The Long Term Trend

by Lance Roberts, STA Wealth Management

Yesterday, I posted an article discussing the lack of ability by investors to accurately predict the future. To wit:

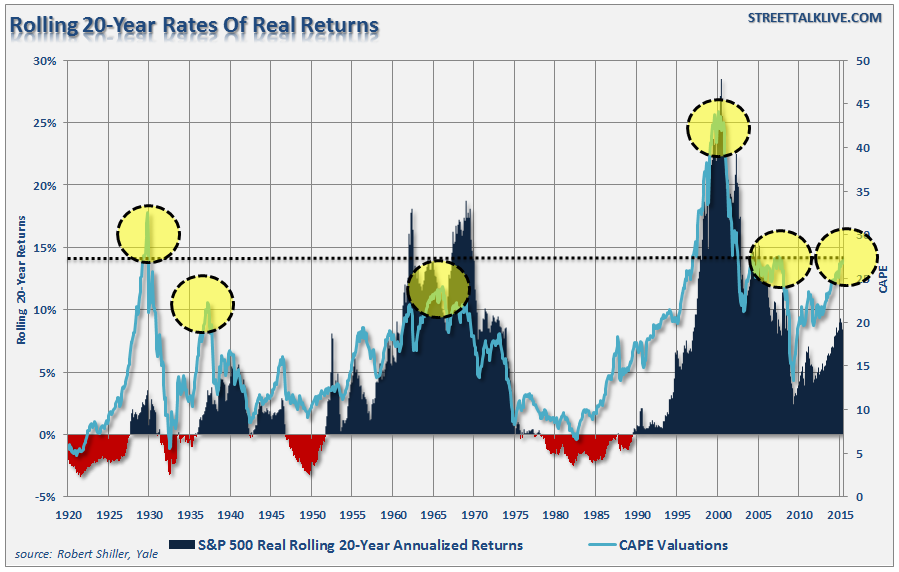

But it is precisely this conversation that leads to a litany of articles promoting "buy and hold" investing. While "buy and hold" investing will indeed work over extremely long periods, investor success is primarily a function time frames and valuation at the beginning of the period. Considering that most investors have about a 20-year time horizon until the reach retirement, the "when" becomes a critical component of future success."

Importantly, when valuations have been elevated, forward returns over the next 20-years have been rather disappointing.

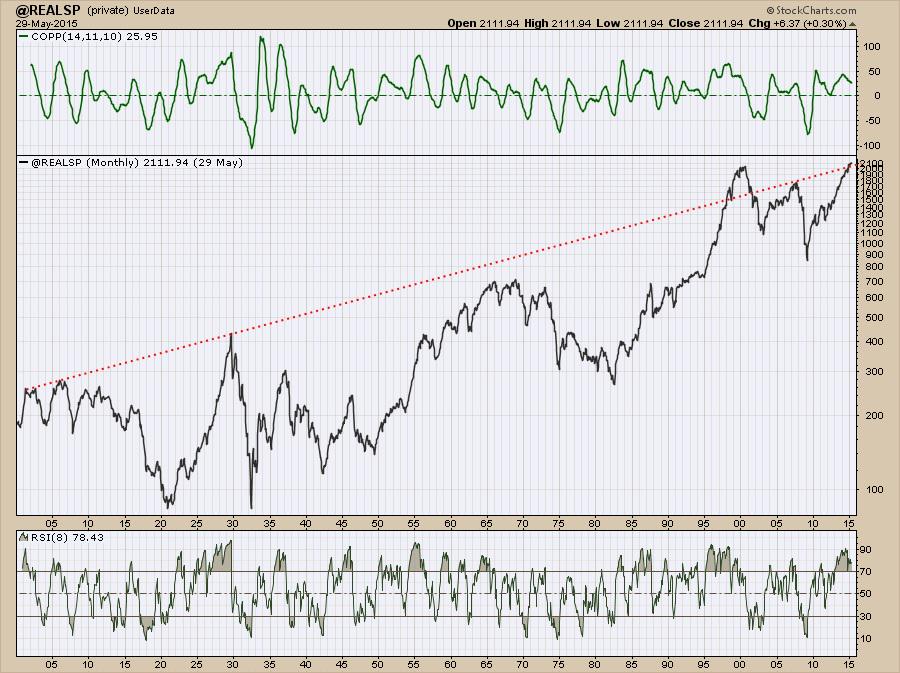

That discussion prompted my colleague and technician "extraordinaire," Walter Murphy, to send the following analysis of the long-term trend of the market.

There are a couple of interesting points to note about this chart. First, on an inflation-adjusted basis, the market is pushing a level of resistance that was only previously, and briefly, exceeded by the "dot.com" exuberance. Secondly, as shown in the RSI chart at the bottom, the market is currently at levels that have coincided with market peaks in the past.

Importantly, this is a monthly data chart that is very slow to develop. Therefore, this analysis does NOT suggest that a massive market correction is set to occur by the time you finish reading this article. It does suggest, however, that there is likely not a lot of relative reward currently remaining in the markets relative to the "risk" required to extract it.

Despite plenty of historical precedent and statistical evidence, the reality is the investors are consistently swept up by the short-term psychosis of "greed" and "fear" which obfuscate more logical decision-making processes. But that is the reality of market dynamics and why outcomes have never been "different this time."

Has The Market Finally Reached It's Ceiling?

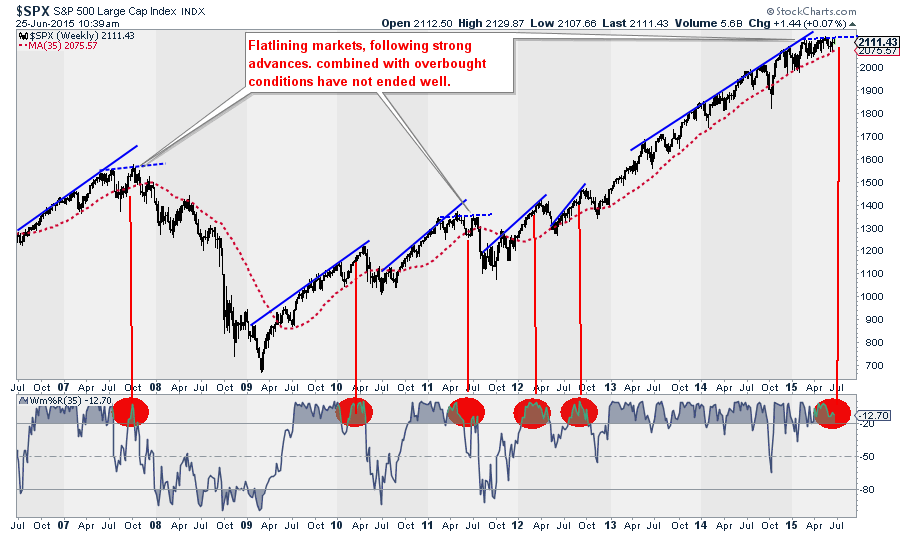

Despite the ongoing bullish parade of commentary that the markets could, and should, only go higher from current levels, it is worth noting that there has seemed to be a somewhat invisible barrier to the markets advance since the beginning of this year.

As shown in the chart below, the flatlining of the market's advance is something that hasn't been witnessed since Bernanke's launch of "QE 3" in December of 2012. However, these periods of increased volatility with little, or no, overall advance combined with very "overbought" conditions have historically been less "bullish" than most of the media suggests.

With levels of investors complacency at extremely high levels, it is a currently "fact" that little can go wrong. There is no recession in sight; the earnings decline was all primarily related to energy companies and most importantly, global Central Banks are continuing to support the financial markets.

Of course, maybe it is the last point that should be questioned. If the economy is doing so well, then why are Central Banks still needing to intervene to support the growth? This is equivalent of saying the "the patient is cured, as long as we don't take him off of life support."

Interest Rates Aren't Going Higher

Despite the recent uptick in interest rates as of late, which has been a short-covering bounce following the sharp decline at the beginning of this year, I remain bullish on bonds longer term. The reason is not because there is going to be a phenomenal return out of bonds in coming years as there is little gain left with rates currently at 2.4% on the 10-year Treasury. But rather because bonds will likely remain stuck at current levels for close to the next decade and will provide a buffer to weaker equity markets in the future.

This was a point I made recently in questioning the logic that "Interest Rates Have Nowhere To Go But Up?"

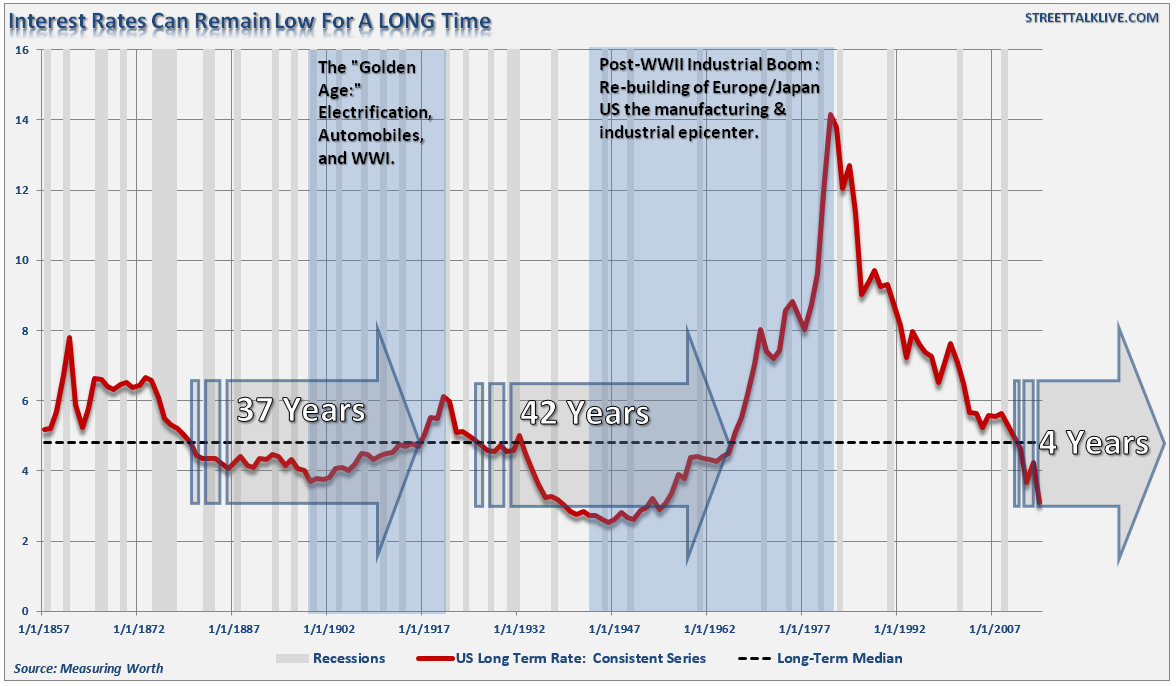

"The chart below is a history of long-term interest rates going back to 1857. The dashed black line is the median interest rate during the entire period."

"Interest rates are a function of strong, organic, economic growth that leads to a rising demand for capital over time. There have been two previous periods in history that have had the necessary ingredients to support rising interest rates. The first was during the turn of the previous century as the country became more accessible via railroads and automobiles, production ramped up for World War I and America began the shift from an agricultural to industrial economy.

The second period occurred post-World War II as America became the "last man standing" as France, England, Russia, Germany, Poland, Japan and others were left devastated. It was here that America found its strongest run of economic growth in it history as the "boys of war" returned home to start rebuilding the countries that they had just destroyed.

Currently, the U.S. is no longer the manufacturing powerhouse it once was and globalization has sent jobs to the cheapest sources of labor. Technological advances continue to reduce the need for human labor and suppress wages as productivity increases. Today, the number of workers between the ages of 16 and 54 is at the lowest level relative to that age group since 1976. As discussed recently, this is a structural problem that continues to drag on economic growth as nearly 1/4th of the American population is now dependent on some form of governmental assistance."

It is worth noting that we are currently only a little more than 4-years into the current low-level interest rate environment. Both previous periods in the U.S. have averaged 40-years.

As stated above, interest rates are a function of strong economic growth which continues to elude policy makers in Washington. Despite annual hopes of stronger economic growth, it has yet to materialize as consumers, which make up 2/3rds of that growth, remain hamstrung by somewhat stagnant wage growth consumed by spiraling healthcare costs.

This was a point made by Stephanie Pomboy in an article entitled "What To Expect In The Q2 GDP Number" by Elizabeth MacDonald.

"Spending on healthcare (insurance and services) has increased $232 billion over the last twelve months. That increase accounts for a big 'two-thirds' of the $353 billion in consumer spending and one-third of the $666 billion growth in total GDP over the stretch.

And wage gains are being wiped out by rising health costs. 'The increase in healthcare outlays over the last year is roughly equal to the $284 billion in wage gains for households during that time.'"

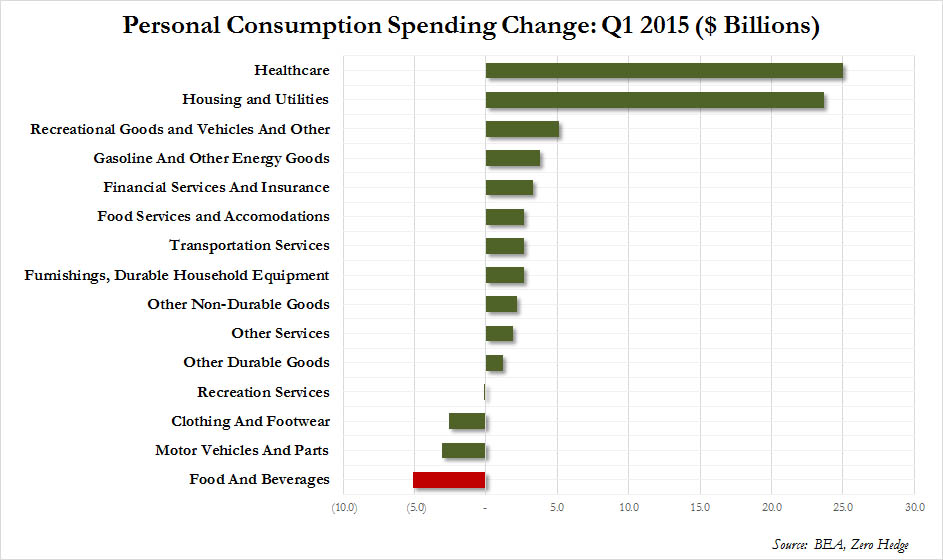

Spending on rising healthcare costs, primarily premiums, does not boost economic growth. In fact, it deters it as it saps spending from other areas that actually do contribute to overall growth. As shown in the chart from ZeroHedge, Q1 GDP growth was primarily supported by rising healthcare and utility costs.

Those expenditures to incite the type of economic growth needed to spur higher borrowing rates. Not now, and not likely any time in the foreseeable future.

So, yes, the "Great Bond Bull Market" is likely over. However, just take a look at Japan and you can start guessing about how long the "Great Bond Bear" will likely remain in hibernation.

Copyright © STA Wealth Management