by Douglas Drabik, Fixed Income, Raymond James

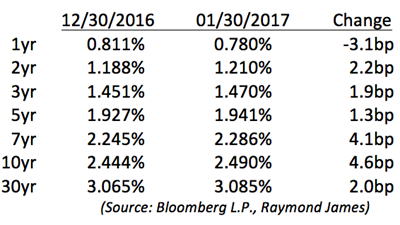

Interest rates inched up last week 8bp to 10bp 5 years and out on the yield curve. For the month, all points on the yield curve are within 5bp from year end 2016. The 10-year Treasury has seen the largest difference moving a mere 4.6bp from 2.444% to 2.49%. Interest rates, since year end’s election volatility, appear to have settled into a tighter trading range.

As tabloid-like reporting overshadows objective news, the more challenging task may be separating facts from dramatization. It doesn’t hurt to remind ourselves where we actually stand: a financial market with slow but steady growth, inflation at healthy levels, adequate employment and a favorable global position. It seems that in the future, when the current times are looked back upon, it will be recorded that these were very stable times for the American economy; however, living in the present, the news seems to paint a more turbulent picture.

President Trump’s first 10 days in office suggest that white house intends to be active. Politics ordinarily are not the center of financial commentary, but there is no denying that things may not be run as in the past. Academia and political personnel are being replaced with business people and it appears the United States may be run with more CEO-type leadership. Like it or not, it doesn’t matter. The votes have been cast and changes may be very impactful to our bond markets. Regulation (or de-regulation), tax code change and trade agreements are among the probable impactful future transformations.

Monetary policy, as set by the central bank (the Fed) has carried the burden of creating market order. It is now expected that the Fed will have help with fiscal policy playing a bigger if not more dominant role. How this will play out is very much in waiting. The initial enthusiastic market reaction felt after the election has settled down to reality. Keep in mind that bond direction is not an overnight occurrence. Generally, it takes months and perhaps years to form. Much like fixed income strategy for wealth-protecting purposes, it should typically be regarded in years if not decades of desired results. Expect that policy changes of any kind may take that long to filter into tangible results. Tax code changes could have a more immediate impact on our markets via corporate profitability and personal disposable income. For now, keep one eye on the market and the other on shifting policy. Change is coming but the timing and effectiveness are yet to be revealed.

Copyright © Raymond James