by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday November 19th

U.S. equity index futures were slightly lower this morning. S&P 500 futures were down 3 points in pre-opening trade.

Index futures moved lower following release of October Housing Starts. Consensus was 1,025,000 units versus an upwardly revised 1,038,000 units in September. Actual was 1,009,000.

Tesla fell $7.03 to $250.67 after Morgan Stanley lowered its 2015 earnings estimate to $2.45 from $4.39 per share.

Blackberry dropped $0.61 to $10.15 after Morgan Stanley downgraded the stock from Equal Weight to Under Weight. Target is $7.00.

More upgrades for agriculture stocks! CF Industries (CF $269.69) is expected to open higher after Credit Suisse upgraded the stock from Neutral to Outperform. Target is $315. Mosaic gained $0.67 to $47.44 after Susquehanna upgraded the stock from Neutral to Positive. Target is $58.

PetSmart added $3.08 to $76.70 after Bank of America/Merrill upgraded the stock from Underperform to Neutral. Target is $80.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2014/11/18/stock-market-outlook-for-november-19-2014/

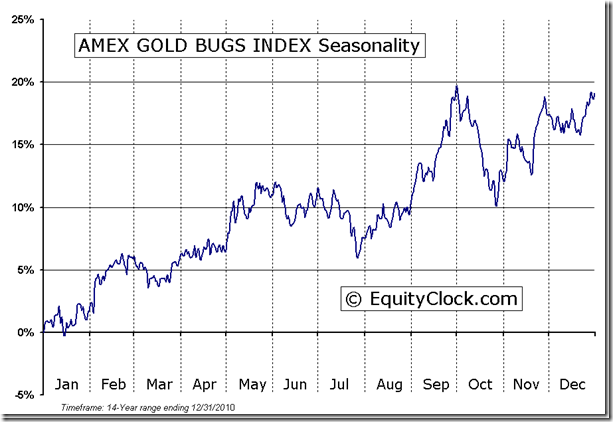

Note comments on the Mines & Metals sector (Favourable seasonal influence start today) and the TSX Composite (Favourable seasonal influences relative to the S&P 500 Index starts at the beginning of December)

Interesting Charts

Technicals for precious metal stocks continue to improve.

· Moved above its 20 day moving average

· Short term momentum indicators are trending up

· Strength relative to the S&P 500 Index has turned positive

Selected Canadian precious metal stocks are breaking above resistance.

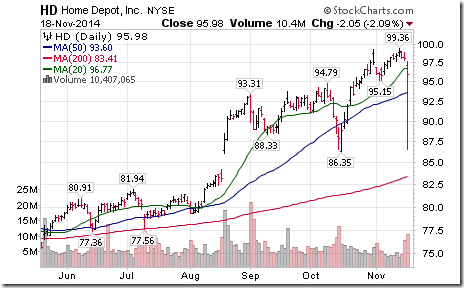

Strange story! The Dow Jones Industrial Average dropped suddenly near the close yesterday due to a sudden drop in Home Depot.

After the close, the New York stock exchange released the following comment:

WASHINGTON (MarketWatch) — The New York Stock Exchange is cancelling all Home Depot HD, +0.31% trades executed at or below $93.33 between 3:55 p.m. and 3:56 p.m. Eastern. The component of the Dow Jones Industrial Average dropped as low as $86.52 before bouncing back, closing at $95.98. The NYSE didn’t explain the sudden drop. The ruling only impacts trades made on the NYSE, though it doesn’t appear any other exchange saw the same movement in Home Depot.

StockTwits Released Yesterday

Technical action by S&P 500 stocks to 10:45 AM: Bullish. Intermediate breakout: $COV, $CTAS, $XYL, $INTC, $STX, $APD, $VMC, $ETR. Breakdown: $URBN

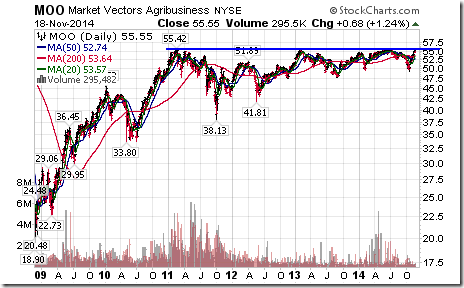

Nice breakout by $M00 to a six year high. ‘Tis the season for strength in the agriculture sector!

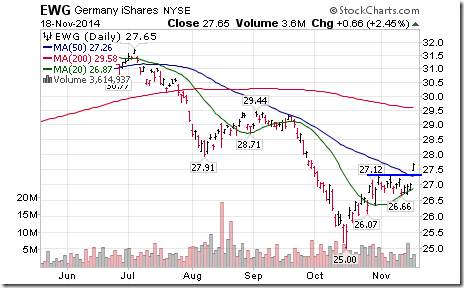

$IEV, big cap European equities ETF completed a base building pattern this morning.

Strength in Europe was led by a breakout by $EWG.

‘Tis the season for strength in the DAX Index!

Editor’s Note: United Kingdom iShares and France iShares recorded similar breakouts yesterday and have similar seasonal influences

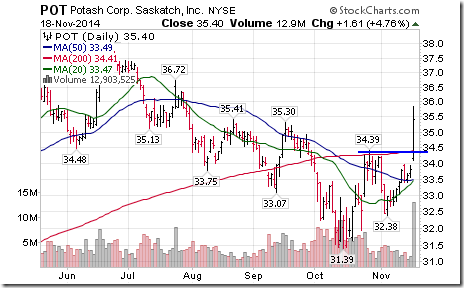

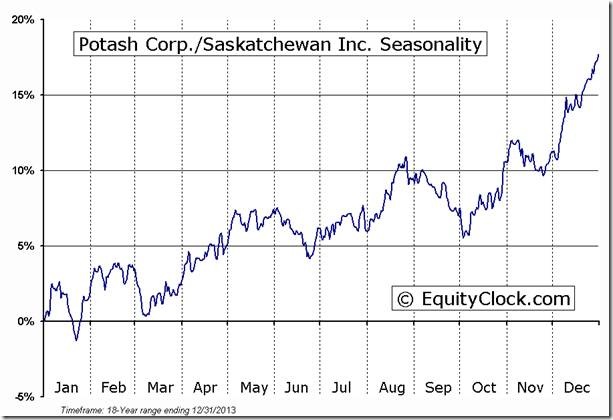

A major reason for the breakout by $MOO is the breakout by $POT. Takeover rumors? ‘Tis the season for strength by $POT.CA

Editor’s Note: Another reason for strength in Potash Corp and other fertilizer stocks yesterday was news that one of Uralkali’s potash mines was evacuated due to possible flooding.

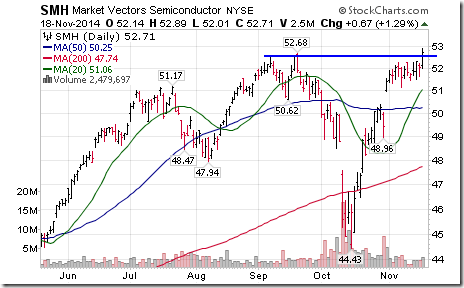

Strength in $XLK has been helped by a breakout by $SMH to a 13 year high.

Technical Action by Individual Equities

After 10:45 AM, another four S&P 500 stocks broke resistance: Regeneron, Eastman Chemical, Carnival and McKesson. None broke support

No TSX 60 stocks other than Potash Corp. broke support or resistance.

Adrienne Toghraie’s “Trader’s Coach Column

|

Recharging for Traders

By Adrienne Toghraie, Trader’s Success Coach

When you plan your vacation do you think in terms of how much it will recharge you? Most people do not, but traders must. Trading is a profession that requires vigilant focus and is a constant trip of discovery about life’s issues. Therefore, it is a profession where traders build up stress. Before you plan your trip, I want you to think about it in terms of how it will translate to profits when you return.

Plan a vacation so that you will not need a vacation from your vacation.

Plan a vacation so that you know ahead of time that your choices will recharge you.

· Make sure that what you need and want is built into the plan

Do not leave it up to others to decide without your input, or you might find yourself doing things that deplete instead of recharge you.

· Make sure that everyone traveling has his or her own activities

Togetherness on activities is great up to a point. Make sure you know what is expected of you and that others have planned out their time without needing you to be involved in every activity.

· Agree ahead of time what are acceptable and not acceptable rules for yourself and others

You want your conflicts to be before the trip, so they will not stress you out on the trip.

· Get in shape before you go for activities that are beyond your scope of agility

If the trip involves exercise or other activities that you are not used to, take time before the trip to make yourself ready for those activities.

Here are some of the vacation mistakes that traders make:

· Too much travel time in aircraft and other vehicles

You will not be refreshed if most of your vacation time is traveling.

· Going to a place that has too much noise

Noise creates stress. Consider if going to big cities, noisy hotels and gambling casinos will recharge you?

· Traveling with people that do not have their own activities

Needy people will empty your energy tank

· Visiting or traveling with toxic or demanding people

Toxic people will add to your stress.

· Over indulgence

Over eating, drinking, and too much exercise are not good for building energy.

· Too little sleep

If anything, you should sleep more.

· Being a slave to electronic devices

Ask yourself, what would you miss without these devices? If you are constantly checking your blackberry and laptop, are you really on vacation?

· Keeping up with the markets

Have someone else monitor your trades, or better yet get out of the markets altogether. There will always be opportunities when you get back.

· Packing too many activities into too little time

Rate the activities that you have planned and only do the most appealing – keeping energy building in mind.

Recommended vacations:

· Nurturing and invigorating environments

A green and blue environment where the weather is cooperative is one of your best recharge choices.

· Traveling and visiting with people who lift you up and give you your own space

Ask your fellow travelers for help in reminding you that you need a stress free environment and maybe they will take the hint.

· Activities that are relaxing and enjoyable to you

Plan these activities and they are more likely to happen.

· If there is travel time involved, make sure that there is also enough recovery time

Vacation at home

If you cannot go away on vacation, then plan a vacation like a tourist in your area. This is not the time for all those projects around the house, unless those projects are relaxing.

Conclusion

If you want to give yourself the best opportunity to earn higher profits, make sure that your vacations are rejuvenating.

Adrienne’s Free Webinars

Join Adrienne on Tuesday, November 25th at 4:30 pm ET

Evening with Adrienne – an opportunity to ask questions on the discipline of trading

Email Adrienne@TradingOnTarget.com

Visit www.TradingOnTarget.com

An Opportunity to “Pay it forward”

Tech Talk’s favourite charity is Wellspring, a charity that offers free support services for people with cancer. Wellspring is a network of community-based centers that offer programs providing support, coping skills, and education to cancer patients and their families.The center here in Oakville serves over 4,000 people resident mainly in Mississauga, Oakville and Burlington. Services offered at the Oakville center includes group support, financial planning, programs focusing on nutrition, relaxation and exercise as well as updated education by medical experts. Jan and Don Vialoux offer their time, talent and treasure to the center. Don Vialoux is a prostate cancer survivor. Wellspring is entirely support by individual and corporate donations and does not receive funding from the United Way or federal/provincial governments. All donations are tax deductible. More information on Wellspring and its services is available at http://www.wellspring.ca/

Now is the time to “Pay it forward” for the free services offered by this blog! Wellspring is holding its annual holiday “Light Up Wellspring” fund raising program. Contributors can help to “Light Up” the Oakville center by donating:

$5 for a bulb

$25 for a strand of bulbs

$250 for a wreath of bulbs

All proceeds go toward providing cancer patients and their loved ones with much needed support programs at Wellspring.

Please join us at 6:30 PM EST on November 27th at Wellspring’s Holiday Open House when the lights will be switched on. The event will include festive refreshments, a bake sale, bazaar and silent auction.

If unable to attend, charitable donations can be made through http://www.wellspring.ca/

FP Trading Desk Headline

FP Trading Desk headline reads ”Shareholder activists keying in on energy sector”. Following is a link:

http://business.financialpost.com/2014/11/18/494410/?__lsa=ad30-1eca

Wednesday, November 19, 2014

If you like to receive our bi-monthly newsletter or know more about our model portfolios and investment philosophy and what areas we are invested in now for clients please complete the form at http://www.castlemoore.com/investorcentre/signup.php.

TOP ASSET 5 CLASSES, SECTORS AND COUNTRY HEAT MAPPING

Comments

In the asset class rankings of note is the persistence of the US long bonds in the top. (We only show the upper 25-30% of each grouping) Also noteworthy is in the strength in the US dollar. While the long term downtrend in bonds is clear, the US dollar’s parabolic move since late July/early October is not so easy to handicap (more on USD below). In the TSX and S&P despite their seasonally strong windows having already “closed” persistence is also seen in consumer staples, healthcare and biotech, utilities and transports. On the country level Turkey and South Africa have popped up on the weeklies, thereby helping to confirm their strength on the monthlies.

CHARTS of the WEEK

Interest Rates

This long term look at the US 10 year bond yield shows a continuing downtrend. For investors with a moderate risk assumption bonds should be a component of a portfolio. If rates rise above the downtrend line bonds can be sold and the capital re-allocated.

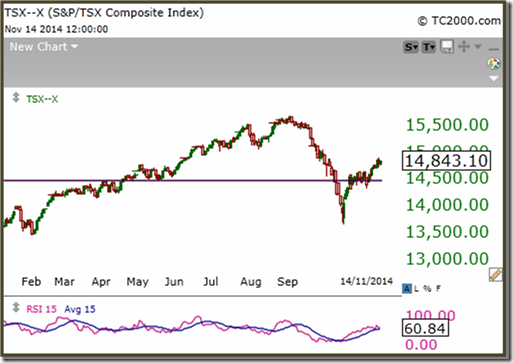

TSX Composite Index

The TSX has bounced nicely since the lows in October. Its greater weighting on energy and metals and mining has held the index back when compared to the S&P. At present, pro-cyclical names do not dominate the rankings as their strong season period begins.

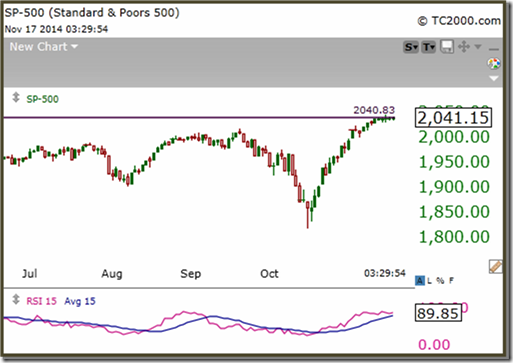

S&P 500 Index

The S&P has surpassed its previous highs after its October plunge. The index has been so successful it has quickly become overbought and as much as it was in September. Expectations are for a slight correction into 1900-2000.

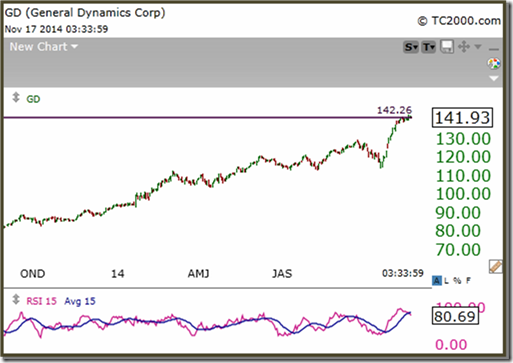

General Dynamics Corp.

General Dynamic is a holding in our pure US equity portfolio, the US 10. We recently sold ½ the position at $142.39 to protect profits and reallocate funds. Selling on our terms is always a preferred strategy and goal.

Intact Financial Corp.

Intact Financial a holding in our pure Canadian equity portfolio, the Toronto 10, is also under the same consideration. Notice the gap in recent trading. Volatility stops have been moved up to just under $80.

US Dollar Index

The US dollar has been the talk of the town, effecting everything from commodity prices to perception of US markets as the place to be for 2015 an on. At the moment the dollar has completed a parabolic move for currencies anyway rising almost 13% since August.

If you like to receive bi-monthly newsletter, know more about our model portfolios or access an audio file of our investment philosophy, “Modern Financial Fiascos”, click on the link

http://www.castlemoore.com/investorcentre/signup.php.

CastleMoore Inc. uses a proprietary Risk/Reward Matrix that places clients with minimum portfolios of $500,000 within one of 12 discretionary portfolios based on risk tolerance, investment objectives, income, net worth and investing experience. For more information on our methodology please contact us.

Buy, Hold…and Know When to Sell

This commentary is not to be considered as offering investment advice on any particular security or market. Please consult a professional or if you invest on your own do your homework and get a good plan, before risking any of your hard earned money. The information provided in CastleMoore Investment Commentary or News, a publication for clients and friends of CastleMoore Inc., is intended to provide a broad look at investing wisdom, and in particular, investment methodologies or techniques. We avoid recommending specific securities due to the inherent risk any one security poses to ones’ overall investment success. Our advice to our clients is based on their risk tolerance, investment objectives, previous market experience, net worth and current income. Please contact CastleMoore Inc. if you require further clarification on this disclaimer.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/

Following is an example:

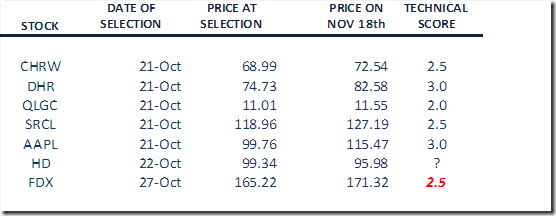

Monitored List of Technical/Seasonal Ideas

Green: Increased score

Red: Decreased score

A score of 1.5 or higher is needed to maintain a position

Disclaimer: Comments, charts and opinions offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed. Don and Jon Vialoux are Research Analysts with Horizons ETFs Management (Canada) Inc. All of the views expressed herein are the personal views of the authors and are not necessarily the views of Horizons ETFs Management (Canada) Inc., although any of the recommendations found herein may be reflected in positions or transactions in the various client portfolios managed by Horizons ETFs Management (Canada) Inc.

Individual equities mentioned in StockTwits are not held personally or in HAC.

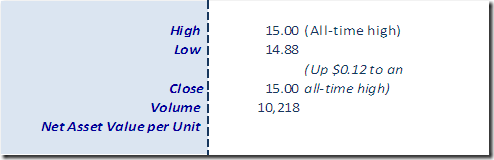

Horizons Seasonal Rotation ETF HAC November 18th 2014

Copyright © Don Vialoux, EquityClock.com