The conference

March 14, 2016

Last week, we watched a 2012 interview with Jeff Bezos, Amazon’s chief executive. Bezos noted that he was frequently asked what he thought was going to change in the next ten years. His response was that the more important question would be “What is not going to change in the next ten years?” This line of thinking seems to be even more relevant today. Change is certainly coming faster than ever. Even though some things do not change (quality, service, reliability, value, integrity), digital technology is changing how almost everything is delivered and/or implemented. Companies that try to ignore this concept are likely to be displaced. Technology is no longer a differentiator – it is an integral part of any successful, global business.

. . . Frederick “Shad” Rowe, Greenbrier Partners (2-29-16)

I thought about my friend Shad’s aforementioned quote as I saw companies last week at Raymond James’ 37th Annual Institutional Investors Conference (IIC). To wit, “Change is certainly coming faster than ever. Even though some things do not change (quality, service, reliability, value, integrity), digital technology is changing how almost everything is delivered and/or implemented.” Another of Shad’s mantras I considered while seeing company presentations was, “It seems to me that there are really two types of companies and two types of investors. The first do what our companies are doing (better, faster, and cheaper) and the second are just making money any way they can. . . . As I look back on my long career, the most successful companies create customer loyalty, as opposed to holding their customers hostage. And I believe that technology now enables people to go around (or over) moats faster than ever before.” There were over 300 companies at the conference, but I only saw about 20. With Shad’s thoughts in mind, I will share a few of the companies that I think adhere to his mantras and that struck me as particularly interesting (no particular order).

1) Shopify (SHOP/$26.70/Outperform). According to our fundamental analyst, “Shopify Inc. is a leading provider of cloud-based commerce solutions that helps businesses create an omni-channel experience, showcasing a merchant’s brand across all sales channels (web, tablet, and mobile storefronts, social media storefronts, and brick-and-mortar, and pop-up shops). We reiterate our Outperform rating on Shopify following broad-based upside in 4Q15, with a 2016 revenue outlook (58% growth y/y at mid-point; 13% above consensus) that suggests fundamental momentum remains much stronger than Street expectations.”

2) MarketAxess (MKTX/$124.93/Outperform). Our analyst writes, “MarketAxess Holdings Inc. operates an electronic trading platform for a variety of fixed-income investments. Products include U.S. high-grade corporate, eurobonds, emerging markets, high-yield/crossover, credit default swaps, and U.S. agency securities. More than 1,000 investor and broker-dealer firms are active users of MarketAxess' trading platform. In addition to trading services, MarketAxess offers financial technology solutions, market data, and analytic products.”

3) Mobileye (MBLY/$34.99/Outperform). “Mobileye designs and develops software and related technologies for camera-based Advanced Driver Assistance Systems (ADAS). Its technology is designed to keep passengers safer on the roads, reduce the risk of traffic accidents and save lives, and has the potential to revolutionize the driving experience by eventually enabling autonomous driving.” At the conference our analyst wrote, “Mobileye indicated that there are currently 10 million vehicles on the road in which its technology has been installed. Mobileye is currently working with 13 OEMs on semi-autonomous driving with four contracts in the production stage and nine in the pre-development stage. In addition, the company now has three major OEMs signed on to use the REM (Road Experience Management) solution including Volkswagen, GM, and Nissan. Together, these three companies represent approximately a third of the total global light auto production per year.”

4) Cavium (CAVM/$62.73/Strong Buy). Our analyst writes, “Cavium is a fabless semiconductor company that designs integrated processors for networking, communications, and security applications. Cavium is currently experiencing the deepest and broadest design win engagement activity in company history, including core Octeon embedded multi-core and Nitrox security platforms, plus new momentum with Fusion M (basestation-on-a-chip), ARM-based server ThunderX, XPliant programmable switch, and LiquidIO SDN accelerators.”

5) Descartes (DSGX/$17.16/Outperform/covered by Raymond James LTd.). “Descartes is a global provider of federated network and global logistics technology solutions, delivered on a Software-as-a-Service platform.” Right after the company’s presentation at the IIC our analyst wrote, “While on the surface DSGX does not report (yet) a lot of organic growth (we estimate low single digit at constant currency), the fastest growing businesses in F2016 were: 1) Omni-Channel/Dynamic Routing & Scheduling (30% of revenue) we estimate grew at ~15% in F2016; and 2) Trade Content (10% of revenue) we estimate grew at ~12% in F2016 and arguably set to do better with MK Data now integrated. Customs & Regulations (20% of revenue) is not quite there yet but we know new regulations (US ACAS, Canada eManifest now mandatory, US ACE) are coming. So in a couple years DSG could have 2/3 of its business growing double-digit organically. We think that's quite interesting.”

We saw a number of other companies that were interesting, but I am running out of space to discuss them. If you want the entire list of companies I saw, and companies I heard about from legendary portfolio managers I spoke with like Lord Abbett’s Tom O’Halloran (I own his funds), please contact the Equity Advisory Group.

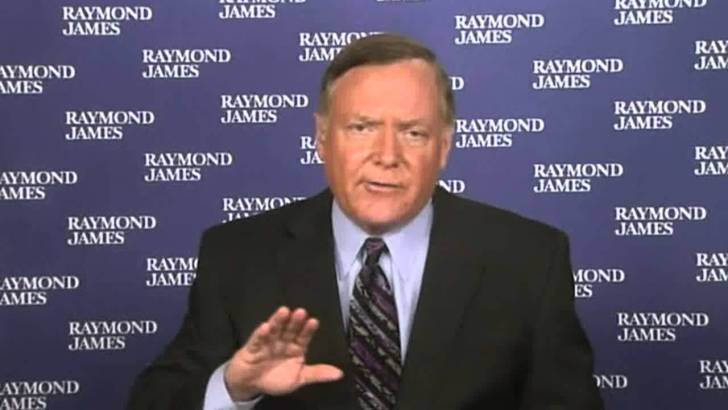

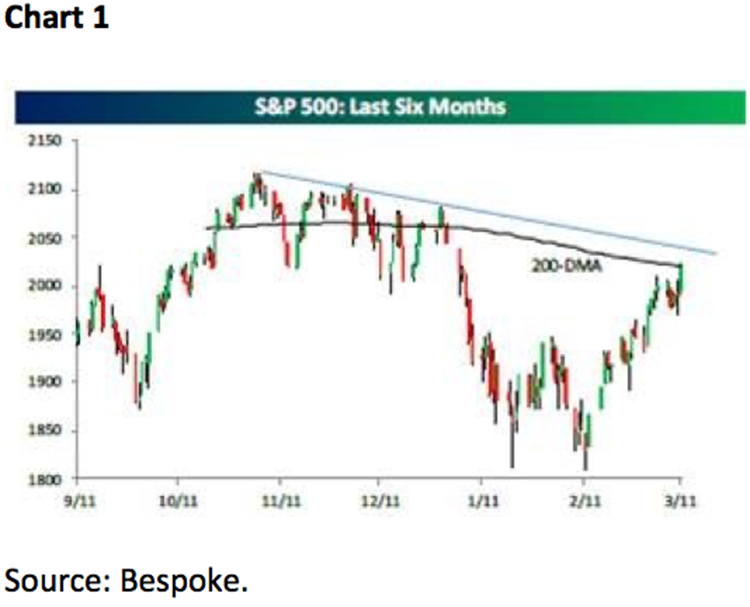

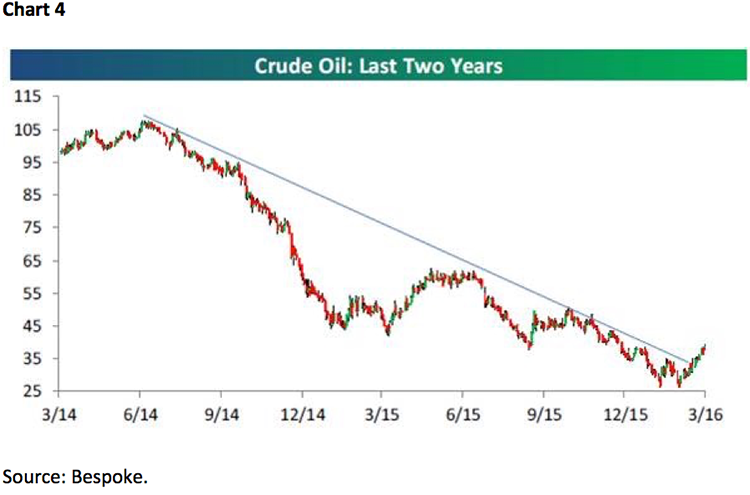

In our absence last week stocks traveled higher, with the S&P 500 (SPX/2022.19) notching its highest close since December 31, 2015 and in the process managing to close above its 200-day moving average for the first time this year (Chart 1). The rally has left the SPX down only 1.06% for the year, but the Equal Weighted S&P 500 is actually up year-to-date (+0.67%). It was a fitting week for the SPX to celebrate its 7th birthday since the secular bull market began in March 2009 (we were bullish). It was the fourth weekly win for the SPX, the longest such streak in more than four months, and it has been driven by better economic reports and the belief a recession will not be forthcoming (Chart 2). Further, wage growth has hooked up and for the past 12 months has been growing at a 3.6% rate (Chart 3). To readers of these missives this should come as no surprise for as repeatedly stated we have thought for some time the various markets were overestimating the odds of a recession. Also suggesting “no recession” has been the strength in crude oil prices since their February 11, 2016 low print of $26.05/bbl; and, recently crude oil prices broke out above a downtrend line that has been intact since June 2014 (Chart 4). Given crude’s +40% rally, my friends at the must have Bespoke organization note:

The table [Chart 5] summarizes the performance of both crude oil and the S&P 500 six months after the prior three periods where crude oil rallied 40%+. In the case of crude oil, returns have been all over the map, while the S&P 500 has seen mixed returns on the one and three month periods, but consistently positive returns over the next six months.

The call for this week: Well, after three “bonks” against the 1945 – 1950 overhead resistance the envisioned upside breakout occurred leaving the SPX streaking toward our next resistance level of 2000 – 2040. The first bonk of this level happened on March 3 at 2000. The second bonk was last Friday, which left the SPX at a closing price of 2022.19. The nearly straight up move from the February 11 low (~1810) has left most of the overbought indicators we monitor pretty overbought (87.9% of the SPX stock are above their 50-day moving averages). Moreover, the stock market’s internal energy is about totally used up. Therefore, it would not surprise to see the same kind of action we experienced as the SPX tried to surmount the 1945 – 1950 level. Eventually, however, we expect the 2000 – 2040 level to be bettered. Hence, we would use periods of selling to reposition portfolios into names like the ones featured in this report. As for sectors, last week the best performing sectors were: Materials (+2.14%), Utilities (+2.13%), Energy (+1.89%), and Healthcare (+1.66%). Yet those paled in comparison to Natural Gas (+15.44%) and Unleaded Gasoline (+8.37%). This morning the preopening S&P futures are flat as participants await this week’s PPI and CPI inflation reports, which have been ticking up, and may impact this week’s Fed meeting.