by Stefan Rondorf, Allianz Global Investors US

Defying expectations, markets shrugged off the Brexit vote and President Trump’s election. Yet our research shows a clear link between political uncertainty and lower P/E ratios. As such, Stefan Rondorf says markets will soon reassess political risks.

Key Takeaways

- Our research shows that in 1998-2017, big increases in political uncertainty had a meaningful negative impact on equities

- Brexit and Mr. Trump’s win didn’t affect equities as expected; we believe it was due to complacency and market/growth momentum

- It’s a mistake to think political risks no longer matter; instead, the markets might just have a delayed reality check

In a head-scratching moment for economists, investors and politicians, the

The most direct transmission channel from politics to equities is via P/E ratios

Brexit vote and President Donald Trump’s election failed to affect equity markets in the same way that political uncertainty generally has during the past 20 years. That got us thinking: Is there something else at work today, or are markets just being overly complacent?

Our analysis of how politics affects the markets

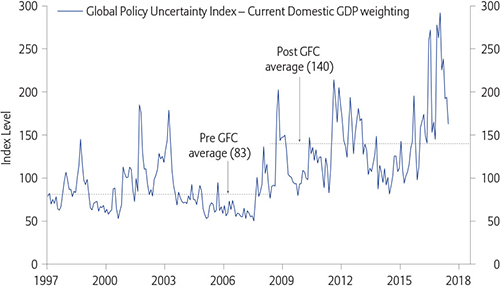

To answer this question, we studied the policy uncertainty indices established by three widely respected US academics – Scott Baker, Nick Bloom and Steven Davis:Policy uncertainty rose noticeably after the great financial crisis

The global policy uncertainty index moved higher after 2008 and reached its highest level in 2016

Source: AllianzGI Global Economics & Strategy team, Datastream as at July 2017. Global Policy Uncertainty Index data begin in 1997 and are weighted by current domestic GDP. Policy uncertainty indices are calculated by Baker, Bloom and Davis (

) using a search of the top business newspapers of a respective country or region to construct an index reflecting the volume of news articles discussing economic policy uncertainty.

Political crises have an impact on valuations

When we looked at how politics can affect equity markets, companies and economies, we found reason to focus our analysis on the valuation impact of political shocks, as measured by price-to-earnings (P/E) ratios.

For 20 years, political shocks have hurt the markets

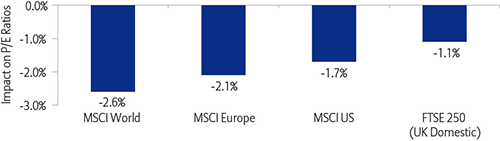

As we focused on valuations, our assessment showed that from 1998 until spring 2017, widespread increases in political uncertainty had a meaningful negative impact.Higher policy uncertainty means lower P/E ratios

We analyzed 12-month-forward P/Es of various indices over 12 months for every 100-point year-over-year rise in their respective domestic policy uncertainty indices

Source: Allianz Global Investors calculations based on data from Datastream and Baker, Bloom, Davis as at 30/4/2017. Equity/uncertainty index pairings: MSCI World and Global Policy Uncertainty; MSCI Europe and European Policy Uncertainty; MSCI US and US Policy Uncertainty; FTSE 250 and UK Policy Uncertainty.

Brexit and President Trump caused barely a blip

Policy uncertainty surged around the time of Brexit and President Trump’s election, yet P/Es barely reacted

Yet when we looked at the past year as opposed to the past 20 years, we saw much different market reactions. The Global Policy Uncertainty Index surged by about 130 points around the time of Brexit, and by a similar amount when Donald Trump won the US presidential election. Yet not only did P/E ratios barely show a reaction to these events, but they even rose slightly for the MSCI World Index.Why did this happen? Two partially interdependent theories come to mind:

1. Complacency

After a quick shock, the markets probably sensed that neither Brexit nor President Trump would have immediate and indisputably negative consequences. Moreover, after Mr Trump’s win, investors began to look forward to his administration cutting taxes, reducing regulations and repatriating cash from corporations’ overseas accounts.

2. Market and growth momentum

By pure luck, the markets were in an upswing before each of these events. In the summer and autumn of 2016, the markets were revelling in a favorable mix of accelerating macro data, recovering company earnings and accommodative monetary policy triggered by stubbornly low core inflation rates.

Why we believe markets will resume their negative reactions

There are compelling reasons why we think the markets will reassess their sanguine

Brexit negotiations won’t be easy, and Mr. Trump faces continued political resistance

view of Brexit and President Trump in the coming quarters:In our view, it is a mistake for investors to think that political risks no longer matter. Rather, the markets’ reality check on recent political surprises might take unusually long.

Copyright © Allianz Global Investors US