Muni Investors Can’t Ignore Inflation Risks - Context

by Fixed Income AllianceBernstein

December 06, 2016

Ignore your bond portfolio’s greatest enemy at your own peril. Inflation may not have been much of a concern for municipal bond investors in recent years, but it could well be in the cards now.

Why is inflation growth more likely today? A probable decline in federal corporate and personal tax rates alongside Trump’s trillion-dollar infrastructure program. Simply put, that means falling federal revenues and increased federal spending, which together create an inflationary environment. There are other reasons the market expects rising inflation, such as decreased regulation.

And if inflation is on the horizon, fixed-income investors should be looking at ways to shield the value of their investments.

One Way to Head Off Inflation

The most common and direct way to get inflation protection is to buy Treasury Inflation-Protected Securities (TIPS). TIPS provide inflation protection by adjusting the face value of the investment by the inflation rate and then paying interest on that adjusted face value. For example, a TIPS with a $1,000 face value and a 1.5% coupon will pay $15 in annual interest. If inflation is 2%, then the value is adjusted to $1,020 and the annual interest increases to $15.30.

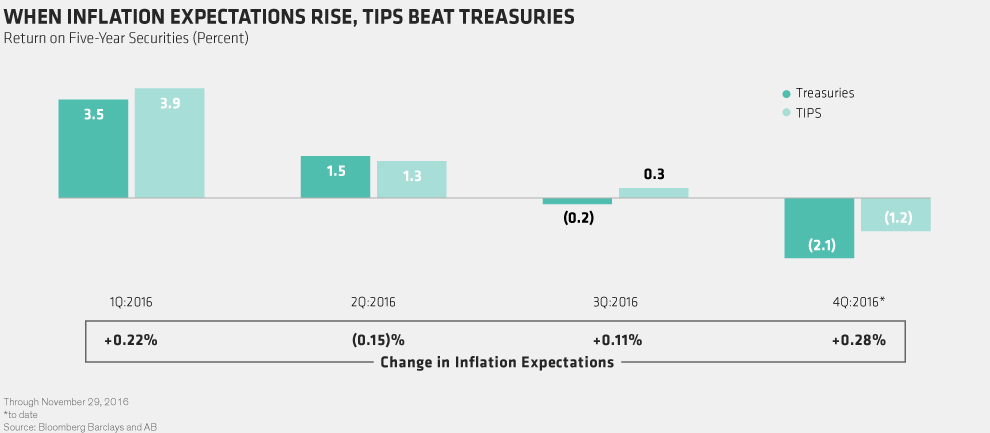

TIPS have done their job this year, outperforming Treasury securities when inflation expectations have risen, as they did in the first and third quarters and in the fourth quarter to date (Display 1).

The advantage of TIPS’ structure is that investors keep up with inflation and are offered a real rate of return. The disadvantage is that, for investors who pay taxes, TIPS are notoriously tax inefficient. The interest on the underlying TIPS is taxed at ordinary income tax rates, and so is the inflation adjustment. But here’s the kicker. The inflation adjustment is received when the TIPS mature, but is taxed in the year in which it was realized. That makes it “phantom income.”

Thankfully, for investors who are subject to taxes, there is a more tax-efficient form of inflation protection.

The Right Tool for the Job

The tax-exempt market has its own form of inflation-protected securities known as municipal inflation-protected securities (MIPS). Unfortunately, due to the MIPS market’s relatively small size—just $1.3 billion—it’s a very illiquid market. Because they are scarce, MIPS often trade at more expensive levels relative to TIPS than the municipal/Treasury relationship suggests.

Fortunately, there’s another way. By combining tax-exempt—and not inflation-protected—municipal bonds and consumer price index (CPI) swaps, investors who pay taxes can tap into two very large and highly liquid markets. (CPI swaps are agreements in which investors arrange to “swap” fixed interest payments for floating-rate payments tied to inflation rates, for a predetermined length of time.)

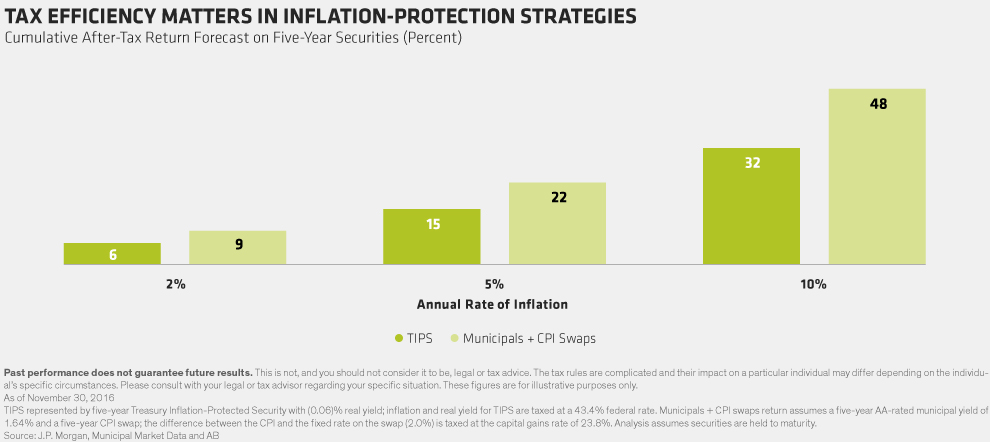

The combination offers two layers of tax efficiency. First, the underlying municipals are exempt from federal taxation. Second, the CPI swaps are taxed at capital gains rates, which can be sheltered through the realization of losses. And, there is no phantom income.

This tax efficiency really adds up during inflationary environments, relative to TIPS (Display 2).

As inflationary pressures continue to mount, tax-efficient inflation protection will become increasingly sought after. And like anything in demand, that will drive up its price. Right now, inflation protection is not too expensive—like snow blowers in July. Investors who wait to see whether there’s a blizzard may find that not only are their bond portfolios exposed to the cold, but protection is costly.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein