The silver lining in portfolios during disorderly markets

By Doug Drabik, Fixed Income, Raymond James

The old adage that markets are driven by fear and greed actually packs a lot of punch. The early start to this year sure could put the fear in any rational thinking investor as in just 10 days of trading, the DOW and S&P are now down 8.2% and 6.5%. Although all investors want healthy growth of their assets while earning solid interest, nobody wants to lose their hard earned money to falling markets. Investors revel during stretches of time when equities, MLPs, real estate and other higher risk potentially higher yielding classes provide that bigger growth and sometimes regular income but fear creeps in when wealth is wiped away in market downturns.

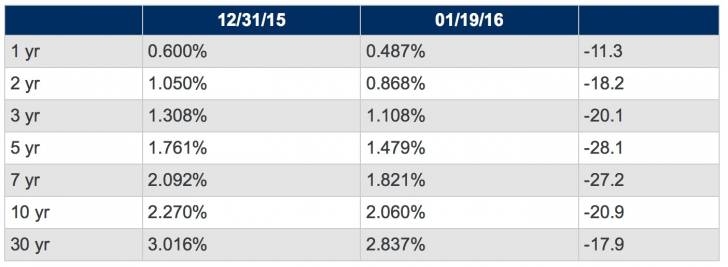

The impact of last year’s late Fed raise is not at all what one might expect as it is being dimmed by a multitude of market dynamics including: the lack of inflation, global diversity with monetary policies, China’s retreating growth, tumbling oil prices, terrorist fears and the strong dollar. Thus far, the entire curve is lower in rates, including the short-end.

The tortoise in the race, fixed income, may be the silver lining not only during these tumultuous times, but during any market. They maintain a few advantages not typically part of growth oriented assets. Fixed income does not necessarily rely on the appreciation component of total return. This is more often than not a buy-and-hold investment that weathers noisy markets. Sure, as rates rise, the market price of a fixed income bond will fall, but that math has no real earning’s impact unless an investor sells. That brings us to the other major advantage: maturity. Fixed income bonds have a finite period that when reached and barring default, the bond returns its entire face value to the investor despite any interim fluctuations in interest rates. In addition, fixed income bonds provide their periodic and predictable cash flow and income. What a calming feature during a period of anxiety and undesirable disruptive markets.

Copyright © Raymond James