by Ben Carlson, A Wealth of Common Sense

There’s a well-known story about how Daniel Kahneman got his start in the study of behavioral psychology a number of decades ago. The story goes like this: Kahneman was asked to help study the performance of pilots in the Israeli air force. The flight instructors were trying to figure out what to do about their incentive and motivation system for the pilots.

They found that after a pilot had a great flight and they paid them a compliment, the next flight wasn’t quite as great and ended up being much closer to average. And the pilots that had a terrible flight were reprimanded and showed improvement in their next flight. The conclusion was that praise for the pilots was a bad thing while punishment improved results. Kahneman looked at the problem from another angle and determined that the reason for the drop-off or increase in performance had nothing to do with the instructor feedback and everything to do with simple reversion to the mean.

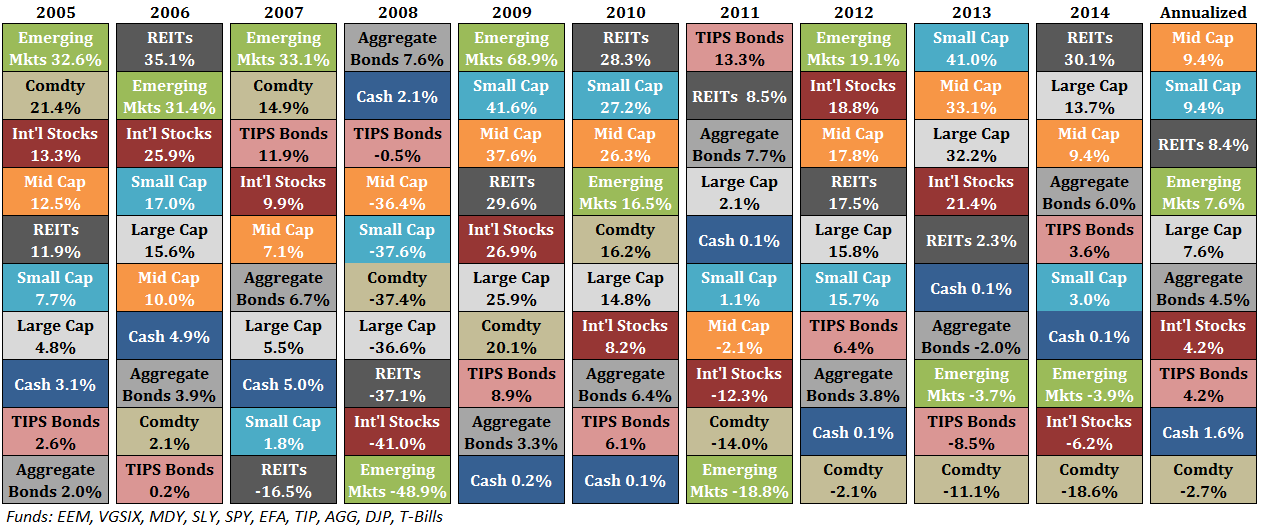

Above average performance can’t last forever so eventually it will be followed by performance that’s closer to the long-term average. And below average performance also tends to improve eventually. And so it goes in the financial markets. Here’s an update of my favorite annual chart on the financial markets, the asset allocation quilt (click to enlarge):

The reason this is my favorite performance chart is because it shows how humbling the investment business can be. There’s little consistency from year-to-year as each asset class takes its turn in the different slots.

A few observations on the past 10 years of data:

- After a bull market in the early-to-mid 2000s, commodities have been a nightmare for investors. Over the past 10 years commodities are down by 25% while they’re down 40% since 2011 alone. The fact that the safest short-term asset on earth – cash – has outperformed commodities by over 4% a year doesn’t help either.

- Foreign developed markets (Int’l Stocks) have acted as a weight around the neck of globally diversified investor these past 10 years. It’s always going to be something.

- The size premium has been out in full force as small and mid cap stocks have outpaced their larger counterparts in the U.S. stock market over the past decade. This relationship didn’t hold in 2014, so we’ll see if it’s a trend that is finally going to reverse after smaller stocks have outperformed handily since 2000.

- A diversified real estate portfolio (REITs) has performed admirably considering we went through one of the worst real estate crashes of all-time in the last decade. This probably says more about the interest rate environment than anything else.

- Bond volatility will increase at some point if we ever get that rising rate environment everyone has been predicting. But over the past 10 years the AGG has a standard deviation of less than 3% — basically no variation in performance from year to year. It’s been an impressive run for high quality bonds.

- On the opposite end of the spectrum, emerging markets have by far the highest volatility, which is apparent from the fact that it’s been the top performer 4 times and the worst twice.

While the mean reversion that Kahneman describes with the Israeli pilots does exist in the financial markets, the timing is always tricky. It’s very difficult to know when those below or above average flights are going to take place. Sometimes trends reverse from one year to the next while other times there are long periods of over- or under-performance in certain segments of the market.

The most important takeaway I get from looking at this asset allocation quilt every year is that it’s basically impossible to predict the winner in any given year and I’ve yet to find an investor that’s able to do so.

Peter Bernstein summed up the conclusion for this table better than I could when he said, “The riskiest moment is when you’re right. That’s when you’re in the most trouble, because you tend to overstay the good decisions. So, in many ways, it’s better not to be so right. That’s what diversification is for. It’s an explicit recognition of ignorance. And I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place.”

Further Reading:

Lessons from Thinking, Fast and Slow

Unlearning From Peter Bernstein

Copyright © Ben Carlson, A Wealth of Common Sense