by Frank Holmes, CEO and Chief Investment Officer, U.S. Global Investors

A New York Times columnist is calling for another depression, volume is rising on the “double-dip” recession debate, and a well-known technical analyst is predicting that a 90 percent plunge is coming for the Dow Jones average.

Ambitious doom-and-gloomers are racing to the bottom to conjure up the most apocalyptic market scenarios – it’s small wonder why many investors are curled up in the fetal position.

In his Forbes blog, Rich Karlgaard labeled this bunch “The Men Who Want to Be Roubini – which is to say rich and famous.” The wealthy and well-known pundit Nouriel Roubini made his name as an uber-bear, but these days he doesn’t foresee a depression, a second recession or an asteroid destroying the planet.

We also don’t share the growing despair. I’ve lived through many market cycles and have learned that there are always opportunities in global markets – we’re just working harder to find them. As active managers, we use sophisticated investment processes, and we play to win. On the macro side, we believe in cycles and seasonal patterns, and that government policies are precursors to change, both domestically and internationally.

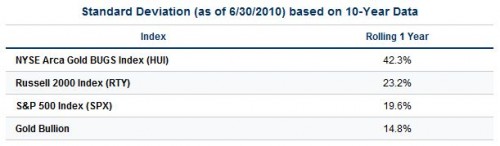

We also believe that each asset class has its own DNA when it comes to volatility. You can see this in the chart below, which shows the rolling 12-month volatility over the past 10 years for gold and gold equities compared to key large-cap and small-cap stock indexes.

For gold, the volatility over any 12 months for the past decade is plus or minus 14.8 percent and for gold stocks (as measured by the HUI), it about three times greater – investors should look at these numbers as “normal” behavior. It may come as a surprise to some that both the S&P 500 and the Russell 2000 are both considerably more volatile than bullion.

If you don’t pay attention to volatility of gold, for instance, you'll risk being herded into buying at the top and then getting upset and selling at a loss after it corrects.

When you understand volatility, it’s easy to see how much risk you have if you’re leveraged. If you're not leveraged, you have the flexibility to be able to buy gold on down days. Volatility can help you buy gold on sale.

It's really important for people to understand that there are peaks and troughs in life and in markets, and you have to be humble when you’re at the peak and hopeful when you’re in the trough.

The image above is a familiar one to many investors – it shows the sequence of emotions during a market cycle. It’s increasingly positive on the way up to the peak, and then progressively negative on the way down to the trough before starting back up again.

The irony, of course, is that investors feel happiest when they are at the highest market peril, and they want to jump out a window when their potential upside is the greatest.

These peaks and troughs don’t correspond just to markets or to the good and bad events in your life – they’re also how you feel inside and how you respond to outside events. How you feel depends on how you see your situation. Do you have hope and confidence, or are you paralyzed by negativity and despair?

I believe the key is to separate the events in your life from how you feel about yourself as a person. If you don't, your emotions can take control and, as an investor, you end up buying at the top and selling at the bottom. When this happens, of course, problems are compounded in a downward spiral.

Actions should be shaped by beliefs and values, not emotions. When investors understand volatility, they can manage market movements better and make better decisions. They can steer their financial ship with confidence, rather than sitting powerless and being pushed around by the market’s powerful tides.