For this week's SIA Equity Leaders Weekly, we are going to look at the Currency asset class and specifically two currencies, one that has shown great relative strength and another one that has shown great relative weakness. Looking at the US dollar index and the Brazil real index, we can see two currencies that moved in opposite directions over the past year. With China’s 2% devaluation of the yuan, triggering the yuan’s biggest fall since 1994 pushing it to its weakest against the US Dollar in almost 3 years, this will be another Currency to keep an eye on as it impacts many global companies and markets. So without further ado, let's look at the 3Ds, (dollars devaluation direction), and the Brazilian Real.

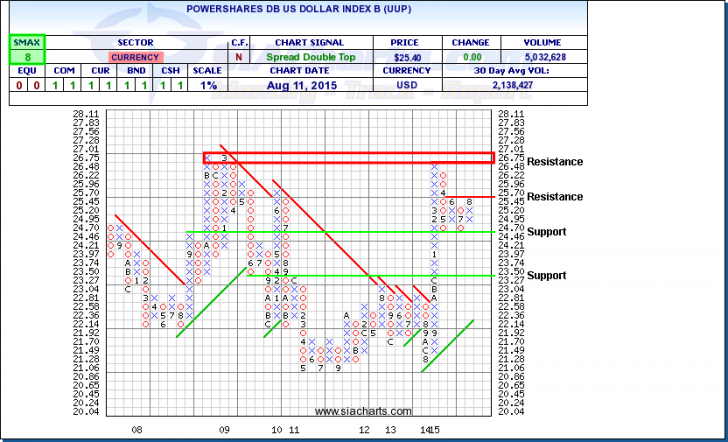

PowerShares DB US Dollar Index Bullish Fund (UUP)

The PowerShares US Dollar Index Bullish Fund (UUP) tracks the value of the U.S. dollar versus a basket of six major world currencies (Euro, Japenese Yen, British Pound, Canadian dollar, Swedish krona, and Swiss Franc) so isn’t a true reflection of all world currencies, but is a useful ETF to understand being long the U.S. dollar versus these other currency moves. Over the past year, this ETF is up 15.65% and up almost 5% YTD. Looking at the chart of UUP, it is up against resistance at $25.70 with further resistance above at $26.48. To the downside, support can be found at the bottom of its past moves at $24.46.

Overall, emerging market currencies have fallen sharply in the past year as the U.S. dollar has strengthened. Also, commodity rich countries like Canada and Australia have also been hit hard by the strengthening U.S. dollar respectively for their country’s currencies. We have done lots of commentary in the past on the USDCAD relationship as the US dollar continues to be a safe haven for foreign investment, especially with China’s sudden yuan devaluation drop, as is found at the top of the relative strength ranking since September of 2014 in the SIA Currency ETF Report available to SIACharts subscribers.

Click on Image to Enlarge

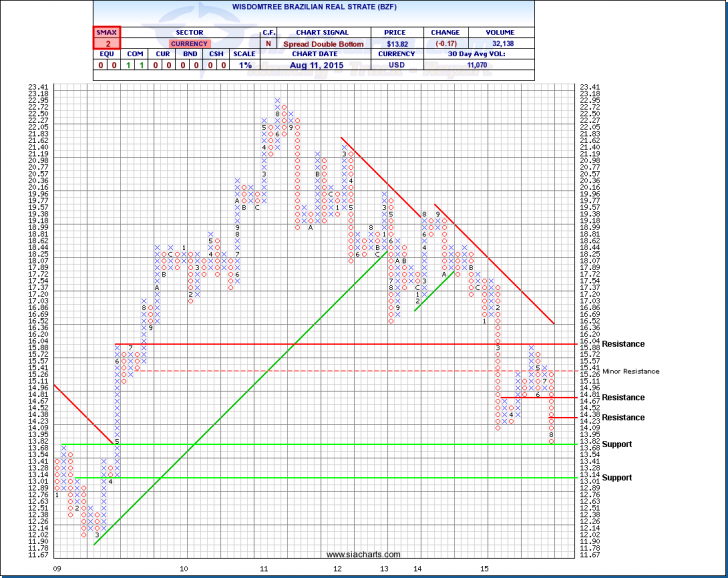

WisdomTree Brazilian Real Strategy Fund (BZF)

The WisdomTree Brazilian Real Fund (BZF) tracks the money market rates in Brazil real (BRL) currency relative to the U.S. dollar. So with the above commentary on the strength of the U.S. dollar, it is no surprise that other currencies would be underperforming against it, but the Brazilian economy and real’s deprecation have also taken a tumble on their own merits. Falling privatization and industry, slowing retail sales, and political uncertainty among other reasons have hurt the economy and with Brazilian Finance Minister slashing its primary surplus target due to deteriorating tax revenues in July, the BRL has continued its downward spiral to 12-year lows against the U.S. dollar.

The chart shows this decline in BZF as well as it has fallen over 27% in the last year and ~18% YTD. The currency has moved down to support at $13.68 with further support found around $13 should this weakness continue. To the upside, resistance is found at $14.38 and at $14.81. With Brazil making up a large part of the Latin American economy, this depreciation in the major currency in the region has led to Latin American focused funds as well as Brazilian focused funds ranking at the bottom of SIA’s International Equity Universe ETF Report available to SIACharts subscribers.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Copyright © SIACharts.com