TSX Death Cross – Equity Action Call Drops Near Unfavoured

For this week's SIA Equity Leaders Weekly, we are going to discuss our SIA Equity Action Call (EAC) ... what it is, what it isn't and its ultimate purpose. A proper understanding of what this indicator is saying is essential to effectively utilizing our Relative Strength Methodology. Then we will discuss the EAC within the context of the current market volatility.

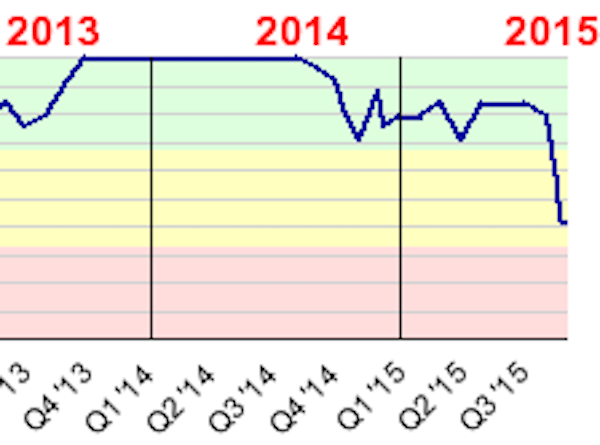

SIA Equity Action Call

SIACharts developed this indicator to help us assess one thing and one thing only ... the longer term risk/reward ratio of equities vs alternative assets. When the EAC is in the Green Favoured Zone, the risk/reward of equities is favourable over alternative asset classes (such as fixed income, currencies, or even cash), when the EAC is in the Yellow Neutral Zone, the risk/reward is equal to that of alternative asset classes, and when the EAC is in the Red Unfavoured Zone, the risk/reward is unfavourable versus the safest of these alternative asset classes, ie. cash. The Equity Action Call then is assessing the changing risk/reward ratios of equities at any given time.

The one misconception about the EAC is that it is predicting or forecasting bull or bear markets? This is not the case! It is constantly assessing the changing risk/reward ratios of equities which provides objective feedback as to the strength or weakness of equities relative to safer assets. Our response is to simply align ourselves with the changing risk/reward ratios. We believe by aligning ourselves with the longer term risk/reward ratios of equities is an effective way to ultimately navigate through the various bull and bear market cycles without trying to predict them in advance.

Another way to think about our EAC is not as a "crystal ball" but rather a "GPS". A GPS is a tool that enables a driver to more effectively navigate through a predetermined route. It is a real-time system that adjusts its recommended path based upon the changing street conditions. When you veer off the path either by mistake or because of a road closure or detour sign, the GPS quickly "recalculates" and suggests the quickest route to get you back on your original path. In investing, our predetermined path is to be in equities over the longer term to attempt to achieve the desired rate of return to satisfy our objectives. However, when we approach a road block or detour sign sometimes we need to move off our original path temporarily (ie. move to bonds, currencies or cash) as a safety precaution. It is during these times that our GPS (the EAC) will "recalculate" based upon the new data it is receiving daily from the markets and determine the quickest route to get you back on your original path when the risk/reward ratio for equities is again more favourable than alternative asset classes. This occurs when the EAC moves back into the Green Favoured Zone.

The SIACharts Equity Action Call adjusts to the longer term changing risk/reward ratio of equities in real time and has become an indispensable tool to help our clients more effectively navigate through the longer term market cycles. What separates the professional investor from the amateur investor is their ability to assess probabilities and risk/reward and develop a system that alerts them to periods of unfavourable probabilities and risk/reward of equities so they can act prudently.

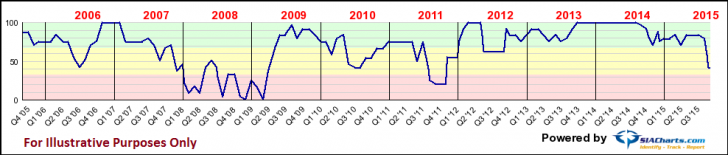

Click on Image to Enlarge

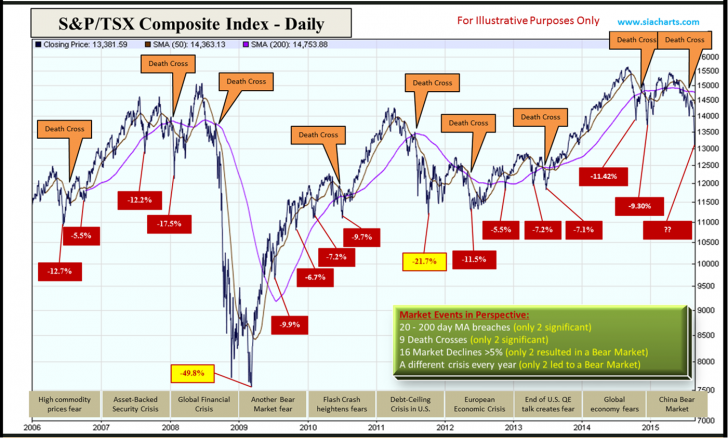

S&P/TSX Composite Index (TSX.I)

This chart illustrates the huge volatility in the S&P/TSX Composite Index since 2006. There were 2 bear markets, 2 bull markets and approx. 14 corrections of greater than 5% during this time. Also, there was no shortage of negative economic events we had to face and a multitude of so-called "bearish signals" suggested by the "talking heads", everything from Death Crosses to 200 day moving average breaches. Those who attempted to predict or forecast their way through this market had to face huge volatility in both directions on both a long term and short term basis. The ability to distinguish a normal correction from the start of a new bear market is one of the keys to successful investing in our opinion. So the question is ... how do you do this?

Again, our EAC was designed to assess the longer term risk/reward of equities versus alternative asset classes. The power in our indicator is how it attempts to reduce the drawdown of a full blown bear market while at the same time ignore the short term volatility created by normal market corrections. It does this by constantly calculating the Relative Strength of equities versus alternative asset classes on a daily basis which provides a risk/reward ratio alerting us to times of increasing or decreasing risk for equities. This enables us to align ourselves with the changing money flows and keeps us in tune with the overall equity markets. We believe the markets are always right, even though they are not always rational! Trying to predict or forecast a system that is not always rational is where many investors get into trouble. They approach investing as a "right vs wrong" exercise. Every trade or forecast is marked as right or wrong in hindsight. This is a frustrating exercise for many since nobody is able to invest in "hindsight"! Rather, an approach that focuses on "risk vs reward" focuses the investor on "today's reality" and provides a prudent approach based upon what we know today. And of course, by keeping in line with the changing risk/reward ratios over time we believe will ultimately lead to investment success!

It is not enough to simply be an investment advisor going forward, successful portfolios will require the services of Risk Managers ... those who understand how to analyze and implement risk strategies in their clients' portfolios beyond the traditional approaches to managing risk. In a world of increasing risks, the value of those investment advisors who are able to make the transition to Risk Managers will be in high demand!

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

Note: Our SIACharts subscribers can download the PDF version of this article within our Marketing > Materials tab.