Lowest close since August 25th

by Eddy Elfenbein, Crossing Wall Street

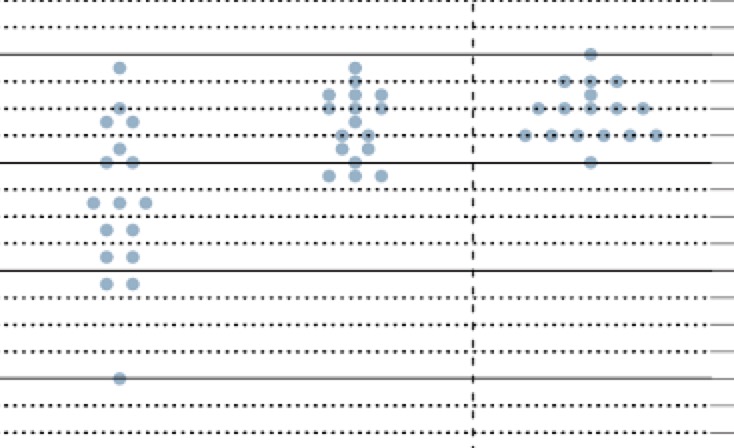

Today was a very unpleasant day on Wall Street. The S&P 500 fell 2.57% to close at 1,881.77. This was the market’s lowest close since August 25.

To give you an idea of how ugly today’s market was, new lows beat the new highs by a score of 73 to 0. Ten stocks closed higher and 492 closed lower. (Yes, there really are 502 stocks in the S&P 500.) The Nasdaq lost just over 3%, and the Dow closed 1.89 points above 16,000.

Energy, Healthcare and Materials were down the most today. Biotech continues to feel the brunt of the sell-off. The Biotech ETF (IBB) was down 6.33% today. But we should remember that Biotech has had a tremendous rally since 2011 prior to a few weeks ago. IBB briefly peeked its head over $400 in July, and it was less than $90 four years ago.

The Healthcare selling spilled over into quality names. For example, both Stryker (SYK) and CR Bard (BCR) were down over 4% today. There’s no news today that should impact either one. Bed Bath & Beyond (BBBY) fell 4.4% to close at $57.15. The stock’s EV/EBITDA is currently 6.07. Wells Fargo (WFC) yields nearly 3%. Microsoft’s (MSFT) yield is now over 3.3%. Ford (F) is at 4.6%.

Utilities (XLU) and Staples (XLP) did the best today, meaning they were down the least. Except for health care, this was a classic defensive day. The 10-year yield is back to 2.1%.

There’s not much to say, but get ready to ride the madness out. I’ve been saying that this won’t be over until the VIX closes below 20, and that hasn’t happened yet. The VIX rose 16% today. It appears that the market wants to “retest” the low from August 24 when the S&P 500 got as low as 1,867.01.

I’ve been especially surprised by the weakness in Materials stocks. Of course, they should be down with the global meltdown in commodities but it’s still stunning to see how dramatic it’s been. Since June 18, the Material Sector ETF (XLB) is down 22%.

Copyright © Crossing Wall Street