Jeffrey Saut: Assassins, hunters, and rabbits . . . oh my

Jeffrey Saut: Assassins, hunters, and rabbits . . . oh my

by Jeffrey Saut, Chief Investment Strategist, Raymond James

It was a few weeks ago that I resurrected a line used in my September 10, 2001 missive from the movie Star Wars that read, “I felt a great disturbance in the force . . . as if millions of voices suddenly cried out in terror and were suddenly silenced. I fear something terrible has happened.” The quip was used because stocks should have been going up in the August/September timeframe of 2001 and they were not. The missive went on to read, “An appropriate line given our sense that for the past few weeks that something is/was out of balance in the universe.” That same “out of balance” feeling struck me again in late-December of 2015 when the Santa rally failed to materialize. This morning I am using another line from Start Wars that reads, “A long time ago in a galaxy far, far away” because I am referencing an article written some time ago titled “Being Wrong and Still Making Money” by Lee Freeman-Shor. The author begins by writing, “The investment ideas of some of the greatest investors on the planet today are wrong most of the time, and yet they still make a lot of money. How can this be? How can the world’s best investors get it wrong and still make millions?” The author continues by noting, “My findings suggest the odds are that an investor’s great idea will lose money. As such, before you invest a cent into an investment idea, it is imperative to have a plan of action as to what you will do if you find yourself in a losing position.” And folks, here is the secret of investing as written by Mr. Shor:

When losing, the successful investors I worked with planned to become either Assassins or Hunters. Assassins sold losing investments that fell by a certain percentage or that declined by any amount and showed no signs of recovery after a certain period of time. Hunters invested a lesser amount at the outset and with a plan of buying significantly more shares if the price fell. Hunters were also unafraid to sell if it became clear that they had made a mistake. The bad investors didn’t have a plan and consequently turned into Rabbits. When losing money, Rabbits neither bought more shares nor sold their holdings. Once forming an initial perception, Rabbits were achingly slow to change their opinion of a stock. Which tribe will you become a member of?

“Assassins, Hunters, and Rabbits . . . oh my” and for the past two weeks the stock market has certainly gone down the “rabbit hole” for the worst start of the year ever! The mauling has triggered a number of cautionary signals. First, the old stock market “saw” goes, “If Santa fails to call, the bears will come to Broad and Wall.” While cute, it does not have a particularly good track record. Since 1900 there have been 35 bear markets (a decline of 20% or more). Only 12 of them have been preceded by no “Santa rally” for a 34% accuracy rate. Second, another stock market meme states, “So goes the first week of the year, so goes the month, and so goes the year.” Hereto, while cute it is not actually what Yale Hirsch proffered in 1972 in the Stock Traders’ Almanac, now termed the “January Barometer.” To be exact, the actual “January Barometer” reads, “So goes January, so goes the year.” According to Jeffrey Hirsch the “January Barometer” has been accurate 75% of the time since 1950. So there is no signal yet from this indicator and we must wait until the end of the month for its guidance. Third, while not an axiom, the “December Low Indicator” was first explained to me in the early-1970s by Wall Street icon Lucien Hooper. It was over lunch at Harry’s (at the Amex) Bar & Grill that Lucien explained it by saying, "Forget all the noise you hear about the January Barometer; pay much more attention to the December low. That would be the lowest closing price for the Dow Jones Industrial Average during the month of December. If that low is violated during the first quarter of the new year, watch out!" To be sure, the December Low Indicator has registered a “watch out” signal as D-J Industrial Average (15988.08) traveled below its December 18 closing low of 17128.55 on January 6 of this year. The S&P 500 (SPX/1880.33) has done the same, given its December closing low of 2005.55.

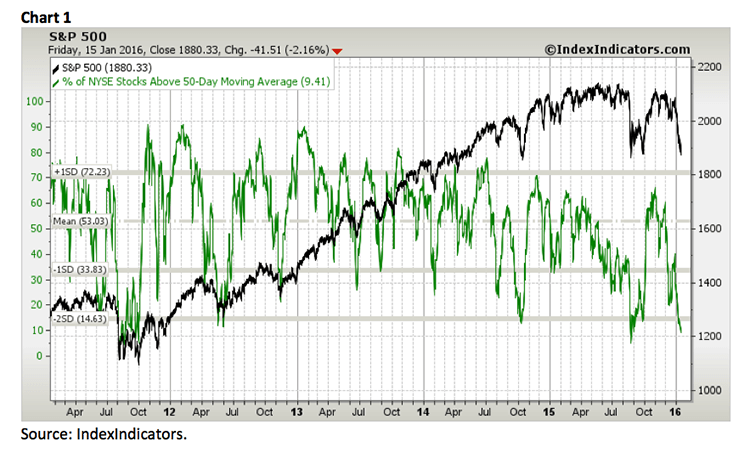

Around the time the “December Low” was violated (January 6, 2016); Andrew and I began suggesting that we could be in a “selling stampede.” At the risk of repeating myself; selling stampedes tend to last 17 – 25 sessions, with only 1.5 – 3 session pauses/rally attempts, before resuming the downside skein. While it’s true there have been a few stampedes that have extended for 25 to 30 sessions, it is rare to have one last for more than 30 sessions. Today is session 13. Also, on CNBC for the past two Fridays I have repeated my mantra of “Never on a Friday,” meaning stocks rarely bottom on a Friday when they are into a weekly Downside Dive. Typically, the markets allow participants to brood about their losses over the weekend and show up the following Monday in “sell mode.” That worked in spades last week and we will have to see if it plays this week as well. That said, the stock market is very oversold on a short-term basis as represented by the percentage of NYSE companies above the 50-day moving average, which is now under 10% (see chart 1). As can be seen, the SPX is just about as oversold as it was at the August 2015 lows. Accordingly, it would not be a surprise to see a rally off of some kind of early week low this week. The question, once again, is will it be a 1.5 – 3 session affair, or something more.

There have been many reasons offered for the first of the year “fade” ranging from the Chinese economy, North Korea’s H-bomb, the Saudi Arabia/Iran tensions, crude’s crash, etc., but last week it was the U.S. economy. While I remain more concerned about the Saudi/Iran tensities, especially after last week’s Zawahiri jihadist audio recordings and written statement for Saudi citizens to revolt, the week’s wilt was attributed to the U.S. economy. Of the 19 economic reports issued four came in better than expected, three met estimates, but a large 12 were worse than expectations. Indeed, it was a mostly negative week for U.S. economic data bringing on cries of recession. At this point we do not see a recession on the horizon. As our economist, Scott Brown, Ph.D. writes:

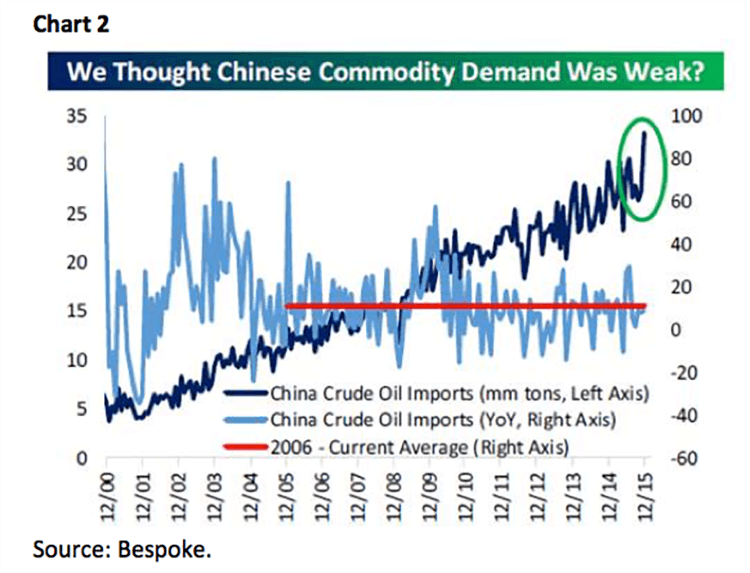

The bottom line is that worries about China are not going to go away. The question is, what does it mean here? The U.S. economy is still largely self-contained. China, our third largest trading partner, accounted for 8% of U.S. exports in 2014 (that’s less than 1% of U.S. GDP). China has been a major importer of raw materials, so commodity exporters (Australian, Canada, and Latin America) are going to suffer. So, we’re talking about a broad global economic slowdown (that’s slower global growth, 3% or a bit less – not a contraction).

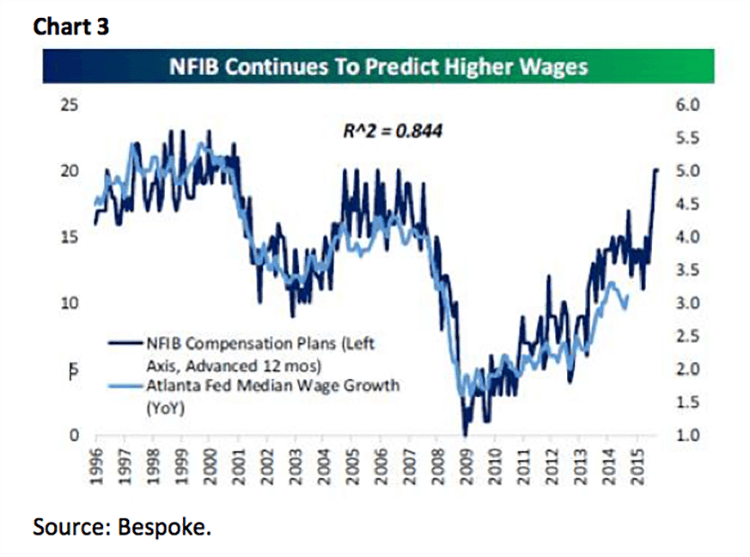

Speaking to a recession in China, last week Chinese trade data soared, credit stats showed an uptick in lending, and China’s crude oil demand surged to all-time highs while growth tracks China’s 10-year average (chart 2). And in this country, don’t look now, but the NIFB continues to predict higher wages (chart 3). So I will say it again, at this point we do not see a Chinese economic collapse, or a U.S. recession. That does not mean, however, the “selling stampede” is over.

The call for this week: I began last week in Sarasota, then off to Fort Myers, Naples, Fort Lauderdale, West Palm, and Lake Wales doing presentations for our advisors and their clients, as well as seeing institutional accounts. Thursday night’s Lake Wales dinner, at one of my favorite Italian restaurants in the world (L’Incontro), Pat Cain, of Pat Cain Wealth Solutions (http://www.patcain.com/), asked me about being “wrong.” I responded with a quote from legendary investor Peter Bernstein:

After 28 years at this post and 22 years before this in money management, I can sum up whatever wisdom I have accumulated this way: The trick is not to be the hottest stock-picker, the winning forecaster, or the developer of the neatest model; such victories are transient. The trick is to survive. Performing that trick requires a strong stomach for being wrong, because we are all going to be wrong more often than we expect. The future is not ours to know. But it helps to know that being wrong is inevitable and normal, not some terrible tragedy, not some awful failing in reasoning, not even bad luck in most instances. Being wrong comes with the franchise of an activity whose outcome depends on an unknown future (maybe the real trick is persuading clients of that inexorable truth). Look around at the long-term survivors at this business and think of the much larger number of colorful characters who were once in the headlines, but who have since disappeared from the scene.

PS: Both the SPX and INDU did not close below their respective August closing lows, so what we have according to Dow Theory is a downside non-confirmation; and stocks are very oversold. Look for some kind of rally attempt this week. This question remains, “Will it be just a 1.5 – 3 session affair, or something more?” This morning it is looking like “something more” as China’s weak economic data bring on hope of more stimulus and Iran’s pledge to produce 500,000 barrels of crude oil per day didn’t rattle the oil market, leaving the February future contract up 1.6% this morning. Accordingly, the S&P 500 futures are better by 30-points at 5:30 a.m. But the question remains, “Is it just another one of these 1.5 – 3 day affairs or something more?”