by Ryan Detrick, LPL Research

We all know the expression “a picture is worth 1,000 words,” but sometimes a handful of words can paint a picture, even if it wasn’t the artist’s intended one. That was the case with a speech by European Central Bank (ECB) President Mario Draghi on Tuesday. Speeches by Draghi are relatively common occurrences; he often uses them to tout the success of the ECB’s negative interest rate and quantitative easing (QE) policies—the purchase of government and corporate bonds by the ECB to support the economy.

This speech didn’t seem very different, at least not to us, but the financial market focused keenly on a few phrases that highlighted the apparent recovery in the European economy and suggested that at some point there would be an end to both policies. Unlike the Federal Reserve, which has a dual mandate (stable inflation and low unemployment), the ECB is only tasked with managing inflation, or more recently fighting deflation. Therefore, the phrase “Deflationary forces have been replaced by reflationary ones” increased speculation that monetary policy may soon be tightening. The market paid less attention to Draghi’s subsequent comments that “inflation dynamics are not yet durable and self-sustaining.”

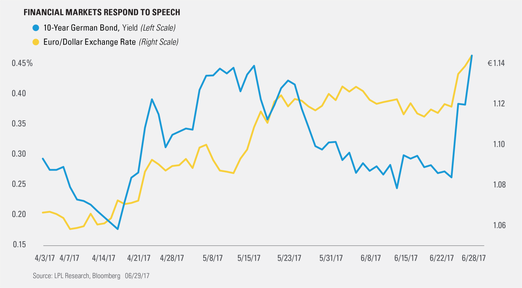

Following Draghi’s comments, the euro moved almost 2% in less than three days, and German bond yields spiked-all based on a few words. The market reaction was so strong that the ECB issued a statement suggesting Draghi’s speech was intended to be more balanced, but the rally in German interest rates continued, though the euro has eased somewhat.

We still believe the market reaction was overdone, and while ECB monetary policy will change eventually, it does not appear that it will be this year and maybe not even the first half of next year.

Although in the U.S. markets are focusing on fiscal policy and increasingly healthy corporate earnings, this week in Europe showed that those markets, despite impressive recent earnings growth, are still eagerly awaiting a return to more normal monetary policy.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

International and emerging markets investing involves special risks, such as currency fluctuation and political instability, and may not be suitable for all investors.

International debt securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards. These risks are often heightened for investments in emerging markets.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and make no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-622220 (Exp. 5/18)

Copyright © LPL Research