by Hong Xie, Global Research and Design, S&P Dow Jones Indices

The goal of the S&P U.S. High Yield Low Volatility Corporate Bond Index is to construct a high-yield bond portfolio with low credit risk and low return volatility by applying a low volatility factor. Does the index methodology truly deliver the effect of reducing volatility? The back-tested results of the 17-year period ending Feb. 28, 2017, show that the S&P U.S. High Yield Low Volatility Corporate Bond Index may offer an intersection that bridges the volatility gap between the high-yield and investment-grade bond sectors, with increased return efficiency.

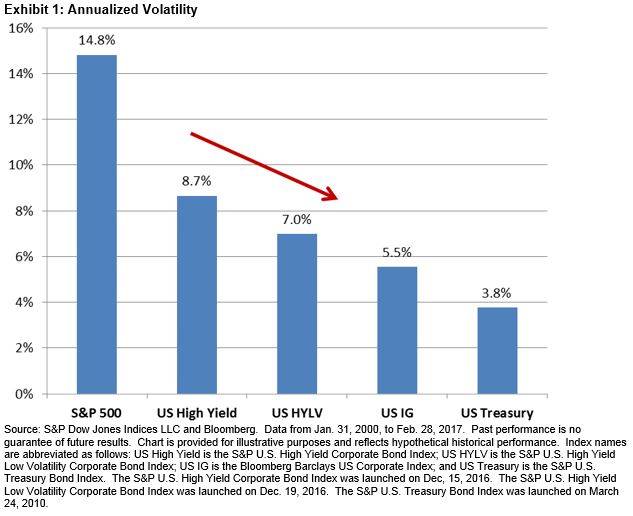

Exhibit 1 shows annualized volatility across the equity and fixed income sectors from Jan. 31, 2000, (the first value date of the index) to Feb. 28, 2017. As expected, the S&P U.S. High Yield Low Volatility Corporate Bond Index sat between the high-yield and investment-grade bond sectors in the volatility spectrum.

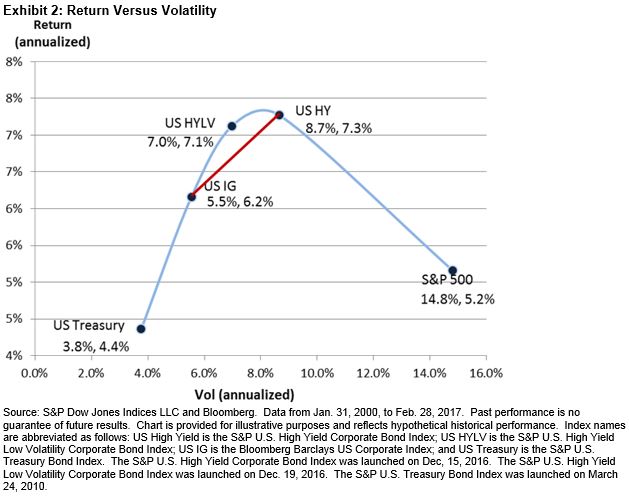

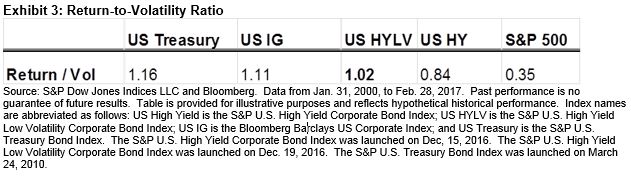

Exhibit 2 illustrates the return/volatility trade-off among various sectors. The fact that the S&P U.S. High Yield Low Volatility Corporate Bond Index is located above the straight line linking the investment-grade and high-yield bond sectors demonstrates that the index outperforms the return frontier established by the two bond sectors. This increased return efficiency can also be seen from the S&P U.S. High Yield Low Volatility Corporate Bond Index’s higher ratio of return-to-volatility than that of the broad-based, high-yield index (see Exhibit 3).

About Hong Xie

Hong Xie is director, global research and design, at S&P Dow Jones Indices. Hong is the lead investment strategist in fixed income, covering research and design of factor based, alternative beta and thematic indices in fixed income, and regularly publishing research papers in this field.

Prior to joining S&P Dow Jones Indices in 2014, Hong was head of fixed income and fund manager with Generali Investments Asia Ltd, and managed Asian Bond fund and Asian Credit Bond fund. Previously, Hong traded US rates and derivatives with BNP Paribas and Lehman Brothers, and was a portfolio manager and trader in global fixed income with China Investment Corporation.

*****

This article is a publication of S&P Dow Jones Indices LLC. © S&P Dow Jones Indices LLC 2016. S&P® is a registered trademark of S&P Financial Services LLC. Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. S&P Dow Jones Indices LLC is not an investment advisor. This publication is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold a security, nor is it considered to be investment advice.

Copyright © Indexology®