KEY TAKEAWAYS

· We believe the solid Q1 2015 broad bond market performance is unlikely to be sustainable for the duration of the year.

· The development of a range-bound environment may slow returns in the coming months.

by Anthony Valeri, Investment Strategist, LPL Financial

Transitioning to a Range trade

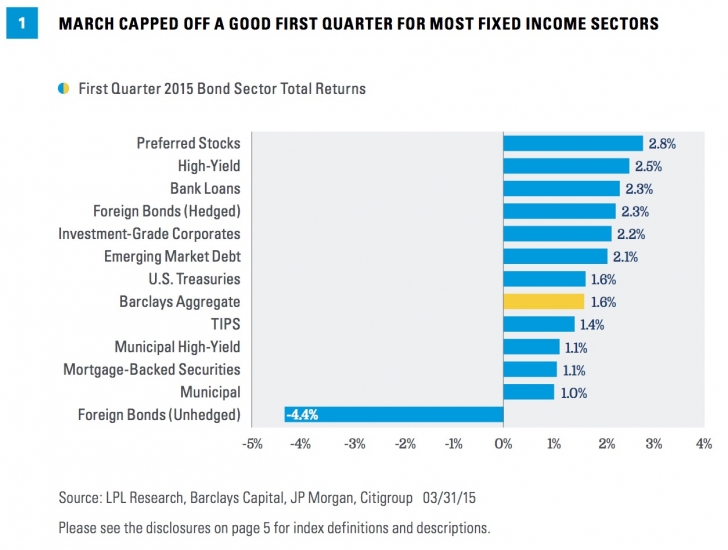

After an up-and-down start to 2015, bond markets firmed in March, providing a slight lift to a turbulent, but positive quarter overall [Figure 1]. With the exception of foreign bonds (unhedged for currency movements), bonds enjoyed good gains across the board. The yield on the benchmark 10-year Treasury witnessed large swings, falling as low as 1.65% early in the quarter but spiking as high as 2.25%. This relatively wide range reflects the push and pull on bond prices and yields over the quarter, with a slight push ultimately winning out. The upper and lower bounds may turn out to set up a range-bound environment until more clarity evolves around the timing and pace of Federal Reserve (Fed) interest rate hikes, the pace of domestic and foreign economic growth, and inflation.

DÉJÀ VU

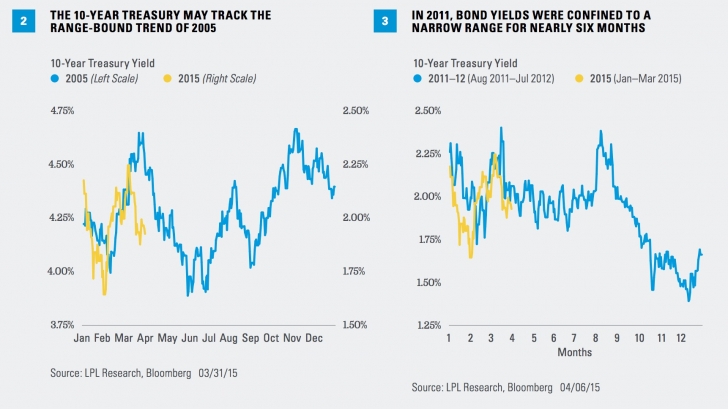

The bond market is no stranger to periods of range-bound activity, and two periods over the past 10 years offer some similarities—2005 and 2011–12. In 2005, ongoing Fed rate hikes left investors continually trying to assess the potential impact to the economy and corporate profits. In 2015, the degree to which a stronger dollar and lower energy prices may impact the economy and corporate profits are focal questions. The potential start of Fed rate hikes is complicating the interpretation, with an earlier start viewed negatively for the economy (and positively for longer-term bonds), and a later start and slower pace positively for the economy (and negatively for bonds). Like 2005, 2015 has also seen wide swings early in the year [Figure 2].

In 2005, yields ultimately closed the year higher, and prices lower, leaving bond returns relatively muted as interest income slightly offset price declines, a situation that may repeat in 2015. The broad Barclays Aggregate Bond Index posted a 2.4% total return for 2005 and there was limited variation among specific bond sectors.

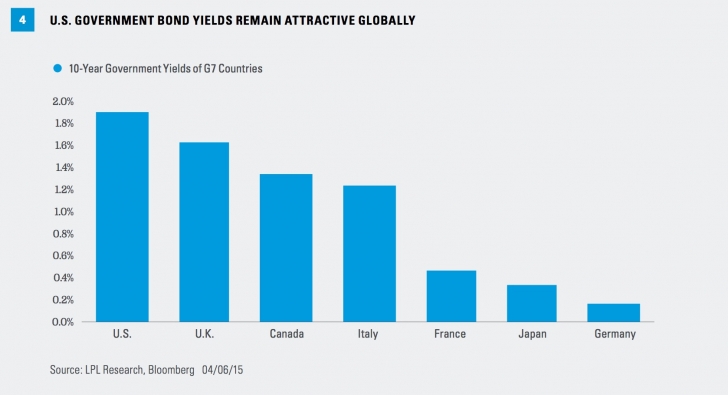

A narrow range-bound environment characterized the bond market for nearly six months from mid-2011 through early 2012. Fears over the extent of the European debt problem, offsetting stimulus from the Fed and European Central Bank (ECB), and concerns over a looming European recession were enough to send the bond market into a prolonged “wait and see” mode before Europe’s double-dip recession and weaker domestic inflation readings pushed bond yields lower into mid-2012 [Figure 3]. The experience of 2005 and 2011–12 shows that conflicting forces can leave bond prices and yields confined to a trading range for an extended period.

Global Context

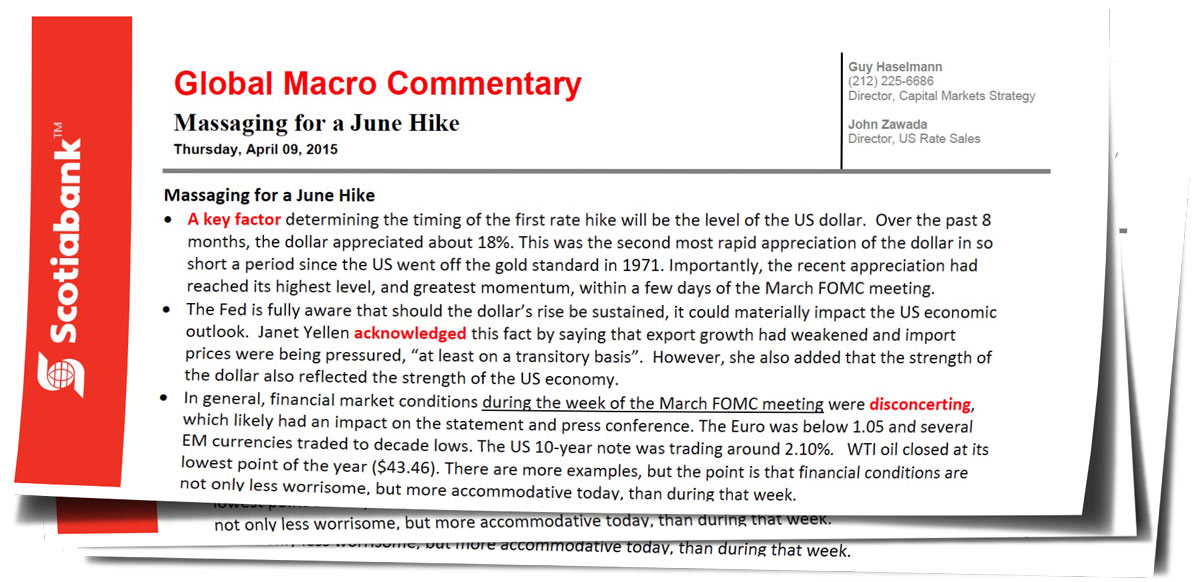

A twist unique to 2015 is the higher yield levels available in the U.S. compared with government bond yields among major industrialized nations [Figure 4]. Yield differentials between U.S. Treasuries and several of their European counterparts remain at near record wide levels. Additionally, austerity in Europe and an improving budget picture in the U.S. have led to a slower pace of issuance. Combined with large-scale bond purchases (known as quantitative easing or QE) occurring around the globe, a relative shortage of high-quality bond instruments is playing a role as well. These global factors are providing key support for high-quality bonds.

Transitory Influences

Transitory influences may support the fixed income market’s “wait and see” attitude. Annualized inflation, as measured by the Consumer Price Index (CPI), may remain negative overall through August or September 2015 if the recent stabilization in oil prices holds. Abnormally low inflation readings are expected to reverse, but uncertainty remains due to oil prices. Similarly, the weak economic growth pace during the first quarter of 2015 has been driven by a stronger U.S. dollar, West Coast port disruptions, and reduced investment by energy companies due to lower oil prices—all of which may prove temporary. On a related note, corporate earnings expectations have fallen sharply for the first part of 2015 but are expected to rebound in late 2015 (see the April 6, 2015, Weekly Market Commentary, “Earnings Recession?”).

Labor market data have been a bright spot relative to other recent economic data points, but March 2015’s disappointing jobs gains have raised questions as to the extent jobs weakness was partially weather related or something more sinister.

On balance, news and data flow have been modestly negative to start 2015, which helps explain the rise in bond prices and decline in yields over the first three months of this year. However, many of the negative factors may prove temporary and push bond prices lower and yields back up to the higher end of the year-to-date trading range. The Fed responded by reducing its fed funds rate forecast to reflect a much more gradual series of rate hikes; however, bond pricing had already factored in that outcome, and implied yields remain below those forecast by the Fed.

Unsustainable Start

Bonds have benefited from this uncertainty during the first quarter of 2015, but the transitory nature of some forces driving bond prices may leave bonds in a trading range. In our view the current pace of high-quality bond performance, which projects out to the mid-single-digit range for the full year, is likely unsustainable absent a further catalyst. This catalyst could result from still weaker domestic data or a renewed decline in oil prices, which may weaken inflation expectations and push back the timing of Fed rate hikes even further. Given that much of this is already priced into current bond prices and yields, we believe this level of performance is unlikely to be sustainable for the duration of the year. Bond performance may not necessarily reverse but the development of a range-bound environment may slow returns.

Read/Download the complete report below, or here:

BondMarketPerspectives_040715(1)

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Because of their narrow focus, specialty sector investing, such as treasuries, municipals, or high-yield, will be subject to greater volatility than investing more broadly across many sectors.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

Barclays U.S. High-Yield Loan Index tracks the market for dollar-denominated floating-rate leveraged loans. Instead of individual securities, the U.S. High-Yield Loan Index is composed of loan tranches that may contain multiple contracts at the borrower level.

The Barclays U.S. Corporate High-Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging market debt.

The Barclays U.S. Corporate Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable corporate bond market.

The Barclays U.S. Mortgage Backed Securities (MBS) Index tracks agency mortgage backed pass-through securities (both fixed rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC)

The Barclays U.S. Municipal Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

The Barclays Municipal High Yield Bond Index is comprised of bonds with maturities greater than one-year, having a par value of at least $3 million issued as part of a transaction size greater than $20 million, and rated no higher than ‘BB+’ or equivalent by any of the three principal rating agencies.

The Barclays U.S. Treasury TIPS Index is a rules-based, market value-weighted index that tracks inflation-protected securities issued by the U.S. Treasury.

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The BofA Merrill Lynch Preferred Stock Hybrid Securities Index is an unmanaged index consisting of a set of investment-grade, exchange-traded preferred stocks with outstanding market values of at least $50 million that are covered by Merrill Lynch Fixed Income Research.

The Citi World Government Bond Index (WGBI) measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGBI is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGBI provides a broad benchmark for the global sovereign fixed income market. Sub-indexes are available in any combination of currency, maturity, or rating.

The JP Morgan Emerging Markets Bond Index is a benchmark index for measuring the total return performance of international government bonds issued by emerging markets countries that are considered sovereign (issued in something other than local currency) and that meet specific liquidity and structural requirements.

DEFINITIONS

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Copyright © LPL Financial