U.S. vs. World

by Doug Drabik, Fixed Income, Raymond James

Just a few weeks ago the consensus opinion had the US economy pegged for a recession as global uncertainties continued to mount and Europe fired a “bazooka” of additional stimulus. This combination left many wondering whether the US could prosper while the rest of the world struggled to grow. Good news, it seems the question has been answered; both high yield (HY) and Investment grade (IG) spreads tightened considerably after reaching levels that typically correspond to an imminent recession. According to YieldBook data, in the last month broad IG spreads are lower by ~40bp to 176bp while HY tightened by ~200bp to ~700bp. Job growth, hourly earnings and other measures of consumer sentiment in the US are very positive. It seems the doomsayers were wrong.

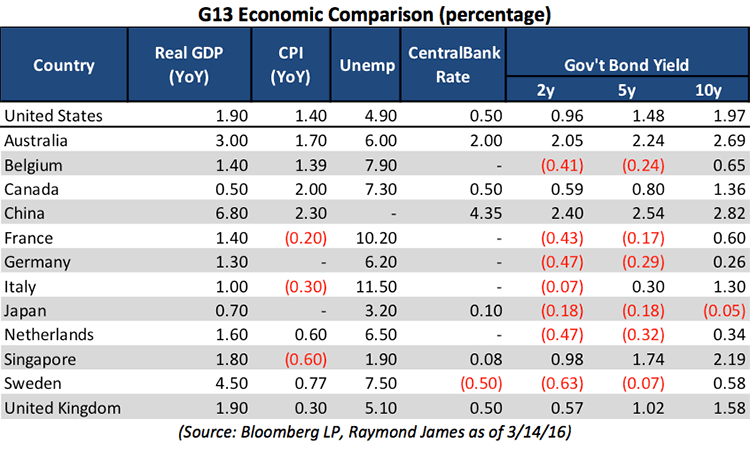

Sometimes numbers speak louder than words; the table below is a quick snapshot of G13 countries and compares economic factors such as GDP, CPI (inflation) and unemployment to their relevant central bank rate and sovereign bond yields. What do you see? GDP is a reasonable 1.90% here at home, not jaw-dropping but very reasonable. Inflation is only 1.40% yet manages to be the 4th highest amongst the peer group (some are negative), unemployment is a solid 4.90% (only two countries are lower) and our target central bank rate is 0.50%, tied for 3rd place behind only Australia and China. Should the US economy decide to issue a press release concerning its health, it should consider borrowing an old phrase attributed to the great Mark Twain and state, “reports of my death have been greatly exaggerated”.

Copyright © Raymond James