If you’re worried about the recent spike in bond market volatility, we’ve got a bit of advice: Don’t be. There are plenty of other risks—chiefly credit quality and flatter yield curves—that are causing shakeups in some corners of the fixed-income world. Happily, there are things you can do about them.

There’s no denying the last few weeks have been volatile ones. But the recent price swings, amplified mainly by signs of weakening global growth, did not cause the two biggest dislocations in today’s bond market: sell-offs in the lowest-rated high-yield bonds and in short-maturity bonds in general.

Selling pressure in these areas has been building for months. As a result, many of these securities have underperformed higher-rated and longer-dated bonds. We think a closer look at the dynamics behind the selling can shed light on opportunities they have created and pitfalls investors should avoid.

Let’s start with the sell-off in short-maturity bonds. These securities are heavily exposed to the risk of rising interest rates, and as the third quarter wound down, it was beginning to look as if the US Federal Reserve could start hiking rates sooner than the market was anticipating. Investors tried to shield themselves by selling short-maturity bonds—investment-grade and high-yield corporates as well as US Treasuries.

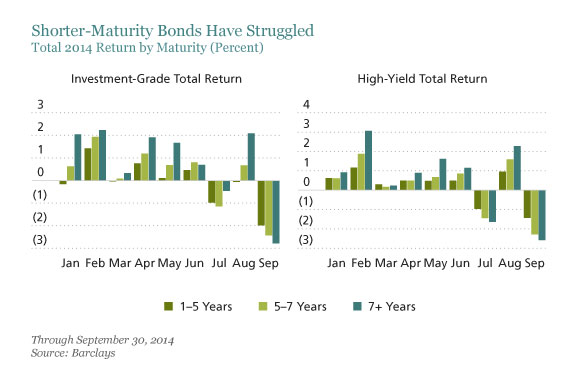

This selling spree pushed up yields at the front end of most curves and shorter-dated bonds widely underperformed. The following Display shows total return for global investment-grade corporates and US high-yield bonds.

We think the sellers may have jumped the gun. While the US economy has gained momentum, recent data from the euro area, China and elsewhere suggests the global economy may be slowing down. Consequently, the market is starting to think the Fed may play it safe and keep rates low for longer.

We think the sellers may have jumped the gun. While the US economy has gained momentum, recent data from the euro area, China and elsewhere suggests the global economy may be slowing down. Consequently, the market is starting to think the Fed may play it safe and keep rates low for longer.

If so, this may prove a good opportunity to buy shorter-dated bonds at reduced prices. Through September, spreads on US high-yield bonds with maturities of one to five years have widened almost twice as much as those on bonds in the five-to-seven-year range. That could mean more potential upside for the short-maturity securities if interest rates don’t rise quickly

By the way, shorter-maturity paper tends to hold up better over a longer time period. Fund managers often refer to it as “cushion paper.” This is why we think the recent sell-off creates some nice buying opportunities for investors looking for short-duration securities with attractive yields.

The other notable disturbance in fixed income has been concentrated in the lowest-rated high-yield bonds. In this case, we view the sell-off as more warning siren than opportunity. Remember, CCC-rated bonds are issued by fragile companies with high leverage and weak balance sheets. It doesn’t take much for such companies to fail, and they often do so before the broader high-yield market starts to see rising default rates.

For most of the past year, investors have overlooked these risks and focused on the higher yields CCC-rated bonds offer. As a result, high demand has pushed yields down to the point where investors, in our view, are no longer being compensated for the risk they’re taking.

But the tide may be turning, with credit hedge funds leading the selling. The resulting rise in yields may tempt some investors to wade back in. But we think stretching for yield at this point in the cycle is risky. Doing so requires extensive credit research, and in most cases, we doubt the returns over the next 12 months will justify the risk.

To sum things up: We don’t think bond investors should fret about overall market volatility. But we do think they should pay attention to the bonds getting beat up the most. Understanding the cause of the selling can make it easier to view the bond market’s opportunities and dangers clearly.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Ashish Shah is Director of Global Credit at AllianceBernstein (NYSE:AB).