by Urban Carmel, The Fat Pitch

Separating Facts From Popular (But False) Narratives

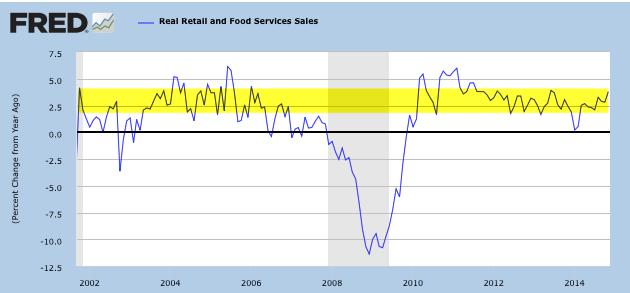

The economy is expanding at a slow but fairly steady rate. Demand is growing and so is employment. The biggest weakness lies in price: inflation has been falling. More here.

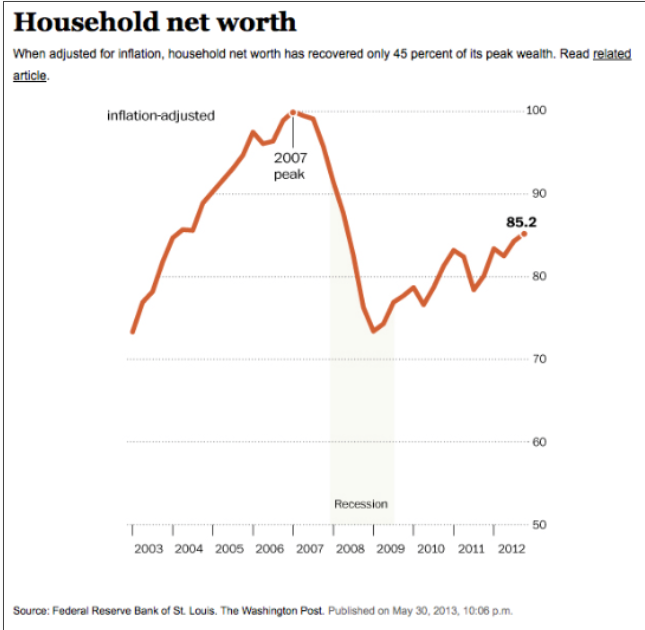

It's true that the recovery has been soft relative to recent history. But the underlying causes of the 2008-09 recession were far different than in prior recessions. A slower recovery was therefore expected. More here.

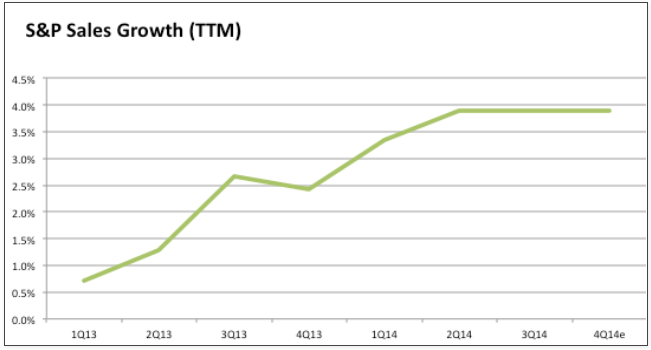

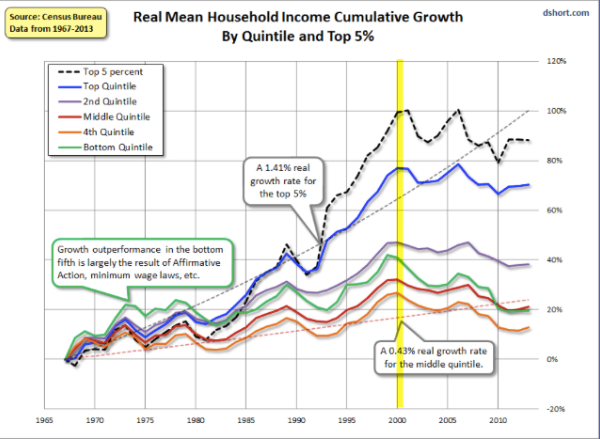

The improving economy is feeding into corporate performance. Among S&P companies, revenue growth is accelerating and profit growth is strong. More here.

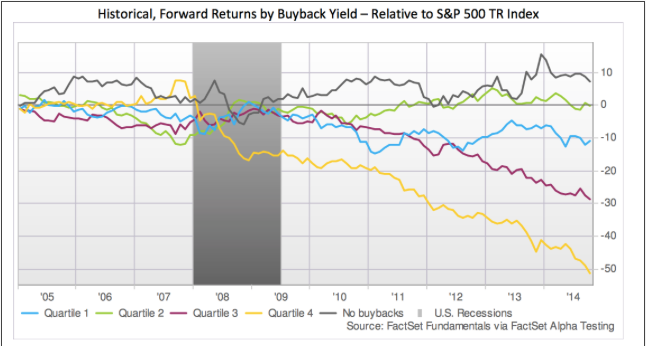

The improvement in corporate profits is not the result of financial engineering. That has been a relatively minor contributor. More here.

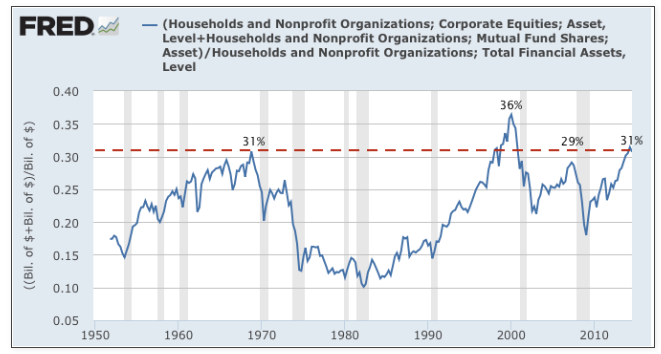

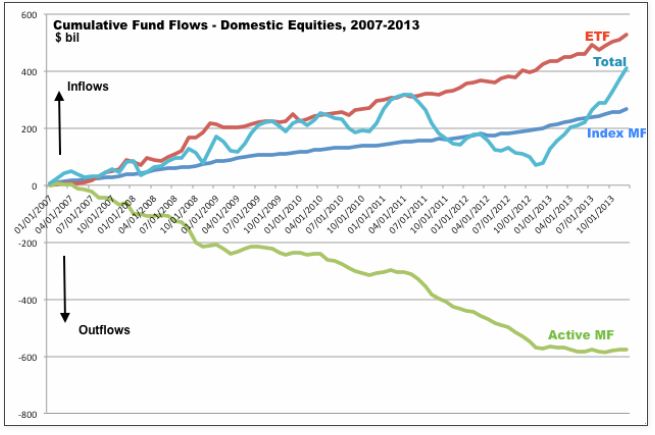

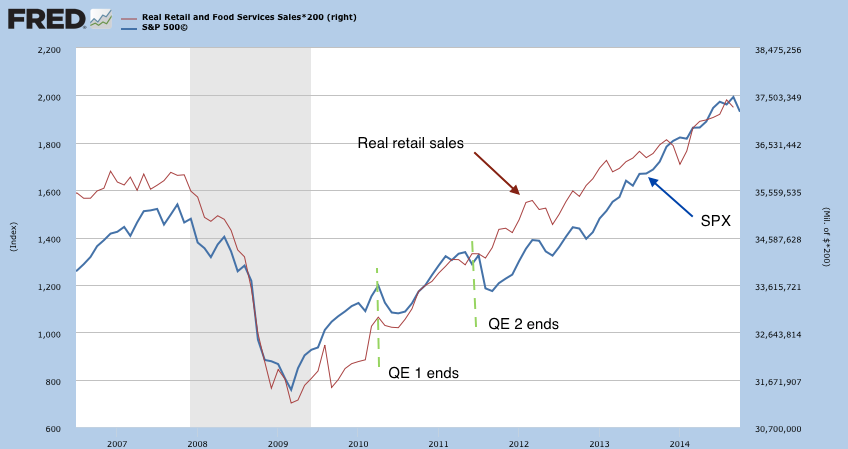

The rise in stock indices is not primarily the result of buying by the Federal Reserve and other central banks. Investors are buying equities. In fact, they have a high proportion of their assets in stocks, and this is a potential concern. More here and here.

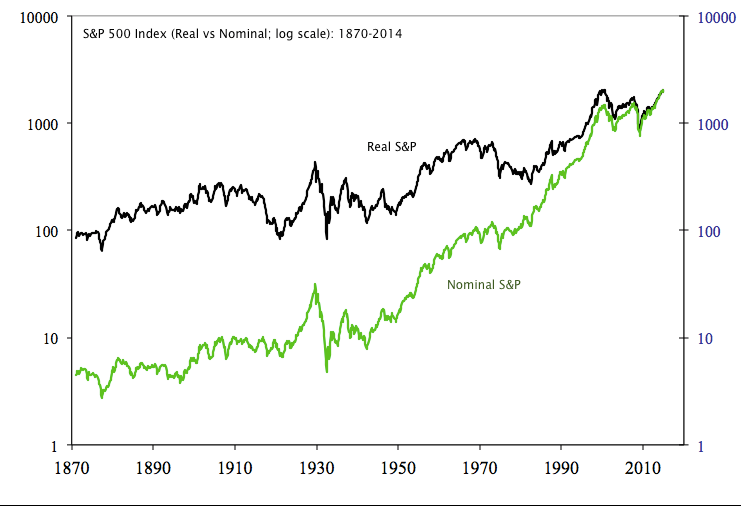

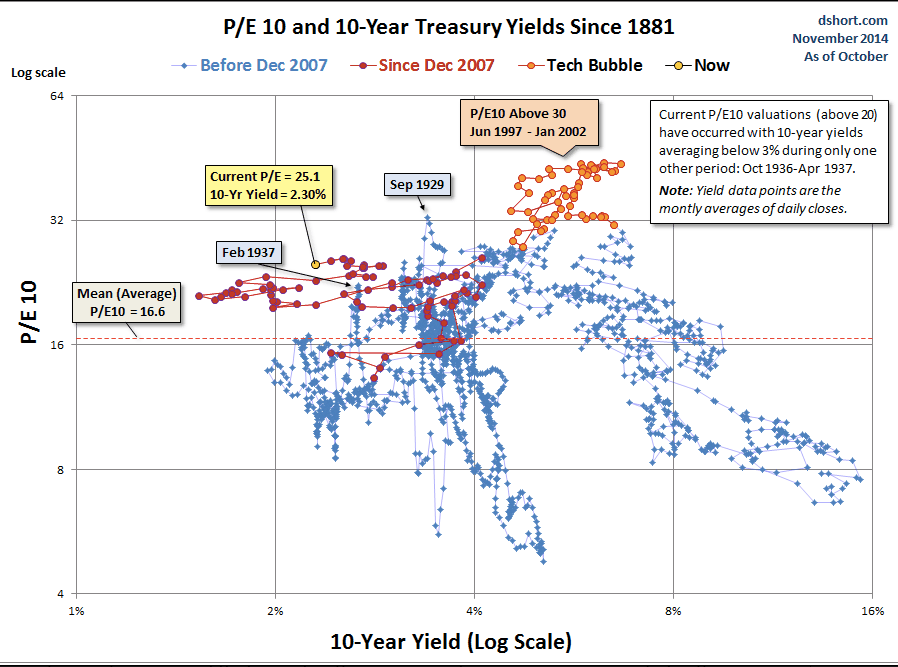

The rise in stock indices has made valuations rich by historical standards. Under these circumstances, 'buy and hold' investing has led to below average returns going forward. More here.

It's true that investors are not as euphoric as they became in the 1990s. But that era was the product of a unique combination of political, economic and demographic factors that are unlikely to combine again in most investors' lifetimes. More here.

Higher equity valuations are not the result of, or justified by, low interest rates. More here.

The Fed has officially ended its Quantitative Easing (QE) program. But the end of QE on its own is not a threat to the equity market. More here.

It's inconvenient that not all aspects of the current investment environment are perfect. They never are. The fundamentals have been improving. This might be as good as it gets, but there is, on balance, little to suggest that the tide is starting to run out. The biggest economic threats are outside of the US and with investor sentiment that is becoming too complacent. Be on guard for the true risks and not those presented by popular but misleading narratives.

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.

Copyright © The Fat Pitch