Fronkensteen Re-visited

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

· The brilliant Mel Brooks 1974 parody Young Frankenstein ranks No. 28 on Total Film magazine’s list of all-time funniest movies. When QE-infinity was first announced, I drew analogous similarities between the monstrous experiments of Dr. Frankenstein (Dr. F) and the Fed (See note: Sep 23 2013).

· In the movie, it was only after the monster went berserk that Dr. F (Gene Wilder) learned that Igor had snatched the “Abby Normal” brain. Clearly, even the most well-intentioned experiments can have unintended consequences. In this vein, the Fed created a financial market monster via six years of ‘pedal to the metal’ Fed stimulus designed to encourage risk-taking and speculation, and like Dr. F, the Fed was confident it had the tools to control it. Unfortunately, history will likely view QE- infinity as the “Abby-Normal” brain that sent its grand experiment awry. The full argument follows.

· There are two important and distinct reasons why QE-infinity was materially different and more hazardous to financial markets than QE1 and QE2: 1) it originated subsequent to earlier action that had already changed investor behavior; and 2) its open-ended time frame hijacked the market’s typical price discovery mechanisms.

· At first, misallocation of resources resulted when money became (basically) free after the Fed lowered its interest rate to zero. Next, the market’s normal functioning was altered, and price discovery distorted, when the Fed decided to embark on QE1 and QE2. Finally, when QE-infinity was introduced, price discovery was completely demolished. It even triggered talk of an equity market ‘melt-up’.

· QE1 and QE2 changed investor behavior because the Fed was implicitly providing a market “put” by suggesting that any dissatisfaction with the pace of the recovery would always be met with more action. In general, investor behavior moved away from determining whether adequate compensation was being received for risks, and towards fear of missing out on the upside of easy Fed-driven market profits. This was particularly true for asset managers who were now even more incentivized to seek out-sized risks to ensure they beat peers and benchmarks. They were convinced because the Fed appeared resolute in its determination, and investors had been overwhelmingly programmed over the years not to ‘fight the Fed’.

· QE-infinity turbo-charged the equity markets myopic focus on its upside potential. Basic finance teaches that asset valuation entails discounting all future cash flows to today’s present value. Yet, when the last QE program was (initially) not given an end date, the market had to accept zero rates (ZIRP) as extending infinitely into the future. In other words, the discounted rate used to value those cash flows was assumed to be zero in perpetuity. Dividing a number by zero equals the empty-set; thus, triggering talk of an equity market “melt-up”.

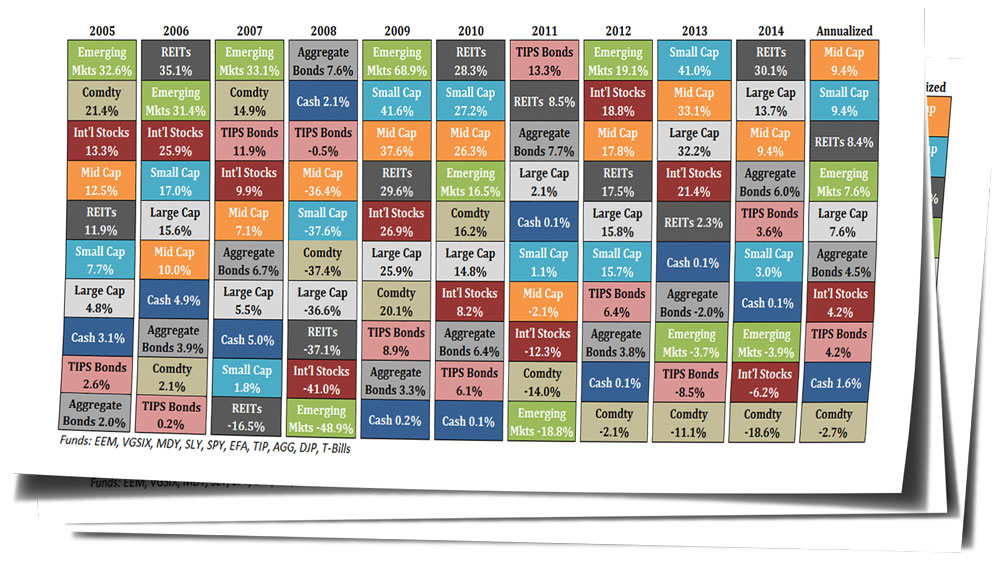

· Furthermore, by forcing interest rates to such artificially low levels, the Fed flipped the foundations of the Capital Asset Pricing Model upside-down. Equities became the preferred asset class simply because they provided uncapped upside, while bonds technically were capped at par. Asset managers even moved into dividend paying stocks as a substituted for their fixed income exposures. This shift in perception had a material impact on asset allocation models and increased systemic risk.

· With QE terminated and expectations of a near-term rate hike looming, the Fed “put” is now much further out-of-the-money. More importantly, the discounting function for future cash flows is moving away from zero. In addition, as the Fed’s policy pivot is tightening the spigot of easy money, share buyback programs that have enhanced the illusion of the power of the equity market will wane.

· Going forward, prices will have to be supported by fundamental values rather than easy money and speculation. The upside vs. downside distribution now looks skewed to the ‘left-tail’. The Junk bond market started declining last June. A move that was not solely due to the decline in oil, since WTI did not fall below $90 until October. The divergence with the equity market is large and worrisome.

· The bottom line is that I expect a large equity price adjustment (down) to occur imminently. Portfolios need to adjust from blindly accepting the Fed’s ‘sugar high’ toward realistically assessing valuations based on fundamentals. After six years of fuel, there is quite a bit of speculation to work off. Risk-assets will not like a hike in rates, while a pause would probably be attributable to bad news that is not good for risk assets.

· During the (volatile) adjustment process, the Fed will likely vacillate between over-confidence and fear. Investors should not be fooled, but rather, should stay focused solely on re-calibrating exposures based on the new market risk vs. reward distribution under a paradigm of declining accommodation. With compromised market liquidity, first movers will have the advantage, especially since market liquidity is dreadful. Risk paring is currently unfolding. Capital will flow to Treasuries. I remain a bond bull.

· “Maybe you had too much too fast, or just over played your part. Nothin’ shakin’ on shakedown street”. – Grateful Dead

Regards,

Guy

Guy Haselmann | Director, Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann@scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia

Read/Download Guy Haselmann's complete report below:

Copyright © Scotiabank GBM