Be on the Right Side of Change

by Equity Research, AllianceBernstein

Companies are having a much harder time producing earnings growth. Those that are positioned on the right side of change should be better placed to increase profits—and deliver investment returns—in a growth-constrained world.

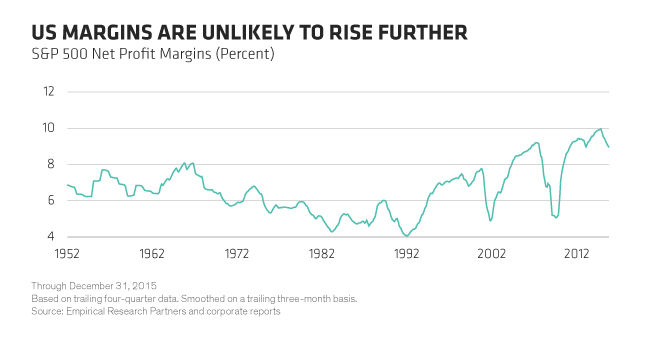

Corporate profit margins today are much higher than their average since the early 1950s (Display). These profitability levels are very high, even when taking into account that the mix of US economic activity has shifted toward more capital-light business models (e.g., services and technology), which inherently generate higher margins.

But not every company or industry is facing the same squeeze on earnings growth. In particular, changes triggered by technology, regulation or structural shifts in specific markets are excellent sources of growth potential—even in an earnings-constrained world. Finding companies that are on the right side of changes like these is one of several ways that active investors can capture excess returns over long time horizons.

Using Technology Right

Technological change isn’t only about the Internet or social networks. Consider the retail sector, where new technology and information systems allow companies to take advantage of massive amounts of available data on customer behavior. Companies that recognize this potential and invest accordingly are using these tools to deepen relationships with customers—and are capable of doing better than rivals who haven’t.

Manufacturing is another case in point. Companies that are at the vanguard of manufacturing innovation have greater flexibility in managing their businesses, which provides a powerful way to boost profitability.

For example, when we researched Nike in 2015, we discovered innovations that looked likely to significantly improve the company’s earnings growth potential. Nike may be adding sophisticated chips to some of its sneakers; this will allow it to deepen its relationship with customers by offering personalized deals that bypass retail outlets, bringing more profit to the shoemaker. It’s also using a new automated manufacturing technology called Flyknit that lets customers customize their orders with minimal labor, allowing Nike to shift its production closer to consumers—in the US and around the world—and save costs on shipping, duties and tariffs. Our research suggests that innovations like these are transforming Nike’s business model and could potentially trigger a leap in its profitability.

Why the wide gap between our view and the street’s? It’s because most analysts aren’t evaluating how new technologies and processes will filter down to the bottom line over several years; the potential payoff is a couple of years beyond their horizon. In a short-term world, building thoughtful, independent models like these can make the difference in choosing stocks that stand out from the crowd.

The Innovation Factor

It’s not only giants like Nike that turn innovation into investment opportunities. It’s becoming easier every year for people to change the world because traditional barriers to innovation—such as capital and time—are falling dramatically.

Today, new ideas can be transformed into businesses for only a fraction of the prior cost thanks to continued exponential declines in the cost of computing. For example, the required costs of a typical tech start-up have fallen by roughly 95% since the dot-com era of the 1990s (Display, left). And the disruptive potential is enormous, as seen in the shift in advertising from print newspapers toward the digital world, which has had a profound impact on profits for both traditional media companies like the New York Times and new media leaders like Google (Display, right). For investors, the challenge is to get an early grasp on how unfolding changes will transform the profitability outlook for a wide range of companies.

Transcending Traditional Industries

This often requires an understanding of broad themes that transcend traditional industries and sectors. For example, increasing environmental awareness is spurring global efforts to address challenges that include carbon emissions, clean water, food availability and sanitation. Policy support and technological progress are making the shift to decarbonized energy inevitable, in our view. And the costs of renewable energy such as solar or lithium-ion batteries for electric cars are falling dramatically (Display). We believe that many investors have underestimated the disruptive potential of exponential cost improvements to drive faster and broader adoption.

Changes like these are opening up big investing opportunities. Over the next 15 years, we estimate that $4 trillion will be invested in new solar and wind capacity. Industries like these are highly fragmented, and offer strong growth opportunities for winners.

But identifying investment targets requires a substantial research effort in order to understand the technological and business dynamics of many public companies operating in nascent industries. By searching for businesses that are on the right side of changes like these, we believe investors can find companies that should be well positioned to grow their earnings—even when broader business conditions are stagnant.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Chief Investment Officer—US Growth Equities

Frank Caruso is a Senior Vice President and Chief Investment Officer of US Growth Equities, a position he has held since 2012. In this capacity, he oversees three services: US Large Cap Growth, US Core Opportunities and US Growth & Income. Caruso has been Team Leader of US Growth since 2008 and Team Leader of US Growth & Income since 2004. From 1995 to 2004, he served as a Growth & Income portfolio manager. Caruso joined the firm in 1993, when it acquired Shields Asset Management, where he had been director of Equities. Previously, he was a managing director and senior member of the Investment Policy Committee at Shearson Lehman Advisors, as well as CIO for Shearson Lehman Asset Management’s Directions and Capital Management businesses. Caruso was also formerly the lead portfolio manager for Shearson’s family of growth and income mutual funds. He holds a BA in business economics from the State University of New York, Oneonta, and is a member of the New York Society of Security Analysts and the CFA Institute. He is a CFA charterholder. Location: New York

Chief Investment Officer—Global Growth and Thematic

Daniel C. Roarty was appointed Chief Investment Officer of AllianceBernstein’s Global Growth and Thematic team in 2013. He joined the firm in May 2011 and was named sector head for the technology sector on the Global/International Research Growth team on July 1, 2011, and team leader for that team in early 2012. Roarty previously spent nine years at Nuveen Investments, where he co-managed a large-cap growth strategy and a multi-cap growth strategy. His research experience includes coverage of technology, industrials and financial stocks at Morgan Stanley and Goldman Sachs. Roarty holds a BS in finance from Fairfield University and an MBA from the Wharton School at the University of Pennsylvania. He is a CFA charterholder. Location: New York

Related Posts

Copyright © AllianceBernstein