by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

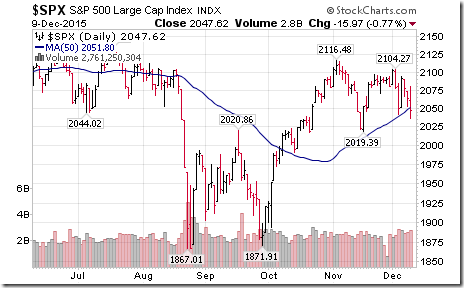

S&P Index charts another test of its 50 day moving average. Industrials and Materials weaken.

Editor’s Note: The Index closed almost exactly at its 50 day moving average

Technical action by S&P 500 stocks to 10:00: Bearish. Breakdowns: $WHR, $COF, $TROW, $AME, $EMR, $JBHT, $RHI. Breakout: $RTN

Editor’s Note: After 10:00 AM, another 19 S&P 500 stocks broke support.

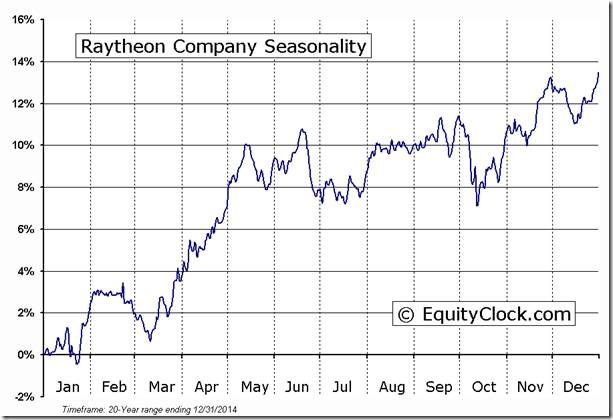

Defense stocks and ETFs $ITA are leading this morning to the upside. Nice breakout by $RTN to an all-time high!

‘Tis the season for Raytheon to move higher until mid-May!

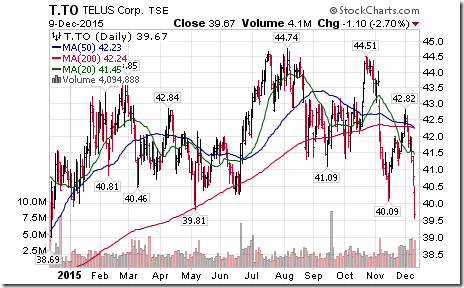

Telus $T.CA broke support at $40.09 to extend an intermediate downtrend.

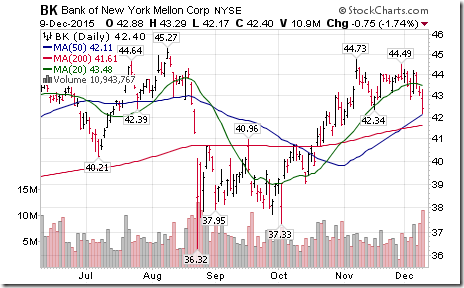

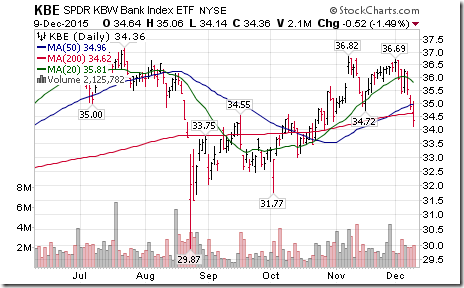

Weakness by S&P 500 stocks this afternoon mainly due to double top breakdowns by financial stocks: $BAC, $BBT, $BK, $C, $MS, $STT.

Editor’s Note: Not surprising, the Money Center Bank ETF also broke support and completed a double top pattern on a move below $34.72

Trader’s Corner

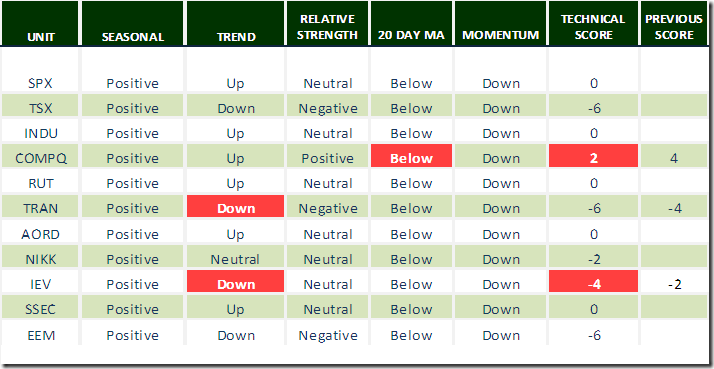

Daily Seasonal/Technical Equity Trends for December 9th 2015

Green: Increase from previous day

Red: Decrease from previous day

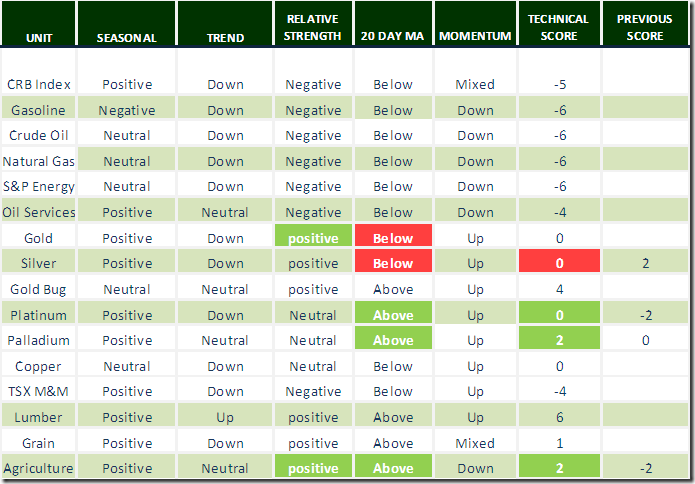

Daily Seasonal/Technical Commodities Trends for December 9th 2015

Green: Increase from previous day

Red: Decrease from previous day

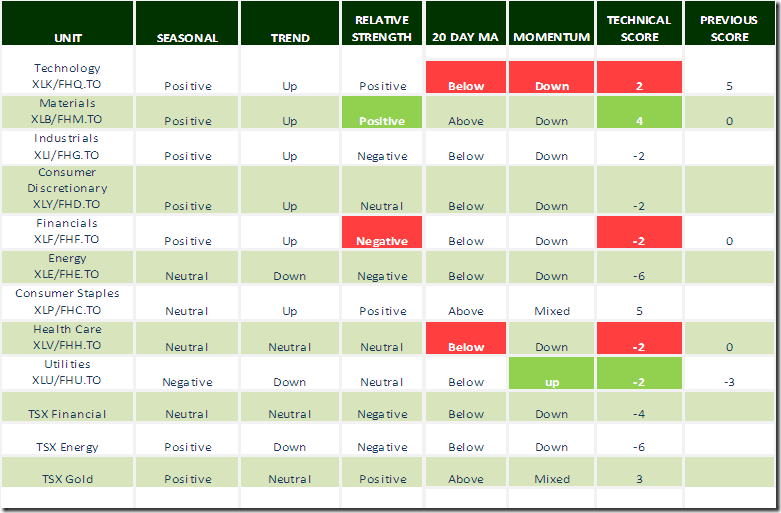

Daily Seasonal/Technical Sector Trends for December 9th 2015

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

The U.S. Dollar Index continues to crater.

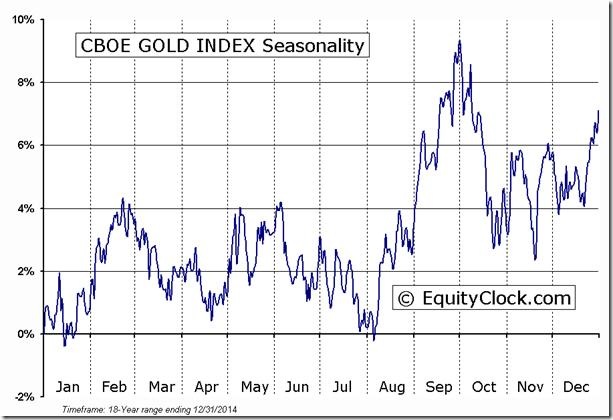

Precious metals and precious metal stocks are responding. They have bottomed and are outperforming the S&P 500.

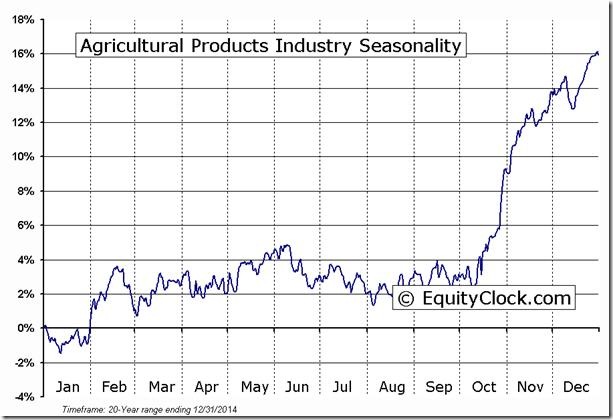

The Agriculture sector is staging a belated seasonal period of outperformance.

The Material sector resumed an outperformance rating thanks mainly to strength by Dupont and Dow Chemical following news of an imminent merger.

Percent of S&P 500 stocks trading above their 50 day moving average continues to trend down.

Percent of TSX stocks trading above their 50 day moving average also continues to trend down, but already has reached an intermediate oversold level below the 25% level. However, signs of a bottom have yet to appear (and are unlikely to appear until near the end of the current tax loss selling period).

Interesting responses by Kinder Morgan and Freeport McMoran! Kinder Morgan slashed its dividend and Freeport McMoran eliminated its dividend. Both stocks moved higher following the news. Negative anticipation of dividend reductions was overdone. Lots of commodity sensitive stocks currently are deeply oversold and likely will remain under pressure until the Federal Reserve announces its decision on December 16th and until tax loss selling pressures are over. Santa Claus is coming to town. Get ready!

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca