to meet margin calls.

Beijing has responded with a host of measures to prevent the market from sliding any further, one of the most significant being a ban on huge institutional shareholders from selling until the Shanghai Composite rises above 4500. As of this writing, it’s just above 3800 after breaking a three-day rally.

The good news is that some analysts believe the worst might be behind us. Financial services firm UBS takes the position that, as massive as the correction was, it shouldn’t have a “major” economic impact.

In the meantime, we have raised the cash level in our China Region Fund (USCOX) and are ready to deploy it when the right opportunity arises.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio.

The Shanghai Composite Index (SSE) is an index of all stocks that trade on the Shanghai Stock Exchange. The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of 300 A-share stocks traded in the Shanghai and Shenzhen stock exchanges.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

July 30, 2015

3 Reasons Why Gold Isn’t Behaving Like Gold Right Now

As many of you know, I was in San Francisco the week before last where I had been invited to speak at the MoneyShow, one of the biggest, most preeminent investor conferences in the world. Over the past couple of decades, I’ve spoken at many MoneyShows all around the country and have covered many different topics. Gold investing is one that often draws a big crowd. Not this year. Guess which natural resource stole the show?

The commodity that attracted attendees’ attention is one that until pretty recently could only be grown and harvested under the shroud of secrecy. Marijuana. Currently legal in 23 states and the District of Columbia, medical marijuana generated $2.7 billion in 2014 and is expected to bring in $3.4 billion this year. Investors are taking notice. The cash crop is even starting to change intranational migration. Whereas many retired seniors flock to warmer climates in which to live out their golden years, others now factor in whether a state will permit them to self-medicate in order to treat their arthritis, according to a recent Time article.

Investors themselves who might have suffered from arthritis attended the pot presentation at their own risk, as it was standing room only. They couldn’t have been pulled away even to sit comfortably in the scarcely occupied room next door. Sentiment toward gold was indeed very bearish at the MoneyShow, as it is around the world right now.

Gold Hits the Reset Button

Gold is universally recognized as a safe-haven investment, a go-to asset class when others look uncertain. Following the 2008 financial crisis, for instance, the metal’s price surged, eventually topping out at $1,900 per ounce in August 2011.

But last week proved to be a particularly rocky one for the metal, even with Greece and Puerto Rico’s debt dilemmas, not to mention the recent Shanghai stock market decline, fresh in investors’ minds. Gold traded down for 10 straight sessions to end the week at $1,099 per ounce, its lowest point in more than five years. Commodities in general dropped to a 13-year low.

click to enlarge

Gold stocks, as expressed by the XAU, also tumbled.

click to enlarge

The selloff was given a huge push when China, for the first time in six years, revealed the amount of gold its central bank holds. Although the number jumped nearly 60 percent since 2009 to 1,658 tonnes, markets were underwhelmed, as they had expected to see double the amount.

Then in the early hours last Monday, gold experienced a “mini flash-crash” after five tonnes appeared on the Asian market. Initially this might not sound like a lot, but five tonnes equates to 176,370 ounces, or about $2.7 billion. It also represents about a fifth of a normal day’s trading volume. Suffice it to say, price discovery was effectively disrupted. In a matter of seconds, gold fell 4 percent before bouncing back somewhat.

Reflecting on the trading session, widely-respected market analyst Keith Fitz-Gerald noted: “Far from being a one-day crash, this could represent one of the best gold-buying opportunities of the year.”

The last time the metal descended this quickly was 18 months ago, on January 6, 2014, when someone brought a massive gold sell order on the market before retracting it in a high-frequency trading tactic called “quote stuffing.” Last month I shared with you that we now know who might have been responsible for the action—and many others that preceded it—and pointed out that the accused party’s penalty of $200,000 was grossly inadequate. Last Monday I told Daniela Cambone during the Gold Game Film that such downward price manipulation seems to result in little more than a slap on the wrist. But if manipulation is done on the upside, traders could get into serious trouble.

Besides apparent price manipulation, other factors are affecting gold’s behavior right now, three in particular.

1. Strong U.S. Dollar

Like crude oil, gold around the world is priced in U.S. dollars. This means that when the greenback gains in strength, the yellow metal becomes more expensive for overseas buyers. With the U.S. economy on the mend after the recession, the dollar index remains steady at a 12-year high.

It’s important to recognize, though, that gold is still strong in other world currencies, including the Canadian dollar. As such, our precious metals funds have hedged Canadian dollar exposure for Canadian gold stocks, which has benefited our overall performance.

2. Interest Rates on the Rise?

Federal Reserve Chair Janet Yellen continues to hint that interest rates might be hiked sometime this year, perhaps even as early as September. When rates move higher, non-yielding assets such as gold often take a hit.

As you can see, the 10-year Treasury bond yield and gold have an inverse relationship. When the yield starts to rise, investors might find bonds a more attractive asset class.

click to enlarge

3. Slowing Manufacturing Activity

Earlier this month I wrote about the downtrend in manufacturing activity across the globe. As many loyal readers are well aware, we closely monitor the global purchasing manager’s index (PMI) because, as our research has shown, when the one-month reading has fallen below the three-month moving average, select commodity prices have receded six months later.

click to enlarge

China is the 800-pound commodity gorilla, and its own PMI has remained below the important 50 threshold for the last three months, indicating contraction. The preliminary flash PMI, released last Friday, shows that manufacturing has dipped to 48.2, a 15-month low. For gold and other commodities to recover, it’s crucial that China jumpstart its economy.

In the meantime, we’re encouraged by news that the slump in prices has accelerated retail demand in both China and India, which, when combined, account for half of the world’s gold consumption.

Battening Down the Hatches

They say that a smooth sea never made a skillful sailor. No one embodies this more than Ralph Aldis, portfolio manager of our precious metals funds. He and our talented team of analysts are doing a commendable job weathering this storm. We’re invested in strong, reliable companies, and when commodities eventually turn around, we should be in a good position to catch the wind.

We look forward to the second half of the year, when gold prices have historically seen a bump in anticipation of Diwali, which falls on November 11 this year, and the Chinese New Year. As you can see, average monthly gold performance has ramped up starting in September.

click to enlarge

“Gold is down 15 to 25 percent below production levels,” Ralph says. “That might cause some companies to halt production.”

And, in so doing, help prices find firmer footing.

After my trip to San Francisco, an important rallying point for the 1960s counterculture movement, it only seems fitting that I traveled to Colorado, one of the first states to legalize cannabis for recreational use. It was only a coincidence that Julia Guth chose to retreat to the state’s beautiful mountains for the Oxford Club’s educational seminar. It was a privilege to present to two assemblies of curious investors like yourself. I enjoy meeting many of you when I’m on the road.

The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indexes. The index was originally launched in 1998 as the Dow Jones-AIG Commodity Index (DJ-AIGCI) and renamed to Dow Jones-UBS Commodity Index (DJ-UBSCI) in 2009, when UBS acquired the index from AIG. The Philadelphia Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The J.P. Morgan Global Purchasing Manager’s Index is an indicator of the economic health of the global manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

July 30, 2015

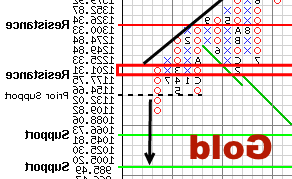

Technical Weekly: What's Going on with Gold and Silver?

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to look at the two important…

July 23, 2015

From Oversold to Overbought to...

Trend Model signal summary Trend Model signal: Risk-off Trading model: Bearish (downgrade) by Cam Hui, Humble Student of…

July 20, 2015

A Dozen Interesting Charts

by Scott Grannis, Calafia Beach Pundit Here are a dozen interesting charts that I've been following rather closely…

July 20, 2015

Two Favourable Sector ETFs: Relative Strength Continues

by SIACharts.com For this week's SIA Equity Leaders Weekly, we are going to discuss a simple but powerful…

July 9, 2015